If we can continue to see battery growth in the Single Electricity Market, it will only encourage more companies to put their faith in Ireland as a place to bring their projects, which in a competitive renewables’ world is what we need to see.

Lisa Foley Principal Consultant

The Single Electricity Market (SEM) across Ireland and Northern Ireland is set for significant battery storage growth, with short-to-medium duration capacity forecast to increase fivefold by 2030. This surge in battery storage expansion is likely to kickstart more investment in renewables, helping Ireland and Northern Ireland in their journey to meet their respective renewable energy targets of attaining 80% of electricity from renewables by 2030.

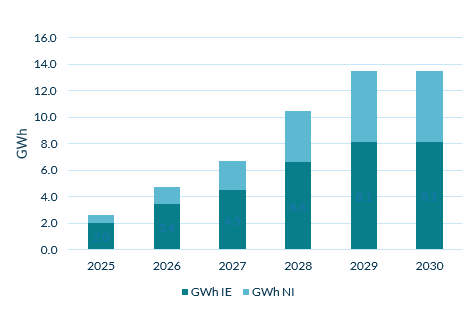

The data from Cornwall Insight’s SEM Benchmark Power Curve, forecasts that the capacity of short- medium term lithium-ion battery storage, which includes batteries from 0.5hr capacity all the way to 4h capacity, will increase from 2.7GWh in 2025 to 13.5GWh by 2030. If these 2030 predictions materialise, this will allow these batteries to discharge up to 5GW of energy at any given time - a substantial increase from the 1GW which is currently possible.

Short- and medium-term battery storage plays a crucial role in replacing fossil fuel usage by providing fast acting reserves that ensure a balance of electricity supply and demand on the grid. As well as providing local support to reduce the amount of produced renewable energy that is lost due to network limitations. This is very important as more intermittent renewables come on to the grid.

The new Irish Electricity Storage Policy Framework released in July, has boosted the forecasts for both short- and long-term duration batteries, with the framework encouraging storage investors to progress their projects in Ireland. While Northern Ireland currently lacks a comprehensive strategy, there is optimism that a battery strategy will start to be developed soon, further supporting the SEM’s energy transition goals.

Despite this positive news, there are still concerns over both Ireland and Northern Ireland meeting their respective targets for 80% of electricity to come from renewables by 2030. Although we did see renewables growth in this year’s fourth Irish Renewable Electricity Support Scheme (RESS 4) auction, technologies, especially onshore wind, are lagging behind their targets. This shortfall has prompted Cornwall Insight to push back its forecast, now projecting that the SEM will not achieve its renewable generation goals until 2033, with planning and connection delays chief amongst the reasons deterring potential bidders and slowing down project timelines.

Figure 1: Battery storage capacity forecasts for the Single Electricity Market (SEM)

Lisa Foley, Cornwall Insight, Principal Consultant :

“The rising forecasts for short-medium term batteries, shows the Irish government’s battery framework, is certainly doing its job – which is good news for investors and decarbonisation targets alike. If we can continue to see battery growth in the Single Electricity Market, it will only encourage more companies to put their faith in Ireland as a place to bring their projects, which in a competitive renewables’ world is what we need to see.

“Of course, batteries are only one part of the decarbonisation pie. While renewable technologies are growing, they are unfortunately not keeping up with the levels needed to reach the 2030 renewable generation goals. Swift action on planning and policy improvements is needed to unlock the full potential of our renewable resources and keep pace with our climate goals.”

Notes to Editors For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.