"With prices forecast to remain comparatively stable over the decade, there's cautious optimism that these price drops aren't just a temporary blip but rather symbolic of a sustained trend."

Tom Musker GB and Ireland Modelling Manager

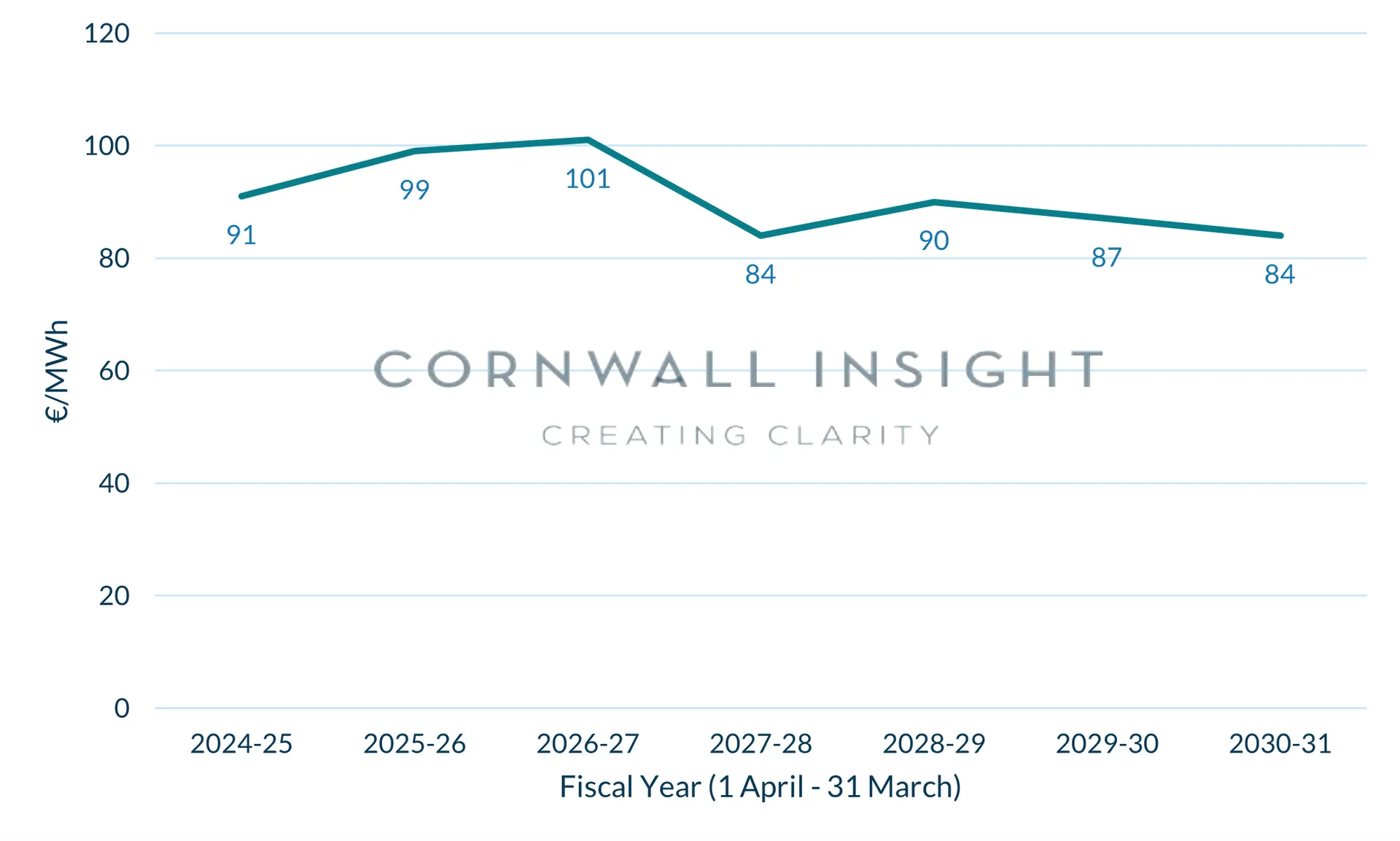

New forecasts from Cornwall Insight’s SEM Benchmark Power Price Curve indicate power prices are set to fall in 2024-25. Power prices are expected to drop from an average €106 per MWh during the previous 2023-24 fiscal year, to €91 per MWh over the 2024-2025 fiscal year, marking a 14% decrease.

This news is positive for both households and businesses, with the trickle down of lower power prices potentially leading to cuts in energy bills.

Cornwall Insight’s power price predictions for 2024-25 have been falling for the past few months. The mild winter coupled with ample gas stocks in Europe have reduced the need for a gas injection over the summer to meet targets, meaning gas prices continue to fall.

Despite the fall, the impact of Europe’s increased reliance on Liquified Natural Gas shipments following the sanctions on imports from Russia, are expected to keep Irish prices above historic averages.

In the medium-term, prices are expected to remain between €90/MWh and €100/MWh. Prices will gradually decrease towards the end of the decade as renewable generators are built to meet the 80% renewable generation target by 2030, replacing capacity provided by higher marginal cost coal- and oil-fired plants.

While the growth in renewables does lead to a small reduction in prices from 2028-2029, the fall in prices is tapered by increasing demand and the completion of the Celtic and MaresConnect interconnectors, which results in Ireland becoming a net exporter of electricity by the early 2030s.

Figure 1: Power price forecast – average price per fiscal year (€/MWh)

[

Source: Cornwall Insight

- €/MWh in real money 2022-2023 prices

Tom Musker, Modelling Manager at Cornwall Insight:

“Our forecasts continue to paint a brighter picture for power prices, with this year’s average power price now expected to be lower than 2023-24. This can only be good news for Irish consumers, who despite recent energy price falls, are still grappling with high energy bills during a cost of living crisis. With prices forecast to remain comparatively stable over the decade, there’s cautious optimism that these price drops aren’t just a temporary blip but rather symbolic of a sustained trend.

“Of course, it’s crucial to stay realistic, Ireland’s dependence on imported energy leaves the country, and much of Europe, at the mercy of global energy price fluctuations. While the energy market remains relatively stable at the moment, unforeseen events could once again shake up the system and lead to spikes in prices. This underscores the importance of Ireland prioritising investment in renewable energy generation. Doing so will help to deliver energy stability and security, without the risks associated with a heavy reliance on imports.”

Reference:

€/MWh in real money 2022-2023 prices Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.