While setting ambitious goals for renewables is crucial, some argue that pushing too quickly could have unintended consequences, diverting resources to short-term solutions at the expense of longer-term energy security and sustainability.

Tom Musker Modelling Manager

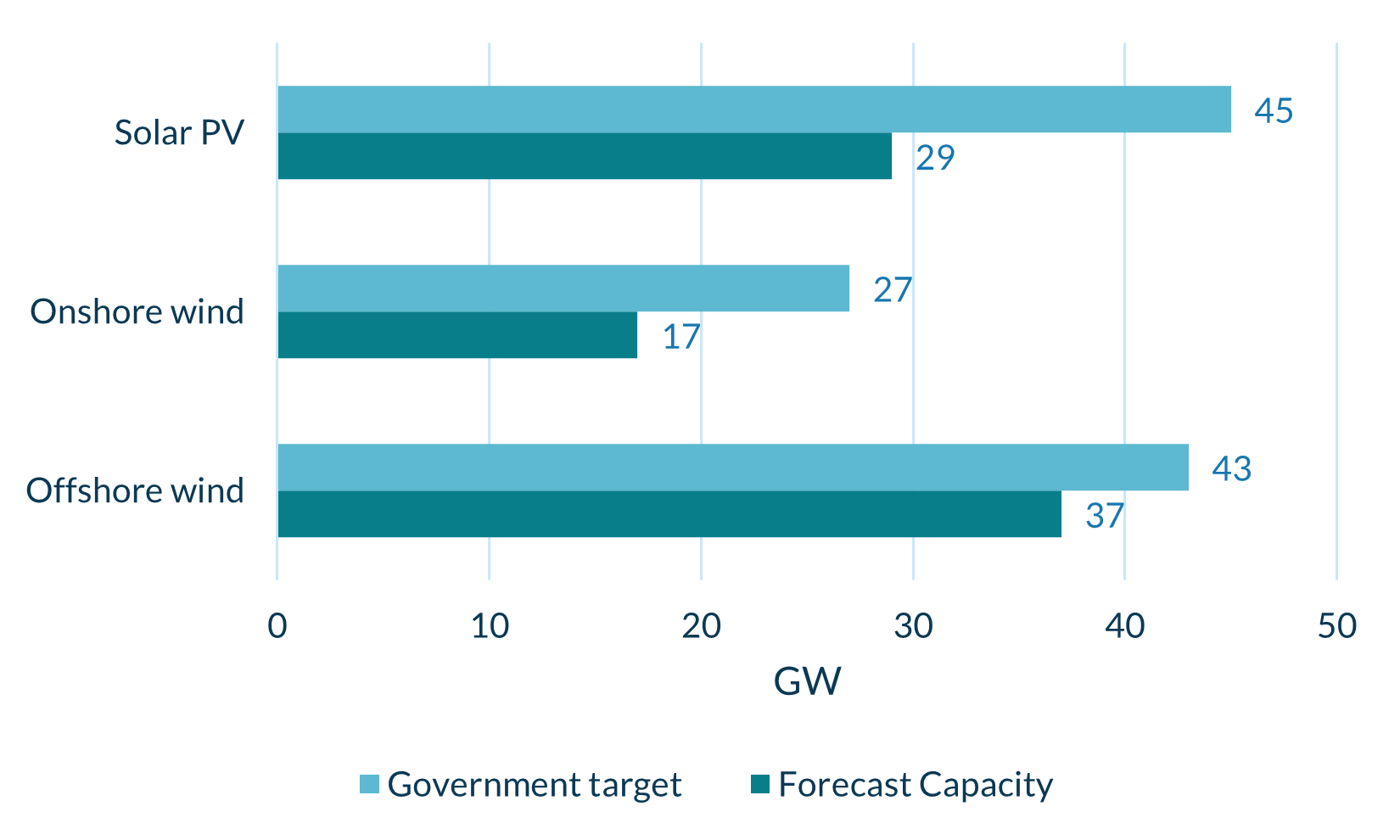

The government is forecast to miss it’s revised Clean Power 2030 targets for offshore, onshore and solar PV by a combined 32GW according to new forecasts from Cornwall Insight.

The data, from Cornwall Insight’s GB Benchmark Power Curve, is projecting a shortfall in capacity, despite the government revising down its capacity targets in its ‘Clean Power 2030 Action Plan’, released in December.

With a 16GW shortfall, solar PV is set for the biggest underperformance, reaching 29GW compared to the 45-47GW government target. Despite the underperformance, Cornwall Insight’s forecast still represents a 70% increase from 17GW installed today.

Onshore wind has been boosted by changes in policy, however, growth is 10GW short of the 27-29GW goal as planning issues continues to hamper progress of projects at the scale needed.

Offshore wind comes closest to the target falling just 6GW short of the 43-50GW goal. Despite cost inflation issues the sector has received consistent support through successive Contract for Difference allocation rounds.

The Clean Power 2030 Action Plan included some much-needed detail on infrastructure and grid connections, as well as investment in flexible generation technologies and storage to balance the intermittent generation, which could see an increase in renewables build-out. However, with 2030 only five years away the impact of these reforms may not materialise quick enough to have a substantial impact on the 2030 capacity.

The growing energy demand from data centres, spurred by the government’s push to expand AI capabilities, underscores the urgency of renewable energy investment. Without sufficient capacity, the UK grid may fall back on fossil fuels, jeopardising decarbonisation goals.

Further uncertainty stems from the lack of clarity around the Review of Electricity Market Arrangements (REMA), particularly the potential move away from national wholesale pricing. These reforms would require a comprehensive overhaul of regulations, contracts, and systems, with significant commercial implications for developers. Without clear guidance, developers are hesitant to invest, threatening the achievement of the UK’s clean power targets.

While the forecasts don’t show the 2030 target being met, the buildout would still be an impressive rise from current operational capacity1. This progress will put the electricity sector on track to achieve net zero emissions in the next decade, ahead of the net zero economy-wide target of 2050.

Figure 1: Forecast 2030 installed capacity vs government target shortfall

Source: Cornwall Insight Benchmark Power Curve Q4 2024

Tom Musker, Modelling Manager, at Cornwall Insight:

"Renewables are set for substantial growth over the next five years, as the country strives to meet its clean power ambitions. However, despite promising progress, the gap between this growth and government targets underscores the urgent need to address both the operational and investment barriers slowing renewables growth. Grid connection delays, supply chain constraints, and uncertainty surrounding electricity market reforms are all creating a challenging environment for developers. Without swift and decisive action to resolve these issues, the UK risks falling significantly behind its clean power ambitions.

"The government’s push towards a fully decarbonised grid represents an opportunity to cement the UK’s position as a global leader in renewable energy. However, while setting ambitious goals for renewables is crucial, some argue that pushing too quickly could have unintended consequences, diverting resources to short-term solutions at the expense of longer-term energy security and sustainability.

"Timely investment in infrastructure, clarity on market reforms, and support for innovative project delivery are vital to unlocking the UK’s clean energy potential. Ensuring we not only meet immediate clean power goals but also stay on track for our broader net zero commitments."

Reference:

- Operational Capacity as of June 2024 rounded to nearest GW: Offshore wind 15GW, Onshore wind 16GW Solar 17GW

Notes to Editors For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is a leading provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish and Australian energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.