“While some may argue that the delay won’t have a significant impact, Ireland’s continued reliance on insecure imports exposes us to global market disruptions, which could drive up prices, while our dependence on fossil fuel generated power is delaying our progress toward achieving net zero."

Kitty Nolan Energy Modeller

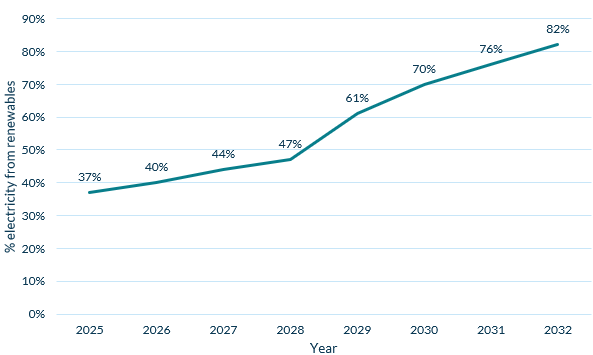

Ireland and Northern Ireland’s ambitious goals of generating 80% of their electricity from renewable sources by the end of this decade, will be delayed until at least 2032, according to new forecasts from Cornwall Insight. The data included in their SEM (Single Electricity Market) Benchmark Power Curve, reveals that by 2030 only 70% of the power grid will be using renewable sources, with the majority of the remaining electricity generated by gas plants.

While the 80% target set by both the Irish and Northern Irish governments is likely to be missed, significant progress has been made, with the SEM currently having the highest contribution of wind generation of any power system in the world. Forecasts also predict a substantial increase in the percentage of electricity from renewables, rising from just over 40%1 in 2023 to 82% in 2032.

Despite the successes, the 2030 target, included all Irelands Climate Action Plans since 2021, has encountered several challenges. Chief among these are delays in planning and a shortage of grid connections. These issues have been significant barriers for generators submitting bids in the Renewable Electricity Support Scheme (RESS) auction, which resulted in only three successful onshore wind projects last year.

Concerns over a lack of procured onshore wind projects have been increased by the announcement that the RESS4 auction, the final auction to procure generation coming on the grid prior to 2030, will see a lower onshore wind auction price cap. This is likely to deter bidders.

Other barriers to meeting the target have been raised by Wind Energy Ireland who recently warned that dozens of wind farms will be forced to shut down before the end of the decade if their planning permission timeline cannot be extended, potentially causing further delays to all Ireland’s renewables transition.

While there are still many obstacles to reaching the renewables target, there have been some positive steps forward for the RESS scheme. Changes include allowing generators to delay their required operational date by up to two years if systems operator grid connection issues or judicial reviews of planning permissions arise, which it is hoped will increase the number of renewables bids.

In further positive news, Northern Ireland is currently designing its own renewable support scheme, aiming to boost renewable energy projects. The first auction is anticipated for 2025/26, but much of the procured capacity is expected to come online after 2030.

Figure 1: SEM future electricity generation from renewables2

Source: Cornwall Insight

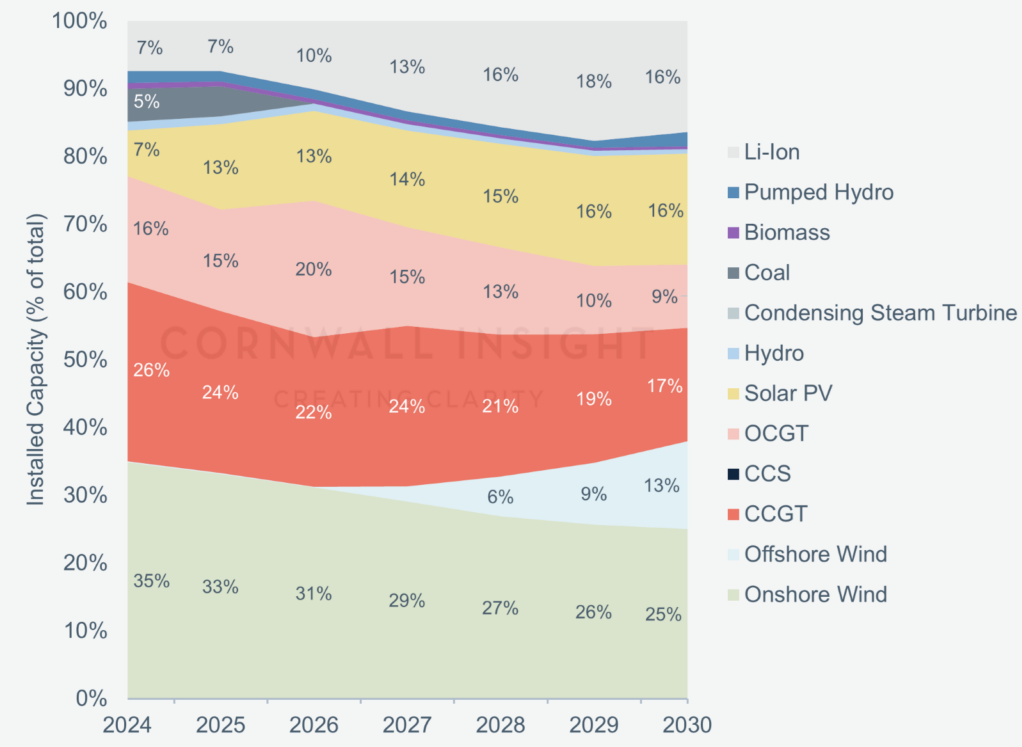

**Figure 2: Future electricity generation capacity breakdown **

Source: Cornwall Insight

Kitty Nolan, Energy Modeller at Cornwall Insight said:

“Without addressing the systemic challenges in Ireland’s renewables development process, including critical infrastructure and planning concerns, the country’s renewable energy goals will remain out of reach.

“While some may argue that the delay won’t have a significant impact, Ireland’s continued reliance on insecure imports exposes us to global market disruptions, which could drive up prices, while our dependence on fossil fuel generated power is delaying our progress toward achieving net zero.

“It’s crucial that we streamline these planning processes and invest in grid infrastructure to meet our climate commitments. Achieving the 80% renewable target is possible, but it requires decisive and immediate action from all stakeholders involved.”

Reference

Ireland had 42%of electricity generated from renewables in 2023 and Northern Ireland had 45.8% This percentage encompasses onshore wind, offshore wind, solar, and hydro energy, and is calculated based on the demand met by renewables.

– Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish, Australian, German and Japanese energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.