The government decision to increase the budget for the renewables Contract for Difference (CfD) Allocation Round (AR) 6 by £0.53bn to £1.56bn could help to secure significant additional renewables capacity compared to the original budget. The precise impact will depend on participation levels in the auction and the bid prices that developers choose to submit.

The updated budget could support a minimum additional offshore wind capacity of 1.2GW compared to the original budget, meaning a minimum of 4.3GW of offshore can now be expected to secure contracts. This is equivalent of ~25% of total GB offshore wind capacity currently installed. However, these figures assume maximum allowed bid prices, known as Administrative Strike Prices (ASPs), and that enough capacity participates in the auction. It is feasible that competition levels mean developers will bid lower and greater levels of capacity may be secured.

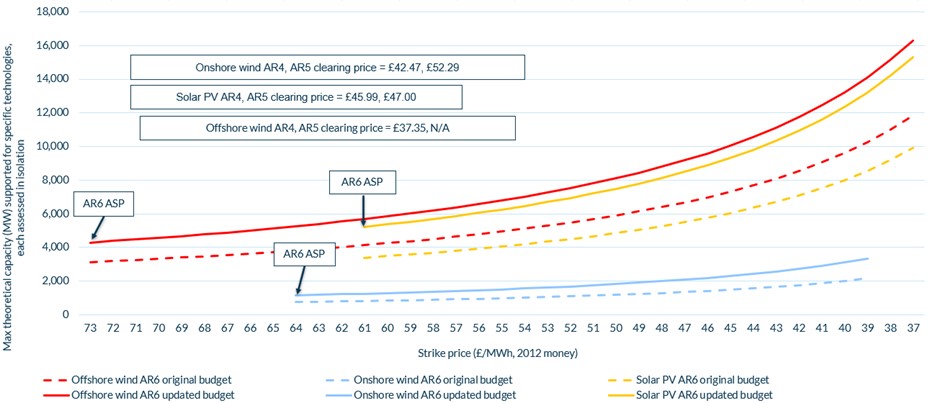

For ‘established’ technologies competing against one another in the same ‘Pot’, the additional capacity secured will predominantly depend on competitive interactions between onshore wind and solar projects. Assessing technologies in isolation of each other (i.e. not eating each other’s budgets), the new budget could theoretically support a minimum additional onshore wind capacity of 0.4GW (to secure a total 1.2GW) or 1.8GW solar PV (to secure a total 5.2GW), according to figures calculated by Cornwall Insight1 as illustrated in Figure 1. However, this again assumes maximum possible bid prices. Competition between developers is intended to result in lower bid prices which would act to increase the levels of capacity supported, but numerous technologies will need to share this budget with the cheapest technologies expected to take the lion’s share.

Figure 1: Theoretical capacities supported by the updated CfD AR6 budget for key technologies at different strike price levels*

Source: Cornwall Insight

*Each technology has been assessed in isolation of other technologies that fall within the same pot (notably onshore wind and solar). It assumes the budget is utilised entirely, and that enough assets participate to utilise the budgets.

The previous Round 5 CfD auction secured no offshore wind, 1.7GW of onshore wind (including remote island wind) and 1.9GW of solar PV contracts.

Despite recent increases in the maximum allowed ASPs, and a record original budget exceeding £1bn, the Secretary of State did not think this was sufficient to procure the level of renewable capacity required to put the UK on track to meet net zero targets.

Reaching the government renewables targets will require addressing many challenges over and above future CfD budget allocations, including looking at grid connection issues, system operation including flexibility, and potential changes to service designs.

The budget rise may also come at a cost to consumers, but the extent will depend on any potential rise in clearing prices from the higher budget, as well as future wholesale prices.

Tim Dixon, Senior Consultant at Cornwall Insight said:

“The increase in the auction budget will be welcomed by renewable developers and will be a great opportunity for the sector to demonstrate it can continue to reduce emissions, while offering value for money and improving energy security in a time of global volatility.

“Although we have already seen changes such as a rise in administrative strike prices to avoid the disappointing results seen at the previous CfD auction, the additional funding will hopefully further boost capacity levels whilst maintaining strong levels of competition.

“While the funding rise is encouraging, it does not resolve all the concerns of the renewables sector or the broader energy industry, nor is it a clear path to stabilising consumer energy bills. To ensure this extra funding truly boosts sustainable energy generation, we must also tackle the broader issues including a lack of grid connections, inadequate infrastructure, planning frameworks, and long-term service designs. Without these changes developers and consumers alike may feel they have been short changed.”

Reference:

- The figures are derived by evaluating each technology independently.

– Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish, Australian, German and Japanese energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.