"The lingering impact of the energy crisis, has left us with a market that's still highly volatile and quick to react to any bad news on the supply front. "

Dr Craig Lowrey Principal Consultant

Cornwall Insight has announced its final forecast for the October - December Q4 2024 Default Tariff Cap (price cap) following the closure of the observation window1 on 16 August.

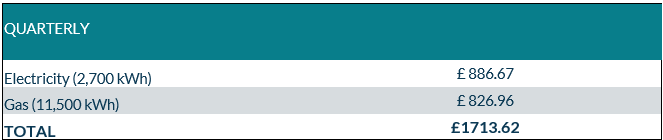

For a typical dual fuel household2 we predict the October price cap to be £1,714 per annum. This is a rise of 9% from the current price cap which was set at £1,568 per year for a typical consumer. Ofgem will announce the October cap on Friday 23 August.

Looking further ahead, we currently forecast the cap will show a further modest increase in January 2025. However, recent tensions in the Russia-Ukraine war could see prices rise further at the start of the new year.

Over the past few months gas and electricity wholesale prices have rebounded, from their 30-month lows in February. The rise in wholesale market prices, particularly since the start of August, has been the key driver behind the forecast uptick in bills.

While prices have stabilised somewhat compared to the previous two years, the market has not fully recovered from the energy crisis and the impact of Russia's invasion of Ukraine. As a result, the market remains highly sensitive to any global events that could disrupt supply. The UK’s reliance on imported energy leaves the country very vulnerable to this global volatility. This is seeing both household and business energy bills forecast to staying far above pre-crisis levels.

It is essential that the vulnerable are protected from rising energy bills in the short-term, this could involve the introduction of social tariffs, revising benefits, or adjusting the price cap mechanism. Ofgem is currently undergoing a comprehensive review of the price cap with potential changes to elements such as the standing charge expected over the coming year.

In the longer-term, a shift towards sustainable, home-generated energy will be necessary to reduce the UK's vulnerability to international shocks. There have been some positive signals from the government, such as increasing the budget for the renewables auction and lifting the de facto ban on onshore wind. However, much more progress is needed.

Figure 1: Cornwall Insight’s Default Tariff Cap forecast using new Typical Domestic Consumption Values (dual fuel, direct debit customer)

Source: Cornwall Insight

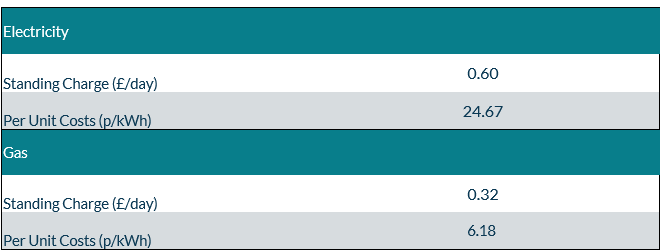

Figure 2: Default Tariff Cap forecast, Per Unit Costs and Standing Charge (dual fuel, direct debit customer)

Source: Cornwall Insight

Note: All figures are national average unless otherwise stated. All intermediate and final calculations are rounded to two decimal places. Totals may not add due to rounding.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight:

“This is not the news households want to hear when moving into the colder months. Following two consecutive falls in the cap, I’m sure many hoped we were on a steady path back to pre-crisis prices. However, the lingering impact of the energy crisis, has left us with a market that's still highly volatile and quick to react to any bad news on the supply front.

“Despite this, while we don't expect a return to the extreme prices of recent years, it's unlikely that bills will return to what was once considered normal. Without significant intervention, this may well be the new normal.

“The government will need to adopt a two-pronged approach to tackle rising energy bills. Immediate action is needed to ease the financial burden on households - such as the introduction of social tariffs, or reform of the price cap - but that's only part of the solution. We must also develop a long-term strategy to secure our energy future. This means a fundamental overhaul of our energy system, with a strong emphasis on increasing domestic energy production. Simply waiting for prices to drop on their own isn't an option, we need a proactive and forward-thinking approach to ensure long lasting energy affordability and security."

Reference:

- The period of time Ofgem use to monitor the market and calculate the wholesale element of the cap.

- Ofgem’s Typical Domestic Consumption Values (TDCVs), are set at 2,700 kWh per annum for electricity, and 11,500 kWh per annum for gas. Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group

Cornwall Insight is a leading provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish and Australian energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.