"If the country maintains this year’s impressive growth in both sales and infrastructure, we are likely to see EVs in the country become increasingly attractive for investors and consumers alike"

Jamie Maule Research Analyst

New analysis has revealed that Battery Electric Vehicle (BEV) growth in Ireland over the past year has surged ahead of most major European countries.

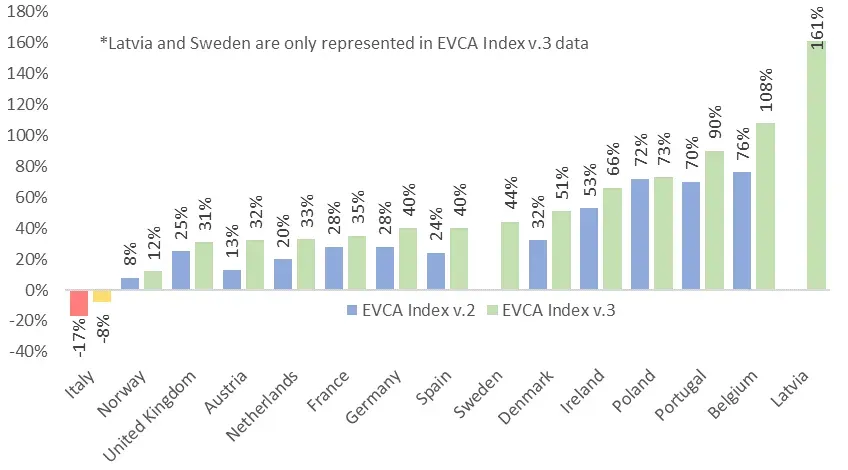

The data, analysed by Cornwall Insight and law firm Shoosmiths for their Electric Vehicle Country Attractiveness (EVCA) Index1, shows Ireland has grown its BEV sales by 66% (Figure 1) over the last four quarters (Q322 – Q223), topping the impressive 60.6% average growth seen across the 27 European Union nations.

Ireland continues to demonstrate its commitment to furthering the Electric Vehicle (EV) transition, which includes the introduction of the National EV Charging Infrastructure Strategy in early 2023. This has seen Ireland grow its publicly accessible charge-point numbers by 129% in the past four quarters (Figure 2), the highest of any major European country.

Despite the progress, Ireland is a number of years behind many other European countries. With only one accessible charge point for every 19.7 BEVs on the road, it is struggling to match up to other European countries in overall attractiveness for investment.

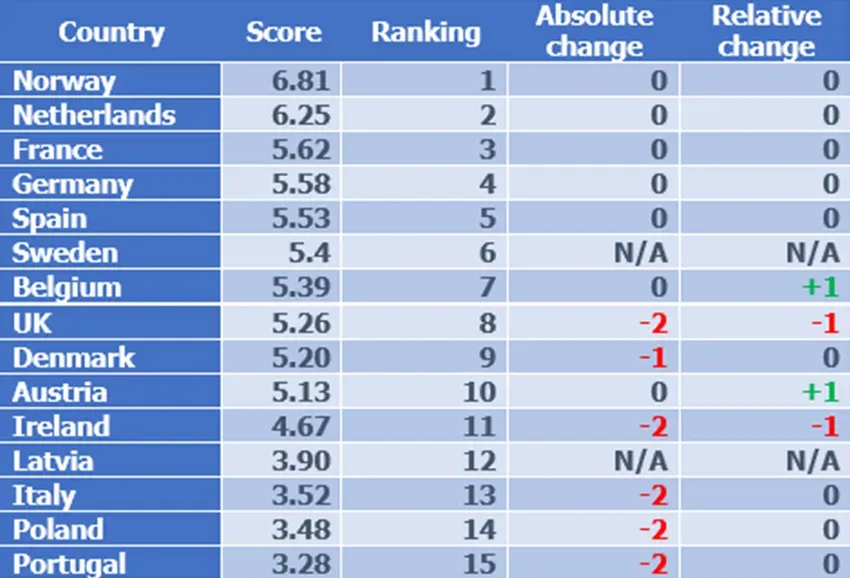

The lack of charging infrastructure and the addition of Sweden have seen Ireland drop from ninth to eleventh place on the EVCA Index, as Norway retains the top spot. However, the impressive growth of Ireland’s BEV fleet and its public charging network over the past four quarters shows promise for the future, and we could therefore see its EVCA index ranking improve.

Figure 1: BEV sales growth, Q322 – Q223

Source: The European Automobile Manufacturers Association (ACEA)

Figure 2: Publicly accessible charge-point growth, Q322 – Q223

Source: European Alternative Fuels Observatory

Figure 3: EV Country Attractiveness index scores and rankings:

Source: Cornwall Insight and Shoosmiths

*Absolute change refers to the overall change in ranking while relative change tracks the change in ranking since the previous iteration of the index, without the inclusion of Sweden and Latvia.

Jamie Maule, Research Analyst at Cornwall Insight:

Ireland’s EV market has demonstrated remarkable growth, positioning the country as a standout performer in European EV expansion this year. The limited availability of public charge points in Ireland has presented a barrier to EV adoption, and the new focus on expanding its infrastructure is a promising step. If the country maintains this year’s impressive growth in both sales and infrastructure, we are likely to see EVs in the country become increasingly attractive for investors and consumers alike, with Ireland having the potential to become a leading player in the European EV market.”

Chris Pritchett, energy and infrastructure partner at Shoosmiths, said:

Although there is some lag behind other European nations, the scope for rapid expansion in Ireland is immense, and we know the charge point operators are targeting the territory with increasing focus. It will be very exciting over the next 12 months to see these opportunities come to market, and we’re looking forward to supporting Charge Point Operators, energy companies, funders, and landowners in driving effective and efficient collaboration to bring these projects home as soon as possible”.

Reference:

1.The Electric Vehicle Country Attractiveness (EVCA) Index is a quarterly ranking that charts the relative attractiveness of major European nations for investment in EVs. A range of indicators, subject to differing weightings, have been utilised in the production of this index. They are listed as follows without regard to importance or weighted value:

- Committed government funding

- National EV sales targets

- National EV charge-point implementation targets

- Support for ICE vehicle rollback or ban

- Available investment subsidies, funds, and tax benefits for EVs and EV charge-points

- Available purchase subsidies, funds, and tax benefits for EVs and EV charge-points

- Ability to conduct business

- Rate of inflation

- Market share of BEVs

- Year-on-year growth of BEV sales

- Wholesale cost of electricity scaled to GDP

Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

Want to keep up to date with Cornwall Insight’s price cap predictions? We have launched a dedicated webpage that will be regularly updated with our released predictions. This page also offers helpful answers to frequently asked questions about the price cap. Don’t miss out on this valuable resource – check out the page today: Predictions and Insights into the Default Tariff Cap

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.

About Shoosmiths

Shoosmiths is a major law firm with a network of offices working together as one team. A key tenet of the firm’s strategy is its focus on five sectors – Mobility, Energy & Infrastructure, Technology, Living, and Financial Services. Electric vehicle (EV) charging infrastructure touches on all of these sectors and, as such, is an area of combined focus for the firm’s sector groups.

Shoosmiths’ national multi-disciplinary e-Mobility & infrastructure team has a proven track record supporting the EV sector. Their specialists advise companies involved throughout the sector from initial corporate fundraising and investment to project site selection (including real estate, commercial, planning and construction advice), to project operation and maintenance, to operational commercial offers for consumers and third-party access to charging infrastructure, to final divestment.