This will be encouraging news for investors and asset owners, signalling a more robust and sustainable future for battery storage investments for the remainder of the decade.

Joe Camish Lead Analyst

New data from Cornwall Insight reveals that profits for battery storage units are set to rebound by 2026 following an extended period of underperformance over the past couple of years. The data from Cornwall Insight’s GB Battery Revenue Forecast, shows rising wholesale prices and added price volatility, alongside renewable build out over the next few years, will lead to the rise in revenues.

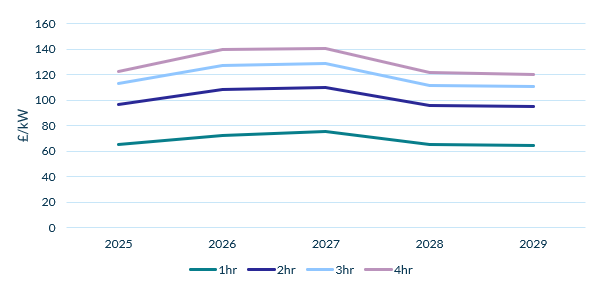

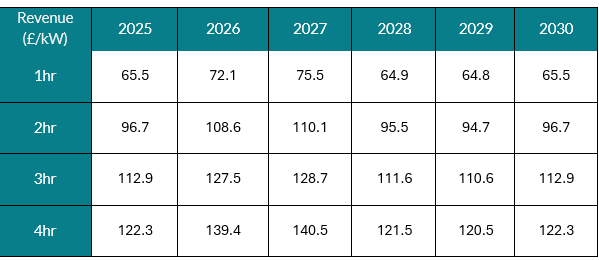

Cornwall Insight's forecast shows, annual revenues for 2-hour assets are forecast to climb from approximately ~£96/kW in 2025 to ~£108/kW by 2026, representing a marked improvement. Similar growth can also be observed in our forecasts for other durations.

Looking further ahead, we forecast a slight slowdown in yearly revenues in the latter half of the decade. This is in line with our underlying projections for wholesale power prices, alongside a greater saturation of the battery storage market. However, these levels will be significantly higher than what is currently being achieved in the market.

This news follows initial analysis from NESO highlighting that storage capacity, including battery storage, will need to increase by up to five times current levels to help support the initial pathways to reach the Clean Power 2030 Government target. It is hoped increasing revenues will encourage the battery growth needed if the government is to have any hope of reaching its decarbonisation target.

Sample scenario - annual battery storage revenue, 2025-2029 (£/kW)

Source: Cornwall Insight

Joe Camish, Lead Analyst at Cornwall Insight:

“After a challenging period for battery asset owners in GB, we are forecasting a recovery in battery storage revenues over the next two years. This will be encouraging news for investors and asset owners, signalling a more robust and sustainable future for battery storage investments for the remainder of the decade.

“This has been underscored by our recent modelling in which revenue levels are projected to remain above current levels, supported by greater wholesale price volatility in the late 2020s. If we are to meet the 2030 power decarbonisation target, NESO have said that storage capacity needs to increase four to fivefold. Hopefully the positive news on rising revenues will help drive the market toward achieving this goal.”

- Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.