Balancing energy prices amid rising demand and the loss of nuclear generation capacity will require thoughtful coordination of policy, investment, and innovation.

Tom Edwards Principal Modeller

The scheduled closure of two of the UK's Advanced Gas Reactor (AGR) nuclear power stations is forecast to trigger an increase in wholesale electricity prices in 2027, with prices remaining elevated through the end of the decade.

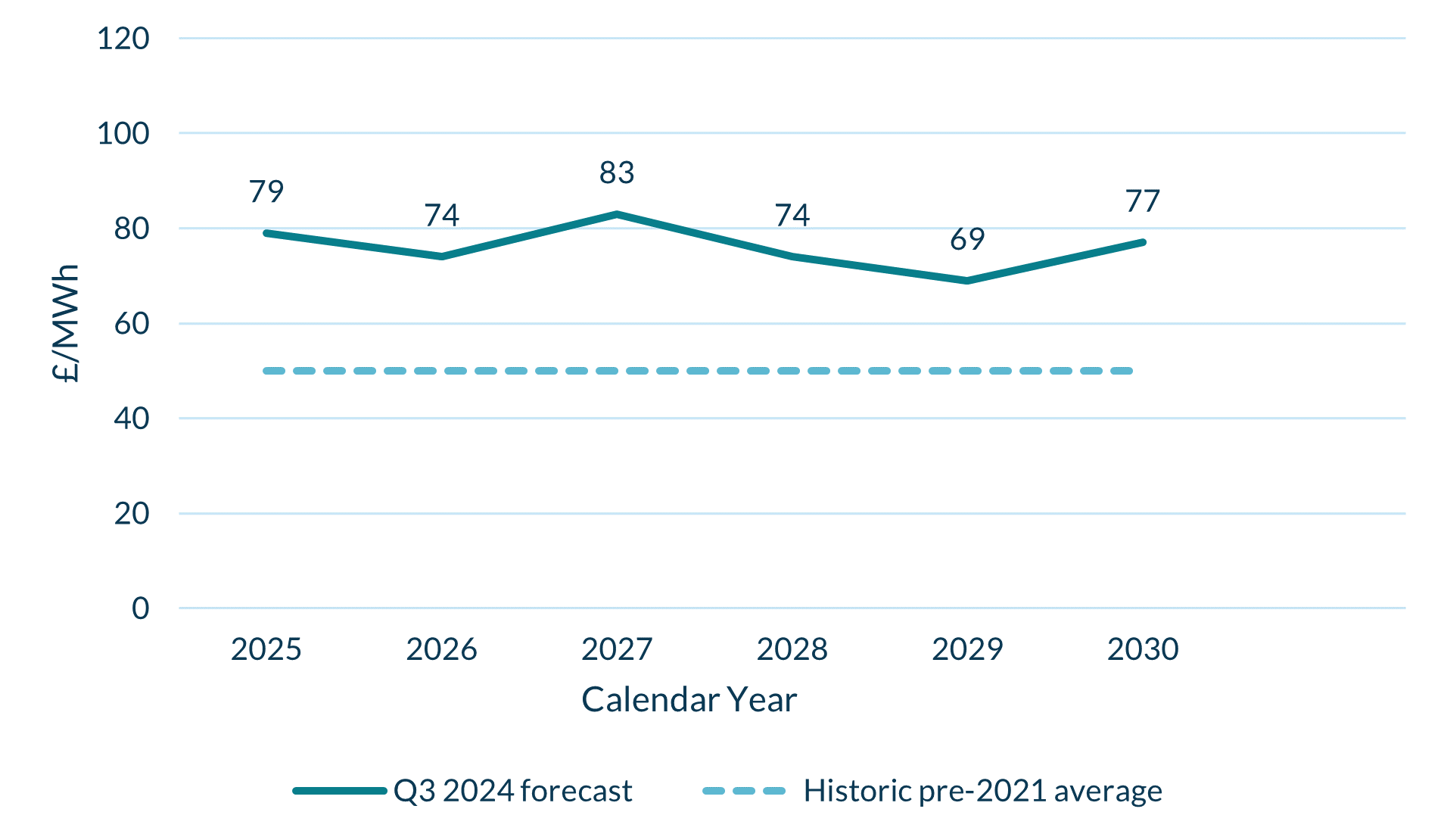

Data from Cornwall Insight’s Benchmark Power Curve shows wholesale electricity prices are projected to reach £83/MWh in 2027, just after the AGRs are due to close. This is higher than the average £81/MWh prices suppliers paid over the past year for the energy they intend to use in 2025. By 2030 wholesale prices are forecast to have only dropped slightly to £77/MWh.

Since wholesale electricity prices make up the bulk of consumer bills, this could jeopardise the government’s promise to significantly reduce energy bills by the end of the decade.

At the beginning of the decade, the UK had eight nuclear power stations contributing to about 16% of the country’s total electricity generation1. Seven of these were AGR stations, with the eighth being Sizewell B. Three of the AGR stations have already been decommissioned, with two more set to close by 2026-27 and the remaining two by 2028-292.

Electricity demand is expected to surge by over 30%3 in the next five years, driven by the electrification of heat and transport. Although more renewable energy sources are set to come online, the closure of nuclear stations and slower-than-anticipated progress on some renewable targets are likely to keep electricity prices elevated. Additionally, high commodity prices will continue to exert upward pressure on costs.

EDF, which owns the remaining AGR sites, has indicated plans to extend the life of the final four stations at a cost of £1.3 billion. A decision on this is due at the end of the year and is subject to regulatory approval and final investment decisions. However, given the age of the plants, there are concerns both inside and outside the industry about the financial, environmental, and safety risks of extending their operation.

However, if feasible, extending the lifetime of these plants would be of notable benefit to the government’s ambition to develop a Clean Power system by 2030. At a load factor of 75%4, these plants would produce 13.1TWh (1.99 GW) — equivalent to the output of 3.3GW of offshore wind, 5.3GW of onshore wind or 13.6GW of Solar PV. If they are not extended, they would need to be replaced by other clean technologies.

Figure 1: Power price forecasts – average price per calendar year

Source: Cornwall Insight GB Benchmark Power Curve

Tom Edwards, Cornwall Insight, Principal Modeller:

"As the UK prepares for the closure of its Advanced Gas Reactor (AGR) nuclear power stations, the challenges of managing capacity during the energy transition are becoming more evident. Balancing energy prices amid rising demand and the loss of nuclear generation capacity will require thoughtful coordination of policy, investment, and innovation.

“A holistic view of the net zero transition is essential. Only investing in Renewables without maintaining dispatchable, low carbon power sources, such as nuclear, will mean there will be periods where reductions in this aging low-carbon capacity will necessitate replacement with higher carbon power sources, which could complicate the government's plans. They’re counting on the growth of renewables to lower short-term wholesale prices - and, by extension, consumer bills.

“However, in the long run, as we expand our renewable energy capacity and energy storage, we can expect more stability in wholesale prices, reduced dependence on volatile imports, and enhanced energy security through domestically produced power. So many will agree it is a price worth paying.”

References:

-

The decommissioning of the AGR nuclear power stations – National Audit Office 2022

-

Ceased generation: Dungeness B, Hunterston B and Hinkley Point B Scheduled to cease generation by 2026: Hartlepool and Heysham 1 Scheduled to cease generation by 2028: Heysham 2 and Torness are scheduled to cease production in 2028.

-

From 334,485GWh in 2025 to 438,173GWh in 2030

-

The ratio of the energy a reactor unit produces to the energy it could produce

Notes to Editors For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.