While bills are currently expected to dip slightly in July, we are talking by a few pounds - not the meaningful drop households will be hoping for.

Dr Craig Lowrey Principal Consultant

Ofgem has today announced the April-June 2025 Default Tariff Cap (price cap) at £1,849 a year for a typical dual fuel consumer1. This is a 6% increase from January’s cap set at an annual rate of £1,738 and will mark the third consecutive rise. This is the first time that the April cap has risen above the January cap since quarterly updates began in 2022.

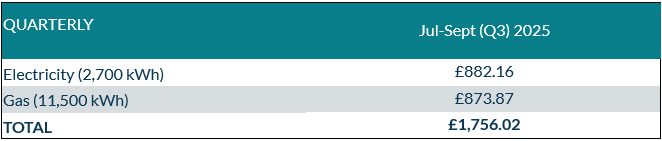

There are however more positive indications from July with bills predicted to fall slightly to £1,756 a year for a typical consumer.

The first two winters after Russia's invasion of Ukraine were unusually mild. However, this winter marked the return of typical cold conditions. Coupled with low renewable energy production across Europe and decreasing gas reserves, this has led to a rise in wholesale prices, which has impacted the April price cap. While the news that prices are due to rise will not be welcomed, the impact will be tempered by reductions in household energy use as we move into the summer months.

Looking at forecasts for July, over the past two weeks we have seen a dip in the energy market, as US - Russia talks on a potential end to the Ukraine war continue. Although these discussions came too late to affect the April cap, the forecasts for the July cap have decreased, albeit remaining hundreds of pounds above the pre-crisis summer cap levels. However, given the high levels of volatility in the market and the ongoing consultations from Ofgem on the non-wholesale elements of the cap, it is extremely likely that forecasts will change multiple times before the July cap is set in three months.

The UK’s reliance on imported gas and the wholesale power market driven by marginal gas costs, leaves it particularly vulnerable to fluctuations in the international wholesale market relative to those nations which meet a greater share of energy demand from their own indigenous sources. As the UK moves forward with the energy transition, and puts more money into renewable generation, it is hoped that this will reduce the need for imported energy and therefore lead to a greater stabilisation in energy bills. However, this process has been taking many years and is expected to take more still.

Figure 1: Cornwall Insight’s Default Tariff Cap forecast using new Typical Domestic Consumption Values (dual fuel, direct debit customer)

Source: Cornwall Insight

Figure 2: Default Tariff Cap forecast, Per Unit Costs and Standing Charge (dual fuel, direct debit customer)

Source: Cornwall Insight

Note: All figures are national average unless otherwise stated. All intermediate and final calculations are rounded to two decimal places. Totals may not add due to rounding.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight:

“There is a sense of déjà vu in the energy market as we watch the price cap rise for a third consecutive time, with the volatile international wholesale market once again the main culprit. Households have been promised falls in bills, and many will be understandably irritated with what they may see as a failure of government energy policy. However, the reality is, our gas-led wholesale power market and reliance on international imports limits the impact of what any government policy can have - at least in the short-term - there is only so much you can do when prices are rising across the world.

“That’s not to say the government and the regulator are without options to help lower consumer bills. Ofgem has ongoing consultations looking at the non-wholesale costs included in the cap, and of course the government has levers it can pull from social tariffs to support payments. We are also seeing initial considerations on structural changes to the cap, with Ofgem’s consultation on a zero standing charge variant announced last week. However, many would argue all of this is merely tinkering with what is - at least for bill payers - a fundamentally broken system.

“While bills are currently expected to dip slightly in July, we are talking by a few pounds - not the meaningful drop households will be hoping for. Ultimately, if we want to reduce bills substantially and sustainably, we need to reduce our reliance on imported gas, through increasing the number of reliable renewables on the grid. However, this is no small ask when we also consider the costs in doing so and also the time associated with market reforms. However, unless we want to remain in the perpetual cycle of volatile markets and increasing bills, this is the only long-term solution.”

Reference:

- Ofgem’s Typical Domestic Consumption Values (TDCVs), are set at 2,700 kWh per annum for electricity, and 11,500 kWh per annum for gas.

Notes to Editors For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is a leading provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish and Australian energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.