"A multitude of factors, from weather patterns to surging demand in Asia, leave Europe open to potential gas shortages if it places its faith in another high-temperature, low-competition winter."

Matthew Chadwick Lead Research Analyst

A new report from Cornwall Insight has exposed the challenges facing Europe’s Liquified Natural Gas (LNG) supply, as growing competition from China and price rises increase pressure on the gas market.

The analysis, focusing on LNG security over the upcoming winter, highlights that heightened Chinese gas demand, driven by economic recovery following repeated COVID-19 lockdowns could intensify the competition to secure LNG.

With only minimal growth in global LNG supplies expected before 2025, the report suggests that an increasingly tight market, combined with global events raising wholesale prices, could leave Europe vulnerable to shortages this winter and next.

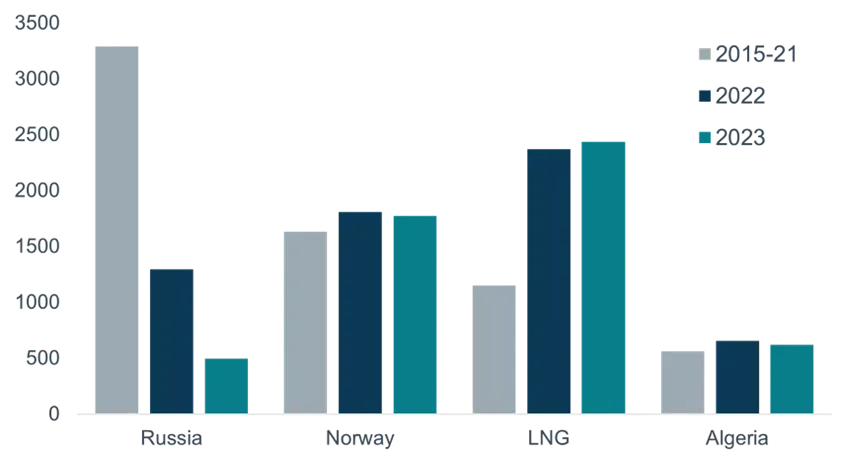

The aftermath of the Russian invasion of Ukraine saw Europe diversify away from Russian pipeline gas, with LNG imports filling a substantial amount of the gap (Figure 1). Last winter’s milder weather and high gas prices helped reduce demand across the continent, which, combined with reduced international competition, particularly from China, helped maintain the security of gas supply to Europe.

China has however seen a 6% growth in gas demand so far in 2023 and while this is currently being covered by domestic production and higher pipeline imports from Russia, the winter could see a need for increased LNG imports, heightening global competition.

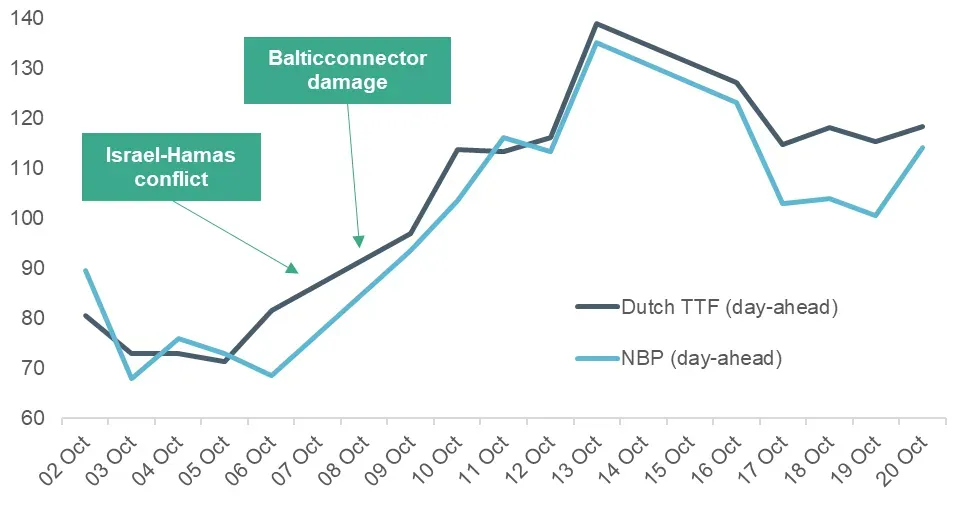

Historically, China and other Asian nations have been willing and able to pay higher prices for gas compared to Europe. In a scenario where bidding wars for limited supplies unfold, Europe might find itself at a disadvantage. Recent global events, such as disruptions to the Finish Balticconnector and the Israel-Hamas conflict, have only exacerbated wholesale price increases, raising the risk of Europe being priced out of the LNG market (Figure 2).

Cornwall Insight’s analysis stresses the critical need for European nations, including the UK, to reevaluate their LNG strategies emphasising that the shift from spot market purchases to securing longer-term LNG supply deals is key to reducing exposure to volatile prices and intensifying competition.

Figure 1: Europe national gas imports (average weekly volumes, mcm)

Source: ENTSOG, Cornwall Insight

Figure 2: Day-ahead European gas prices (p/th) for the Dutch TTF and UK NBP

Source: Cornwall Insight, Marex Spectron

If procured, LNG could bolster Europe’s energy security in the short to medium term. However, it’s vital to remember that LNG, despite emitting 40% less CO2 than coal and 30% less than oil, remains a fossil fuel and a source of significant carbon emissions, not least from its transportation. In the upcoming years, there’s a pressing need to strike a balance between LNG’s role in energy security and Europe’s transition towards greater renewables and decarbonisation. The report emphasises LNG could be a transitional solution, but renewables must lead the way for a sustainable energy future.

Dr Matthew Chadwick, Lead Research Analyst at Cornwall Insight, said:

In a landscape of increasing global competition, Europe’s LNG supply faces growing uncertainty. A multitude of factors, from weather patterns to surging demand in Asia, leave Europe open to potential gas shortages if it places its faith in another high-temperature, low-competition winter.

As China’s economic recovery drives up gas demand and worldwide events send prices skyrocketing, Europe can no longer cling to the illusion of on-demand LNG. To secure gas supply this winter, they must make a concerted effort to shred their reliance on short-term, risky LNG purchases. It is crucial they focus on building strong partnerships, improving infrastructure and securing supply chains, so Europe can safeguard its energy security while working towards its longer-term decarbonisation goals.”

–Ends

Notes to Editors

Link to full paper: The shifting sands of Liquified Natural Gas in Europe

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/ie/

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.