"One major challenge is increasing the energy obtained from each auction until 2030, which is no small feat. Merely maintaining the current pace will not suffice if we aim to meet the targets."

Sean Hughes Modelling Analyst

Analysis conducted by Cornwall Insight Ireland has unveiled that Ireland must significantly increase its renewable’s procurement efforts if it is to meet its ambitious Climate Action Plan 2023 (CAP23) targets.

Cornwall Insight’s All-Island forward curve analysis indicates that an additional capacity of nearly 1GW must be secured at every eligible renewables auction up to 2030 if it is to avoid missing its climate targets.

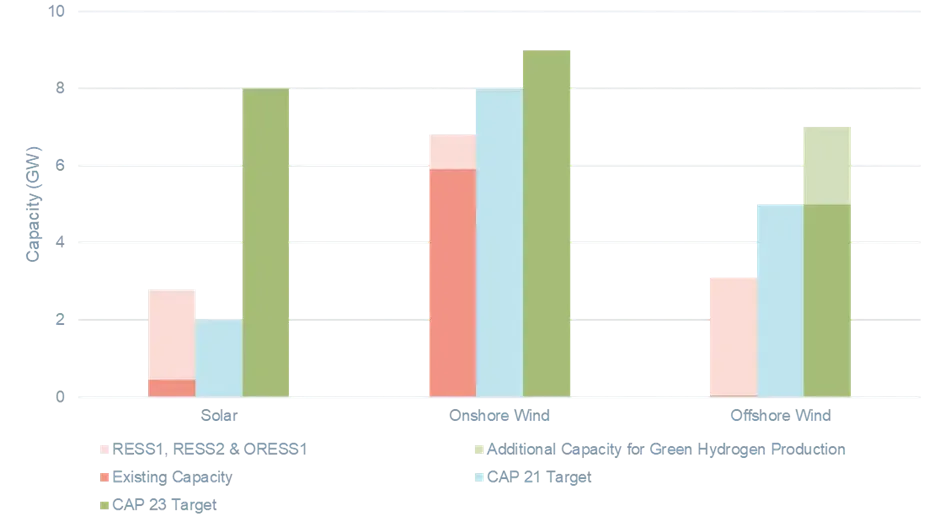

In December last year, the government increased its renewable’s goal from 15GW in the Climate Action Plan 2021 (CAP21) to 22GW in CAP23, in an attempt to reach an 80% renewable electricity share by 2030.1 To achieve the new target Ireland will need to secure an extra 0.5GW of solar power, on top of what they already obtain through auctions, at every Renewable Electricity Support Scheme auction (RESS) up to 2030. Additionally, a further 0.3GW of onshore wind capacity must be procured.

Although offshore wind is currently meeting its targets, some projects from the Offshore Renewable Electricity Support Scheme (ORESS) auctions will only become operational after the 2030 target date, and therefore not contribute to the targets.

These findings come off the back of the recent call for evidence paper on CAP24 by the Department of the Environment, Climate & Communications. The paper calls for proposals from industry for additional policies and measures to reduce greenhouse gas emissions and enhance resilience to climate change in preparation for the release of the CAP24 consultation. This will include a roadmap for the industry to further develop and refine the actions, measures, policies, and plans set out in CAP23.

Figure 1: Renewables capacity targets under CAP23

Source: Eirgrid, SONI, ESB and the Department of the Environment, Climate and Communications

Figure 2: Capacity needed for future Auctions to meet CAP 23 targets

| Technology | Average Capacity Procured per Past Auction | Capacity Needed per Future Auction for CAP 23 Targets |

|---|---|---|

| Solar | ~1.2 GW | ~ 1.7 GW |

| Onshore Wind | ~ 0.4 GW | ~ 0.7 GW |

| Offshore Wind | ~ 3 GW | ~ 1 GW |

Source: Cornwall Insight

In Ireland’s pursuit of meeting climate targets, challenges extend beyond procurement, including grid connections and system security. Limited capacity for connecting renewable generation to meet demand poses a hurdle, while the unpredictable nature of solar and wind raises concerns about system security. Investment in storage technology, vital for balancing renewable fluctuations, lags behind renewable generation. Addressing these challenges is crucial for a successful transition to a sustainable energy future.

Sean Hughes, Modelling Analyst at Cornwall Insight Ireland:

The increased ambition for building renewables over the last year is encouraging, however, there are significant obstacles to overcome if Ireland hopes to achieve its renewable energy targets. One major challenge is increasing the energy obtained from each auction until 2030, which is no small feat. Merely maintaining the current pace will not suffice if we aim to meet the targets.

Even if we manage to enhance procurement adequately, the absence of grid connections and energy storage could render those efforts futile. After all, if the energy cannot reach consumers or be stored for future use, the purpose of its production becomes obsolete.

Ireland stands at a critical juncture in its net zero journey, The recent call for evidence paper on CAP24 is a resounding plea for collaboration in the industry to meet its ambitious renewables targets, and it is hoped that the subsequent roadmap will help to cement Ireland as a leading renewable energy nation. By prioritising the procurement of renewable resources and fortifying its grid infrastructure, the country can pave the way towards a sustainable and resilient energy future.”

Reference:

- Offshore Wind: Same 5GW target with an additional 2GW for green hydrogen production.

Onshore Wind: 9GW, up from 8GW in CAP21.

Solar: 8GW, from 1.5-2.5 GW in CAP21

- Ends

Notes to Editors

Cornwall Insight employs a meticulous modelling process, considering factors such as demand forecasts, development costs, non-synchronous generation limits, and other essential variables. This thorough evaluation allows us to shape a well-informed perspective on the future of all-island renewable generation.

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.