A new study has warned the three-year delay to the critical €350 million North-South Interconnector will see Northern Ireland fall substantially short of its ambitious 2030 renewables target, which aims for 80% of electricity consumption to come from renewable energy.

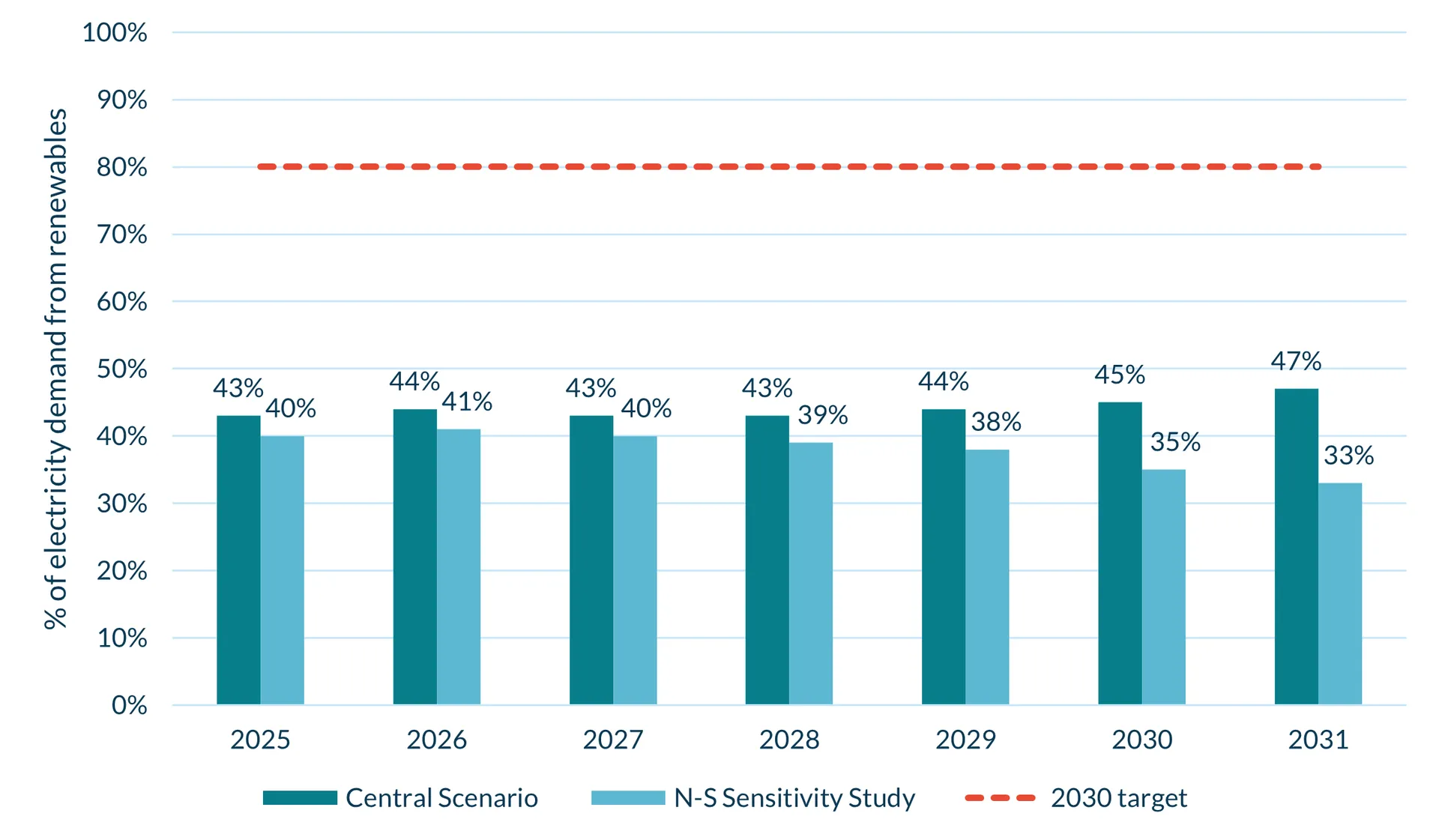

Early analysis by Cornwall Insight, included in their SEM Benchmark Power Curve Report, shows that the latest delay to the interconnector – now expected to be operational in 2031 rather than 2027 – could see renewable generation meet just 35% of electricity demand by 2030.

The full impact of this change on network operational plans and policy remains to be seen, but if this scenario unfolds, the percentage of electricity from renewables would fall below the 2024 level of 43.5% and would see Northern Ireland miss it’s legally binding 80% renewables target included in the 2022 Climate Change Act.

The interconnector was first conceived in 2006 and has seen several delays over the past few years, the latest delays have been blamed on planning permission. A judicial review of the plans commenced on April 9, and if successful, could further postpone the project.

Without the additional capacity from the interconnector to move power across the island, renewable generation is increasingly vulnerable to grid constraints and curtailment. The current system can only absorb so much renewable electricity before reaching its technical limit, meaning more output could be 'dispatched down'- effectively wasted.

Renewable generation is already subject to high levels of dispatch down. EirGrid data from 2024 shows wind and solar assets in Northern Ireland lost 29.6% and 16.9% of their output, respectively, due to system limitations.

With electricity demand expected to rise over the next decade as Northern Ireland moves towards wider electrification, renewable output will need to grow just to maintain current percentages of renewable generation - let alone meet future targets.

The findings raise concerns about the long-term viability of future renewable projects. Without the ability to export surplus power, there’s a growing risk that new generation could be wasted - and investment decisions delayed or diverted elsewhere. And if developers expect more generation to be lost, the level of support needed to make projects viable is likely to increase - driving up costs for consumers.

Cornwall Insight had originally forecast Northern Ireland to reach 45% renewable electricity by 2030, while still lower than the target, the potential disincentives to investment that could come from the delayed interconnector has pushed this forecast down further.

Whilst all these projections for 2030 fall well short of the 80% target, the SEM Benchmark Power Curve Report shows the introduction of offshore wind capacity will eventually close the gap. However, it is currently anticipated that this will connect post the 2030 target deadline.

Figure 1: Northern Ireland – Renewable Electricity Generation Share

- ‘Central scenario’ is based on a N-S commissioning data of 2027. The ‘N-S Sensitivity study’ investigates the impact of the delay to 2031, as well as a relative decrease in renewables deployment compared to the Central scenario, and SNSP levels capped at 80% in Northern Ireland

Source: Cornwall Insight – SEM Benchmark Power Curve

Kitty Nolan, Modeller at Cornwall Insight, said:

“The delay to the North-South Interconnector has far-reaching consequences. It risks turning renewable progress into renewable waste. A functioning, flexible grid is essential to unlocking investment, maintaining momentum, and ultimately hitting Northern Ireland’s energy targets. Without it, the region faces a widening gap between ambition and delivery. Northern Ireland is, unfortunately, not in control of its own destiny here, and delays stem from planning issues across the border, but it’s Northern Ireland that will bear the cost.

“Investors and developers need confidence that the infrastructure will be in place to support new renewable projects. With such a significant portion of clean electricity already being lost due to dispatch down, the delay sends the wrong signal at a crucial time. Accelerating grid upgrades and interconnection is not just an engineering challenge - it’s a necessity for the energy transition.”

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is a leading provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish and Australian energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.