"Any dip could derail the transition, and with Ireland’s EV programme at an earlier stage than many major European countries, it is essential they keep up momentum."

Jamie Maule Research Analyst

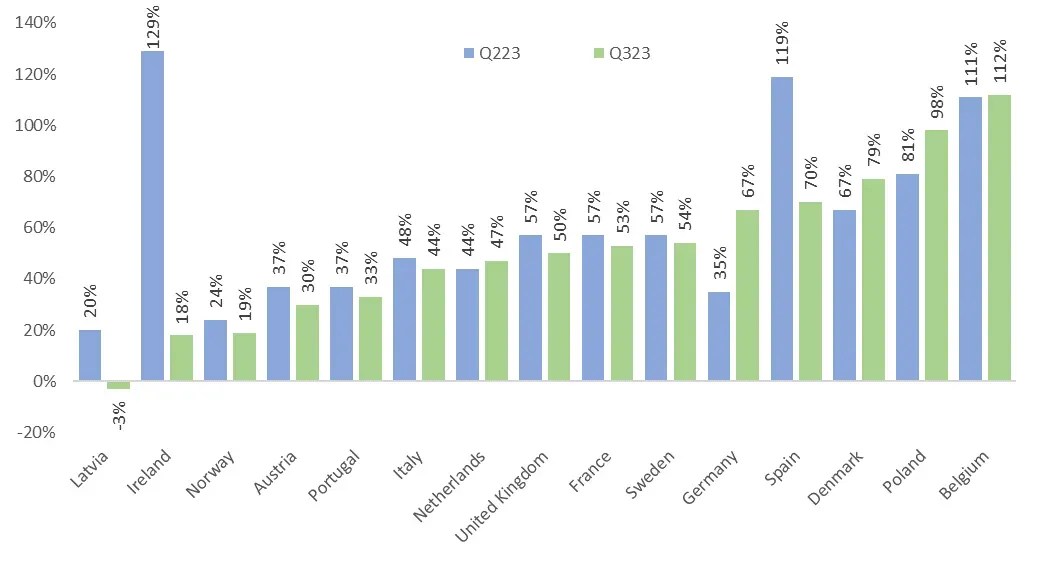

Ireland’s year-on-year growth in publicly accessible charge-points for Battery electric vehicles (BEVs) has seen a substantial drop in Q323, falling by 111 percentage points compared to Q322.

The data analysed for Cornwall Insight and law firm Shoosmiths’ Electric Vehicle Country Attractiveness (EVCA) Index1, has shown that despite previously holding the highest growth rate among major European countries, soaring at an impressive 129% from Q222 to Q223, growth has now dwindled to 18% in Q323.

Although Ireland’s network of public charge-points is now within the estimated 2,540-4,850 needed by 2025 – according to the Electric Vehicle Charging Infrastructure Strategy 2022-2025 – such a drop-off in growth could act to slow down the country’s electric vehicle (EV) transition.

It is hoped that this decline will be temporary with Ireland’s Budget 2024 bringing clarity and incentives for continued growth. This includes extending vehicle registration tax relief and benefit-in-kind tax rates for BEVs until 2025.

This, combined with the development of a national delivery plan for en-route charging due for release in late 2023, implies that Ireland could reinvigorate its BEV market moving into 2024.

Figure 1 – Publicly accessible charge-point growth, (year-on-year change)

Source: European Alternative Fuels Observatory

Despite the drop in the charge point expansion this quarter, Ireland has retained its position at number 11 on the EVCA Index. It is hoped the government’s policy announcements will help the country move up the table in 2024.

Figure 2 – EVCA Index scores and rankings

Source: Cornwall Insight

Jamie Maule, Research Analyst at Cornwall Insight said:

Ireland’s recent slowdown in EV charge-point growth is a reminder that we cannot rest on our laurels when it comes to EV adoption. Any dip could derail the transition, and with Ireland’s EV programme at an earlier stage than many major European countries, it is essential they keep up momentum.

While this decline is certainly not good news, we are hopeful that it is temporary. The Irish government has taken some positive steps to support the EV market moving in to 2024, and we are confident that the country will be able to get back on track.”

Chris Pritchett, Energy and Infrastructure Partnerat Shoosmiths said**:**

Ireland’s Budget 2024 and a national delivery plan for en-route charging could, by offering tax relief and incentives for BEV owners, provide a much-needed boost to the country’s EV transition, following a slower growth in public charging infrastructure this quarter. The transition is all about maintaining momentum and confidence, and whilst we are seeing new EV hubs being deployed by the likes of Weev, Instavolt and Fastned greater speed is needed to keep Ireland in the race”

References:

- The Electric Vehicle Country Attractiveness (EVCA) Index is a quarterly ranking that charts the relative attractiveness of major European nations for investment in EVs. A range of indicators, subject to differing weightings, have been utilised in the production of this index. They are listed as follows without regard to importance or weighted value:

- Committed government funding

- National EV sales targets

- National EV charge-point implementation targets

- Support for ICE vehicle rollback or ban

- Available investment subsidies, funds, and tax benefits for EVs and EV charge-points

- Available purchase subsidies, funds, and tax benefits for EVs and EV charge-points

- Ability to conduct business

- Rate of inflation

- Market share of BEVs in new registrations/sales

- Share of BEVs in the passenger car stock

- Four-quarterly growth of BEV sales

- BEVs per publicly accessible charge-point

- Charge-points per kilometre of motorway

- Four-quarterly growth of publicly accessible charge-points

- Achievement of Alternative Fuels Infrastructure Regulation (AFIR) fleet-based charge-point targets

- Wholesale cost of electricity scaled to GDP

2. Electric Vehicles Charging Infrastructure Strategy 2022 – 2025 – Gov.ie

- Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.