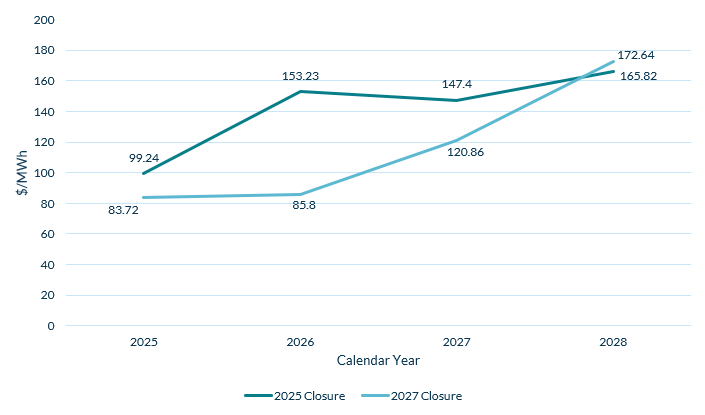

New power price forecasts suggest pushing back the closure date of Eraring power station from 2025 to 2027 will cut NSW power prices by 44%, dropping from a predicted $153/MWh to $86/MWh in 2026 – a fall of $67. The data included in Cornwall Insight’s NEM Benchmark Power Curve report show this trend is set to continue into 2027, with new forecasts showing an 18% dip in power prices for that year compared to closing Eraring in 2025.

In May the NSW state government made a decision to delay the closure of Eraring. Holdups at renewable developments and transmission lines were a key reason behind the decision, with the Australian Energy Market Operator (AEMO) saying there was a risk to energy reliability if national and state energy projects aimed at compensating for Eraring’s closure were delayed.

Power prices are forecast to drop as the temporary increase in reliability of supply calms the market. This is expected to filter down to consumer bills.

Under the agreement Eraring’s may stay in operation for a further two years out to 2029, though this is largely dependent on progress at Snowy Hydro 2.0 with the development facing issues with construction, pandemic-induced delays, and a key project contractor going bust in 2022.

While power prices are expected to fall in the short term, there has been criticism of the decision to delay the closure, with the cost of government subsidies to keep open the plant, alongside the impact it will have on meeting state and national emissions goals pointed to as key concerns.

Figure 1: Average Power Prices ($/MWh) in NSW with Eraring closing in 2025 vs 2027

Thomas Fitzsimons, Senior Energy Modeller at **Cornwall Insight **said:

“Delays to infrastructure projects at a state and national level have left us with a potential electricity supply gap as we move into the second half of the decade. While delaying the closure of Eraring was a controversial decision, the data shows that without this intervention power prices in NSW, and potentially in other NEM states, would have risen and ultimately this would have shown up on household and business bills.

“Since Eraring is the largest single generating station in the NEM, its eventual retirement will be closely tied to the energisation of new renewable and storage projects in the state and in particular Snowy Hydro 2.0. Given the complexity of this project pipeline and the issues seen at Snowy 2.0 to date, we may yet see a further extension of Eraring’s operating life.”

– Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish, Australian, German and Japanese energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.