While measures like the Long-Term Decarbonisation Auction (LTDA) show promise, more targeted reforms are essential to accelerate wind and solar deployment.

Sarah Nolan Senior Modeller

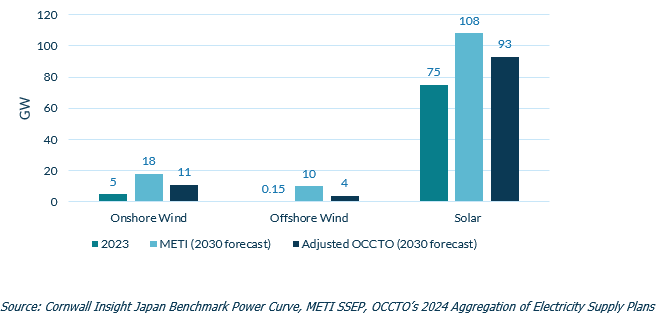

Japan is falling short of its ambitious renewable energy targets, according to analysis from Cornwall Insight. The new report reveals, that by 2030, the country is likely to miss its capacity goals by 7GW for onshore wind, 6GW for offshore wind, and 15GW for solar PV. This shortfall could leave non-carbon sources supplying just 41% of Japan's energy mix by 2030—well below the government’s ambition of 59%, laid out in the Ministry of Economy, Trade and Industry (METI), Sixth Strategic Energy Plan (SSEP) and the GX Decarbonisation Power Supply Bill.

The Japanese government have ambitious targets of 18GW of onshore wind, 10GW of offshore wind and 108GW of solar PV by the end of the decade. However, Cornwall Insight’s Japanese Benchmark Power Curve Report, in partnership with Shulman Advisory, highlights major challenges in Japan’s decarbonisation journey, including mixed results from auctions, grid infrastructure issues and local opposition to developments, alongside other barriers. Cornwall Insight’s analysis is based on the Organisation for Cross-regional Coordination of Transmission Operators (OCCTO) 2023 “Aggregation of Electricity Supply Plans”.The report evaluates installed capacity and projections for 2028 and 2033, using data submitted by developers and the regional transmission system operators. Adjusting the scenario for 2030, Cornwall Insight’s report shows Japan’s renewable capacity is set to fall short, underscoring the need for accelerated action to overcome hurdles in renewable deployment.

While METI and OCCTO differ regarding the share of low carbon generation in the capacity mix by 2030, technologies such as wind (particularly offshore wind), solar, hydrogen, and battery storage are forecast to see growth in both scenarios.

There are various mechanisms that the country has put in place to increase low carbon capacity, including: the Feed-in Premium (FiP); the Green Transformation (GX) Promotion Act; GX Economic Transition Bonds; wind power auctions; the single year capacity market; and most recently the Long-Term Decarbonisation Auction (LTDA), with an aim to gradually increase the proportion of renewable assets on the system.

The results of the inaugural LTDA saw out of the 9.8GW awarded, 5.7GW was LNG supply and 4GW was non-LNG 'clean power sources' supply contracted for 2027-47. While LTDA did exceed expectations with Battery Energy Storage Systems, no bids for wind or solar were submitted as developers increasingly favour private bilateral agreements over the LTDA’s revenue-sharing structure.

Japan has implemented several changes for the next LTDA auction to promote the construction and replacement of decarbonised power sources and accelerate nuclear rollout. However, no significant changes are expected to help incentivise more renewable technology assets such as wind and solar, therefore the next LTDA auction is likely to see a similar basket of results.

Other barriers to the renewable’s rollout include challenges on the grid, with grid infrastructure gaps, including insufficient connectivity. As well as coordination challenges with Japan’s unique dual-frequency grid system (50Hz in the east and 60Hz in the west) adding complexity to integrating nationwide renewable capacity.

On top of these concerns, significant obstacles, including limited land availability, and local opposition to renewable projects, are also thwarting Japan’s low carbon success.

The government is expected to agree on the Seventh Strategic Energy Plan in 2025. This revision is should to take into consideration expected demand growth in Japan as well as refocusing on security of supply and the role of carbon capture and storage in meeting 2050 ambitions. It’s also hoped that the plan will provide more clarity on how Japan plans to meet its ambitious renewables targets in the coming years.

Figure 1: Forecast capacity for Japan’s power market in 2030

Sarah Nolan, Senior Modeller at Cornwall Insight:

"Japan's ambitious renewable energy targets face significant structural challenges. While measures like the Long-Term Decarbonisation Auction (LTDA) show promise, more targeted reforms are essential to accelerate wind and solar deployment. If the challenges surrounding the LTDA can be overcome, then the auction could open pathways to investment and opportunities for foreign investors to collaborate and provide a means of working towards Japan’s decarbonisation. However, without decisive action, Japan risks falling far short of its 2030 aspirations.

“Beyond the LTDA, progress is needed across multiple fronts, such as enhancing grid infrastructure improvements, and streamlining planning processes through stronger collaboration between developers and local communities. Addressing these areas is critical to meeting the government's ambitious energy targets. “Even if the government’s goals prove out of reach, there is room for optimism. Renewables will continue to grow in both wind and solar sectors, and upcoming announcements in the new year are expected to drive further progress. With sustained efforts, Japan can speed up its energy system decarbonisation and deliver a more sustainable and secure energy future.”

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is a leading provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish and Australian energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.