"With the stakes higher than ever, the report underscores the critical role that financial incentives play in driving innovation and accelerating the development of long-duration energy storage technologies."

Matthew Chadwick Lead Research Analyst

A new report, jointly authored by Cornwall Insight and global law firm DLA Piper, has highlighted the urgent need for financial incentives to speed up the development of long-duration energy storage systems, which are crucial for meeting the UK’s ambitious net zero goals.

As more renewables enter the market, energy generation will become increasingly intermittent, raising the need for flexibility to make sure energy is available at times of low wind or solar. While batteries play a pivotal role in short-term energy storage, they do not provide a viable option for durations longer than four hours. The report ‘Ready and waiting: Opportunities for energy storage’ looks at ways to encourage investment in alternative electricity storage technologies capable of accommodating longer durations, including compressed air or pumped hydropower.

The analysis emphasises the range of avenues available to help incentivise the development of new technologies, including grants or tax incentives. Additionally, compensating generators for the fixed costs associated with maintaining the long-duration capacity, through the implementation of capacity market mandates, could speed up the development of the crucial new storage.

The report suggests there may also be an opportunity to implement a Contract for a Difference style scheme providing a fixed price guarantee for electricity generated by long-duration energy storage assets. Drawing inspiration from Australia’s Long-Term Energy Service Agreements, which offer up to 40-year contracts with a cap-and-floor Contracts for Difference style approach, Cornwall Insight and DLA Piper say this proposal may not only attract investors with a steady revenue stream but also enhance market stability and investor confidence.

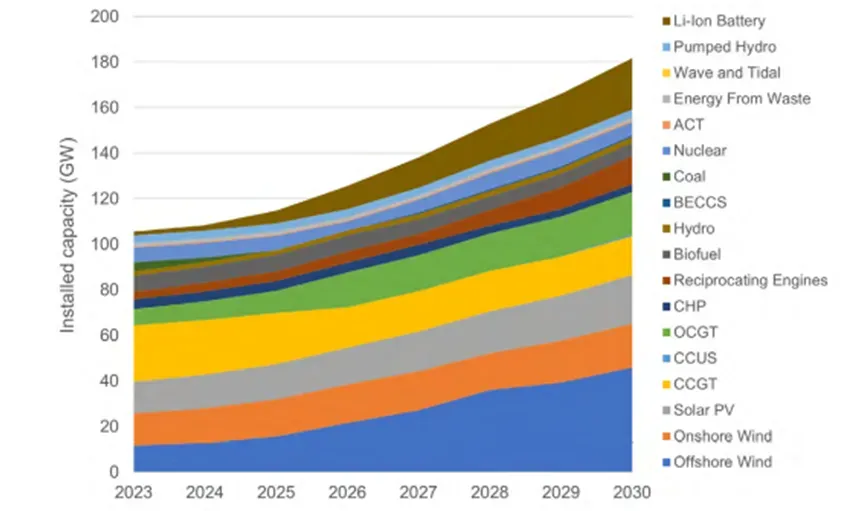

Figure 1: Forecasted renewable and non-renewable GB generation and storage capacity until 2030

Source: Cornwall Insight – Benchmark Power Curve (March 2023)

The report presents additional strategies and market approaches that the UK can consider fostering to increase energy storage as more renewables come onto the market. One of these is the co-location of energy storage assets to overcome the long wait times new assets are currently facing to access a grid connection. However, this approach also presents its own set of challenges that need to be carefully navigated.

Dr Matthew Chadwick, Lead Research Analyst, Cornwall Insight said:

On the path towards enhancing energy storage capabilities, numerous challenges lie ahead, including grid capacity constraints and financial uncertainties. However, amidst these obstacles, there exists an array of opportunities to expand storage capacities, boost flexibility, and actively contribute towards the UK’s net zero goal.

With the stakes higher than ever, the report underscores the critical role that financial incentives play in driving innovation and accelerating the development of long-duration energy storage technologies. By implementing a strategic combination of grants, tax incentives, capacity market mandates, and contract schemes, the government can catalyse the growth of a robust and diversified long-duration energy storage sector. Such advancements would not only ensure a reliable and resilient electricity system but also position the UK as a global leader in sustainable energy solutions, ultimately paving the way towards achieving its ambitious net zero targets.”

James Carter, Head of UK Energy and Natural Resources at DLA Piper said: The role of energy storage in the UK’s energy future cannot be underestimated. It is the critical support structure which delivers stability and security of supply in a volatile market. It can be seen as a keystone in the development of an energy system which allows the UK to move at the pace required to a cleaner, greener economy.

Although the UK’s electricity storage sector faces various challenges, including supply chain vulnerability and the potential for revenue volatility, there also remain significant opportunities, particularly in the context of the growth of long-duration energy storage. It is in this context that we have prepared this report, focused on the opportunity which energy storage presents.”

- Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.

About DLA Piper

DLA Piper is a global law firm with lawyers located in more than 40 countries throughout the Americas, Europe, the Middle East, Africa and Asia Pacific, positioning us to help clients with their legal needs around the world.