"Since our previous forecasts, concerns regarding lower energy capacity on the continent have increased. Due to a rise in export requirements and limited import capabilities, prices are expected to remain significantly higher than pre-pandemic levels."

Ruth Young Senior Consultant

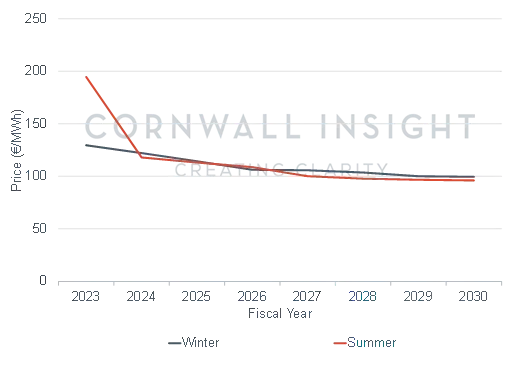

Cornwall Insight has raised its long-term predictions for power prices in Ireland as a projected rise in interconnector exports and reduced imports pushes up demand and costs. Ireland’s first 2023 – ‘All-Island Power Market Outlook to 2030’ – which looks at data modelled in the first quarter of the year, has shown prices levelling out at around €100/MWh from 2027 up until 2030. We previously forecast these would fall below €100/MWh from 2026 onwards. This is due in part to lower capacity in the continent, with the impact of developments such as lower French nuclear production contributing to the price rises. The impact is expected to be greatest in the summer as the shift in the balance between imports and exports narrows the gap between seasonal prices.

In the short-term power prices are expected to remain high for the remainder of 2023, as Europe continues to rely on volatile international LNG to replace the lower-cost Russian gas. However, the outlook in the mid-term is more optimistic as expensive coal and oil-fired power plants are replaced by lower marginal cost renewable energy generators as part of Ireland’s commitment to achieving its 80% renewable electricity target by 2030. Additionally, the completion of the North-South interconnector, which will link Northern Ireland and Ireland, is expected to make the network more efficient helping to lower prices further.

While the electrification of the economy, particularly for heat and transportation, and higher exports to the continent have raised power price predictions for the latter part of the decade, prices are expected to stabilise at a significantly lower level than the current rates. While they may not drop below pre-pandemic levels throughout the decade and potentially beyond, there is a notable shift towards more affordable pricing.

Figure 1: Power price forecasts – average price per fiscal year

Ruth Young, Senior Consultant at Cornwall Insight, said:

The overall direction of the power prices out until 2030 is positive and we are continuing to see predictions up to mid-2020 fall as the closure of high-cost fossil fuel plants makes way for lower-cost offshore wind and solar. While prices level out later in the decade, they are poised to remain significantly lower than the historical highs witnessed in the past two years.

While the outlook gives us reasons to be positive, the rise in our long-term forecast is still a worry. The electrification of the economy in Ireland was always going to raise demand and with it prices. However, since our previous forecasts, concerns regarding lower energy capacity on the continent have increased. Due to a rise in export requirements and limited import capabilities, prices are expected to remain significantly higher than pre-pandemic levels.

Despite raised predictions, we are cautiously optimistic that the worst of the energy crisis is behind us and it is unlikely that the exceptional prices witnessed over the past two years will make a comeback in the next decade and likely beyond. However, the energy crisis has taught us the importance of not taking prices for granted. While we predict stability, unforeseen events could disrupt the market once again, especially considering our continued reliance on costly and volatile imports. Nevertheless, the transition towards renewable energy in Ireland, as part of its 2030 goals, offers increased energy security that we hope will help shape a more favourable and cost-effective energy landscape for the years to come.”

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/ie/

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.