"With gas reserves easing supply anxieties in the short-term, lower power prices are on the horizon and we're optimistic that this trend will trickle down to consumer bills."

Evelin Blom Modeller at Cornwall Insight

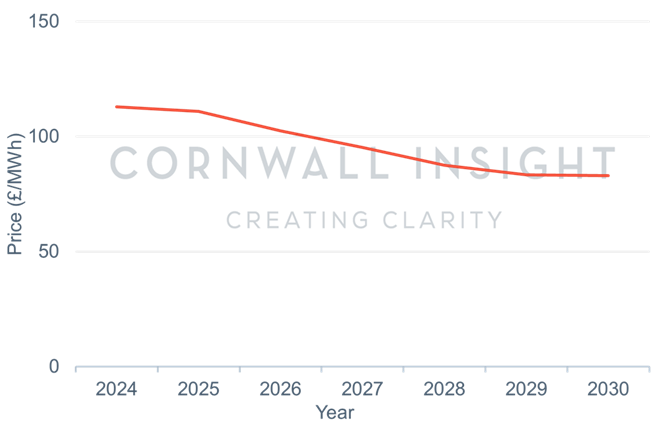

Cornwall Insight have cut their short-term power market price forecast by 12%, with average costs for 2024 now predicted to be £113 per MWh (1).

The decrease in electricity price predictions is attributed to the higher than expected gas reserves in Europe, lowering fears of shortages this winter.

The data, included in Cornwall Insight’s fourth 2023 GB Benchmark Power Curve, reflects a £16 per MWh drop from the previous quarterly forecast. With 20252 and 20263 forecasts also seeing a decline.

Despite the fall, forecasts remain substantially higher than the £50 per MWh historic averages, with Europe’s dependence on international Liquified Natural Gas, following sanctions on imports from Russia, cited as a key reason.

In the medium-term the shift away from higher-cost fossil fuel technologies toward affordable renewables sees prices continue downward, however growing demand from the electrification of the economy and increased exports to Europe means prices are expected to stay above pre-2021 levels until the end of the decade.

The report forecasts power prices will level out to around £83 per MWh by 2029.

Figure 1: Power price forecasts – average price per fiscal year4

Source: Cornwall Insight GB Benchmark Power Curve

Exact figures included in reference

Evelin Blom, Modeller at Cornwall Insight:

“Cuts to power prices will bring much-needed good news for GB households and businesses. With gas reserves easing supply anxieties in the short-term, lower power prices are on the horizon and we’re optimistic that this trend will trickle down to consumer bills.

“While this relief is welcome, GB consumers face a long road to truly affordable energy. The rise in electricity demand poses a significant hurdle, and without action, threatens to keep power bills elevated until the end of the decade and beyond.

“Achieving a clean and affordable energy future requires a balanced approach, one that embraces diverse technologies like offshore wind and nuclear alongside smart renewables investment incentives. By prioritising affordability, security, and sustainability, we can ensure a brighter energy future for all.”

Reference:

- Q3 (Jul – Sept) forecasts for 2024: £129 per MWh

Q4 (Oct-Dec) forecasts for 2024: £113 per MWh

- Q3 (Jul – Sept) forecasts for 2025: £119 per MWh

Q4 (Oct-Dec) forecasts for 2025 £111 per MWh

- Q3 (Jul – Sept) forecasts for 2026: £106 per MWh

Q4 (Oct-Dec) forecasts for 2026: £103 per MWh

- Power price forecasts (Q4) – average price per fiscal year (£ per MWh)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|

| 112.90 | 110.89 | 102.57 | 95.39 | 87.57 | 83.48 | 83.11 |