Note: Cornwall Insight Ireland release the ‘All-Island Power Market Outlook 2023’ on a quarterly basis. The increase in long-term power prices refers to the comparison with our Q3 Power Market Outlook released in October 2022.

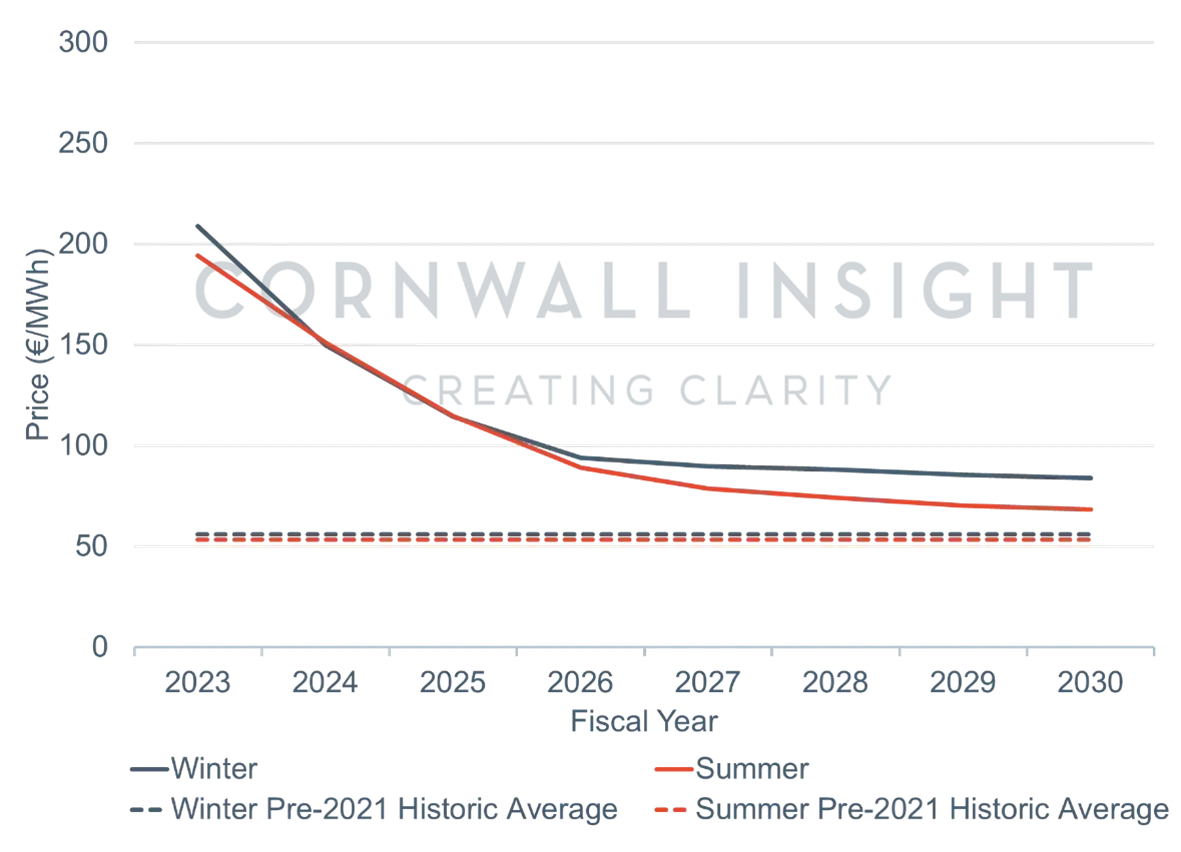

Data from Cornwall Insight Ireland’s fourth – ‘All-Island Power Market Outlook to 2030’ – has forecast that energy prices will not return to pre-pandemic levels before 2030. Revised timelines on investment decisions for onshore wind have seen predictions for power prices in the late 2020s increase. This has dashed the hopes of prices dipping below historic levels, which our previous outlook report, released in October had predicted would happen in 2027.

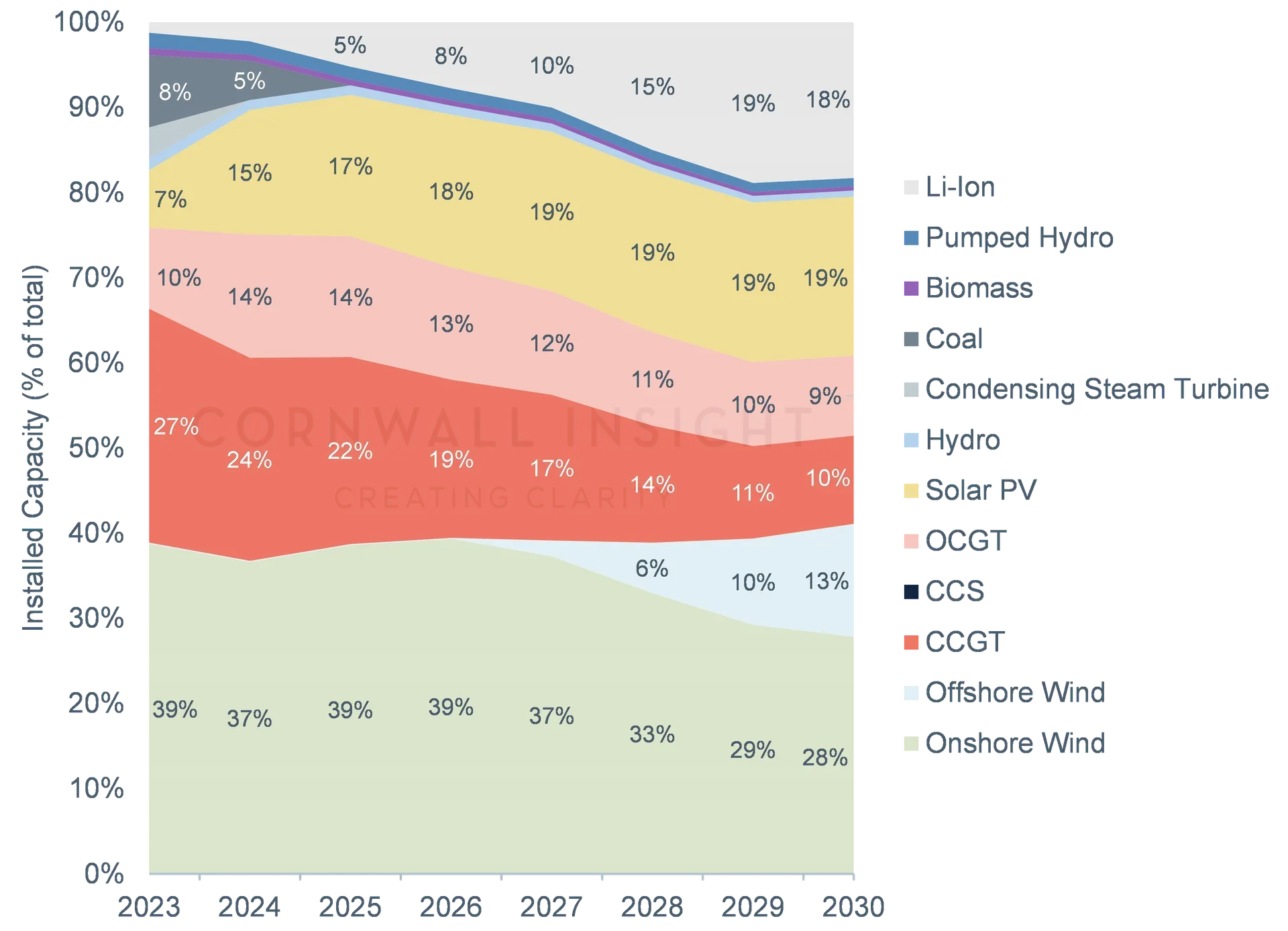

Onshore wind is a key technology for meeting additional demand and carbon targets, as it is a cheap to install form of new generation capacity. However, increased capital costs have delayed wind buildout and, in turn, the retirement of certain gas plants. This has increased the floor price in the late 2020s and has caused winter power prices to stay above summer prices.

There was some good news, with forecasts decreasing in the early 2020s as milder weather and higher storage capacity lower gas prices.

Delays to wind power capacity and the corresponding higher power prices will potentially be detrimental to households and businesses, with bills remaining comparatively high. It could also see damage to Ireland’s net zero ambitions; however, offshore wind, solar capacity and an increase in battery storage will hopefully keep Ireland on track to meet the 80% renewable electricity target by 2030.

Figure 1: Power price forecasts – average price per fiscal year

Source: Cornwall Insight Ireland

Figure 2: Future electricity generation capacity breakdown

Source: Cornwall Insight Ireland

Ratnottama Sengupta, Senior Consultant at Cornwall Insight, said:

It was hoped that Ireland would see prices return to so-called normal” levels as we moved from the middle to the end of the 2020s; unfortunately, higher costs and the subsequent delay to onshore wind have caused us to raise our predictions. The increased power prices will inevitably filter through to households and businesses, who could now be faced with comparatively high bills for the next decade.

Despite the revising of forecasts, our report shows power prices are still scheduled to drop significantly in the mid-2020s as the closure of high-cost fossil fuel plants makes way for lower-cost offshore wind and solar. The introduction of the new North-South interconnector should also help to improve efficiencies and with-it lower prices.

Ireland is still on track to meet its 80% renewable electricity target in 2030, and maintaining focus on the move to low-carbon energy sources will be key to securing energy supply, lowering prices, and finally emerging from the energy crisis.”

–Ends

More information: If you would like to find out more on our Benchmark Power Curve service please get in touch.

You can also find out more on our website: Benchmark power curve

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/ie/

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.