"Of course we must recognise lower prices don't erase all the problems. The very fact we are still seeing bill levels which are hundreds of pounds above pre-crisis levels underscores the ongoing challenges faced by households."

Dr Craig Lowrey Principal Consultant

The predictions for the Default Tariff Cap in this piece are out of date please click HERE to find our most up to date forecasts.

Cornwall Insight has announced its final forecast for the July-September Q3 2024 Default Tariff Cap (price cap) following the closure of the observation window1 on 16 May.

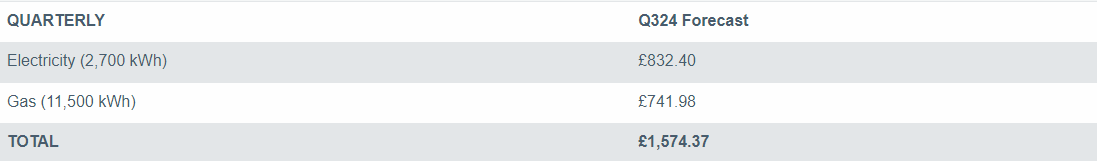

For a typical dual fuel household2 we predict the July price cap to be £1,574.37 per annum. This is a fall of approximately 7% from the current price cap which was set at £1,690 per year for a typical consumer. If predictions are correct this would represent a 25% drop over the past year, with prices around £500 a year lower than July 2023.3

Looking further ahead we forecast the cap will rise slightly in October and remain at this level in January 2025.

Predictions have seen a slight rise in recent weeks as gas and electricity prices rebounded from their 30-month lows in February before broadly stabilising from mid-April. This reflects a combination of short-term market influences such as weather and supply availability, alongside longer-term drivers such as geopolitical concerns and raised oil prices.

While a reduction in the price cap is good news, bills still remain hundreds of pounds above pre-crisis levels and concerns continue to be raised about the effectiveness of the price cap in bringing consumer costs down to more affordable levels for households.

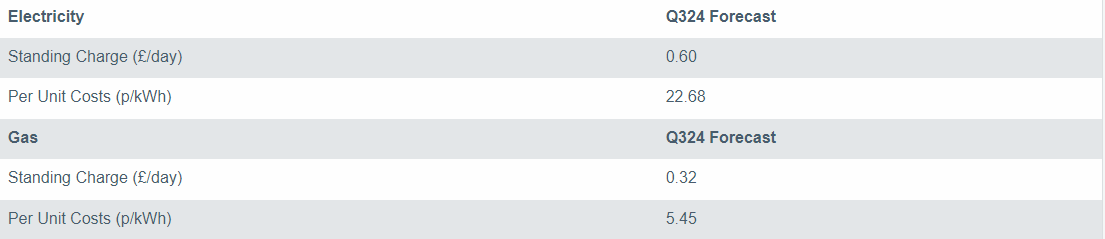

Earlier this year, Ofgem announced that it would undertake a comprehensive review of the cap and its structure. As such, significant changes to the cap could be on the horizon within the next one to two years, especially with the upcoming election likely to influence the landscape. This includes the continued focus on energy standing charges, with the government and Ofgem having faced calls from a number of energy suppliers and other stakeholders to scrap the daily charges.

**Figure 1: Cornwall Insight’s Default Tariff Cap forecast using new Typical Domestic Consumption Values (dual fuel, direct debit customer) **

Source: Cornwall Insight

**Figure 2: Default Tariff Cap forecast, Per Unit Costs and Standing Charge (dual fuel, direct debit customer) **

Source: Cornwall Insight

Note: All figures are national average unless otherwise stated. All intermediate and final calculations are rounded to two decimal places. Totals may not add due to rounding.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight:

“When faced with headlines announcing minor changes to the cap it can be easy to overlook the broader trend of declines. Our projections suggest that from July, the average annual bill will fall by around £500 compared to last summer, offering further relief given the quarter-on-quarter drop seen in April.

“Of course we must recognise lower prices don’t erase all the problems. The very fact we are still seeing bill levels which are hundreds of pounds above pre-crisis levels underscores the ongoing challenges faced by households.

“While the cap is certainly not the ticket back to long-term energy bill affordability, Ofgem’s review could pave the way for fairer, more efficient energy bills. However, given the breadth of reforms being considered by the regulator, it is worth remembering that such changes will inevitably lead to trade-offs. For example, reducing standing charges, while seemingly beneficial for low-energy users, could lead to higher unit prices. This could disproportionately impact those in less energy-efficient homes or with greater energy needs, some of whom could be vulnerable. Finding the right balance is crucial.

“The path forward for energy pricing remains uncertain, and with stakeholders advocating for reforms – coupled with a general election on the horizon – energy bills are likely to be an area of continued debate and transformation in the months ahead.”

Reference:

-

The period of time Ofgem use to monitor the market and calculate the wholesale element of the cap.

-

As of October 2023, Ofgem’s Typical Domestic Consumption Values (TDCVs), are set at 2,700 kWh per annum for electricity, and 11,500 kWh per annum for gas.

-

The price cap was set at £2,074 for Q3 2023

Notes to Editors For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is a leading provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish and Australian energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.