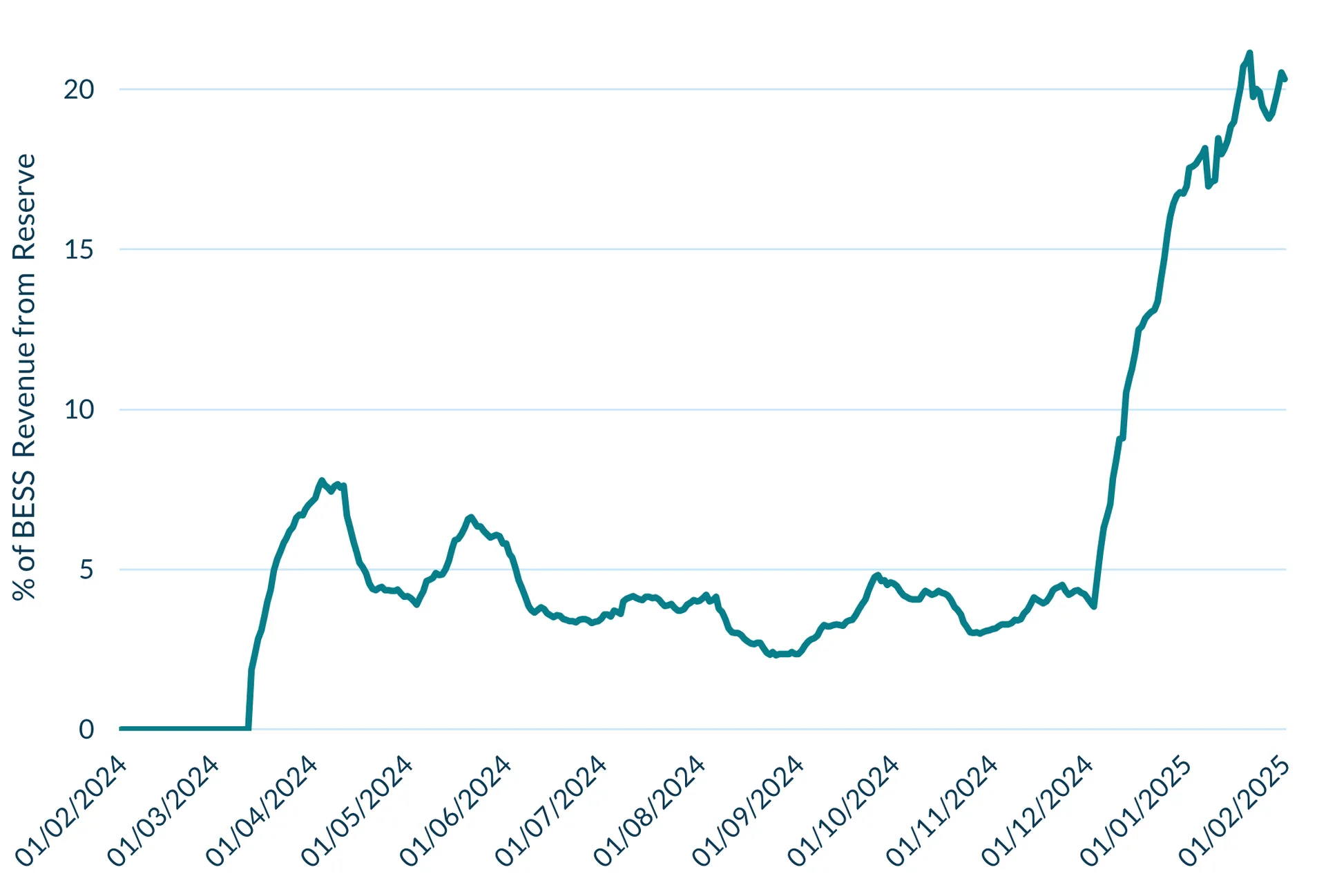

New data reveals a surge in battery energy storage system (BESS) revenues since December 2024, primarily driven by the 20% of revenue now being brought in from grid stabilising reserve services - up from just 4% at the start of December.

The data from Cornwall Insight’s BESS Analytics report, shows average BESS revenues have quadrupled over the past year1. Half of this increase has occurred since December 2024, with the rise largely attributed to the introduction of Quick Reserve in November 2024 - a frequency management tool from the National Energy System Operator (NESO) to counter supply-demand imbalances. Tight system margins were also a partial factor in the increased revenues.

Renewable energy generation is on the rise as the UK pushes towards its ambitious targets for a clean power sector by 2030 and a net zero economy by 2050. However, as renewable production is inherently variable, influenced by factors such as wind levels and the amount of sunshine, maintaining grid stability is becoming more dependent on battery storage. Quick Reserve ensures stability by getting batteries to rapidly ramp up (positive) or down (negative) energy use within one minute. This capability makes batteries indispensable for providing both positive and negative energy services, unlike other renewables that can only offer negative energy services, lacking the speed required for positive Quick Reserve.

There has been a relatively narrow range of technologies bidding into Quick Reserve so far, with batteries very much dominating, and accounting for all accepted volumes during December 2024.

Given the saturation of other response services, Quick Reserve has provided a valuable additional revenue source for batteries in recent months. However, this may not continue, with our BESS Analytics project pipeline indicating that another ~6GW of batteries are due to come online by the end of 2025. More battery capacity means it is possible that the healthy returns seen so far from Quick Reserve could follow a similar pattern to the other frequency response markets, with market saturation dampening revenues.

Figure 1: BESS Revenue from Reserve Services (February 2024 – February 2025)

Source: Cornwall Insight - BESS Analytics

Dr Matthew Chadwick, Lead Research Analyst at Cornwall Insight, said:

“The rapid rise of battery storage revenues from Quick Reserve highlights how critical flexibility services are becoming in the UK’s evolving energy system. Ultimately, getting to net zero will involve more intermittent energy generation coming on to the grid, and that is where batteries will thrive. Other technologies simply do not have the ability to ramp up production that quickly – Quick Reserve is a batteries market.

“Of course, as with any revenue stream, the more competition there is, the less the returns. With another 6GW of batteries due to come onto the system this year – and more to follow – we could see revenues for Quick Reserve fall, as returns on other frequency response services have done.”

Reference:

- Cornwall Insight’s BESS Analytics Energy Storage Revenue Index saw the 30-day rolling average increase from £21,000/MW/yr in January 2024 to £92,000/MW/yr in January 2025

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is a leading provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish and Australian energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.