"The impact could be far-reaching, from job losses and disrupted supply chains to a decline in consumer spending—consequences that can ripple through the broader economy."

Dr Craig Lowrey Principal Consultant

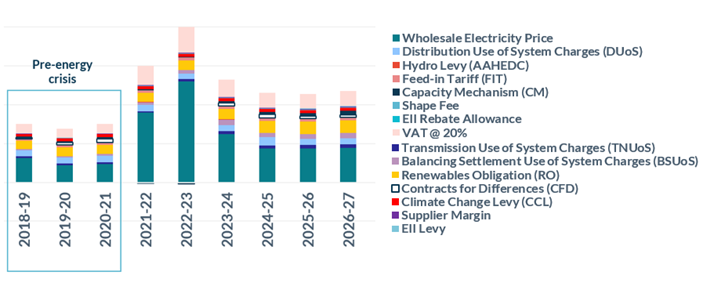

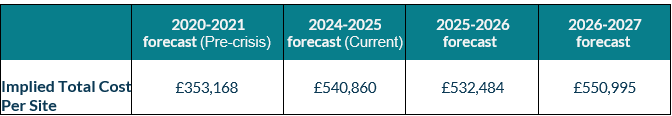

Electricity bills for small industrial consumers1, including large retail and leisure units as well as small manufacturers, are set to rise to around £200,000 more than pre-crisis levels in 2026.

Data from Cornwall Insight’s Business Energy Cost Forecast, reveals that small industrial businesses are predicted to be paying £550,000 annually (£238 per MWh) for electricity by the contract year April 2026 – March 2027. This marks a 57% increase compared to the pre-energy crisis level of just over £350,000 (£151 per MWh)

The 2026-2027 costs will be a rise from current bills which sit around £540,000 per year (£232 per MWh).

The forecast, which aligns with the typical April to March contract renewal period for most businesses, reveals that while small industrial business energy costs have fallen from the highs seen in 2022-2023 - where they were nearly £1mn a year - the residual effects of the energy crisis and Russia’s invasion of Ukraine continue to influence the wholesale market. This - alongside other changes, including network charging reforms - has kept prices higher than historic averages. Changes coming in over the next couple of years, including the rise in newer carbon levies and the anticipated introduction of new cost elements, are expected to see prices increase from April 2026. Similar trends exist across SME and large industrial customers.

While households are also experiencing high bills, the Default Tariff Cap (price cap) provides some degree of protection. Businesses do not have a corresponding cap and are therefore exposed to the full cost of the electricity market. With many other economic pressures, particularly on the retail sector, this could highly impact profitability and cause more companies to exit the market.

While it is anticipated that the renewed focus on domestic renewable generation capacity will filter through to bills, due to the lead time associated with investment in new projects it may take several years before consumers start to feel the benefits of this shift.

Figure 1: Breakdown of small industrial customer bills, nominal exc. Metering (£/MWh)

Source: Cornwall Insight

- Annual electricity demand of 2.33GWh, Cornwall Insight consumer archetype

Figure 2: Business Energy Cost Forecast, Small industrial consumer, implied electricity cost

Dr Craig Lowrey, Cornwall Insight, Principal Consultant:

“While the electricity bills of businesses have remained above historic averages for many years, political conversations under both the current and previous government have been dominated by household energy bills, with businesses largely left out of the discussion—it’s the energy elephant in the room.

“Many businesses, especially in the retail arena, are navigating an increasingly challenging environment, with some struggling to survive month to month. Our forecasts showing energy costs are going to rise in 2026, only add to the pressures faced by businesses. The impact could be far-reaching, from job losses and disrupted supply chains to a decline in consumer spending—consequences that can ripple through the broader economy.

“We hope the renewed focus on delivering sustainable domestic production can bring some stability to the energy market and lower bills in the long run. However, as we await these potential cost reductions, it’s essential that policymakers and industry leaders work together to find solutions that can help alleviate the burden on businesses, many of whom cannot afford to wait years for relief."

References:

- This is based on an annual electricity demand of 2.33GWh

- Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.