Ofgem has today announced the October (Q424) Default Tariff Cap (price cap) at £1,717 a year for a typical dual fuel consumer1. This is a 10% increase from July’s cap set at an annual rate of £1,568. Wholesale price rises, particularly since the start of July, have been cited as the key reason for the increase in bills, with GB’s reliance on imports – particularly of gas – making it vulnerable to the volatile international energy market.

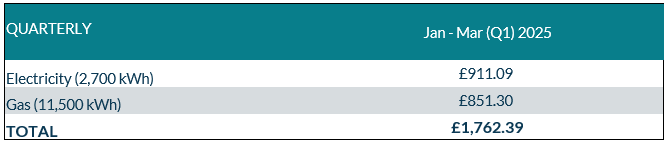

New forecasts from Cornwall Insight indicate that this may not be the last of the increases. The January 2025 (Q125) cap is currently projected to rise by an additional £.45to £1,762 (Figures 1 and 2), this would mark a 3% increase from October’s cap.

The October increase - and the forecast rise in January - will put more pressure on the government to introduce measures, such as social tariffs, which could shield vulnerable households from some of the effects of these hikes during the winter period.

It may also increase calls for the price cap to be reformed or scrapped altogether. Critics argue that the cap is a distraction to the overriding concerns in the energy market at best and at worst risks impeding competition and customer choice. Ofgem is currently undertaking a comprehensive review of the cap as part of its assessment of general consumer protection measures, and we await the findings.

Figure 1: Cornwall Insight’s Default Tariff Cap forecast using new Typical Domestic Consumption Values (dual fuel, direct debit customer)

Source: Cornwall Insight

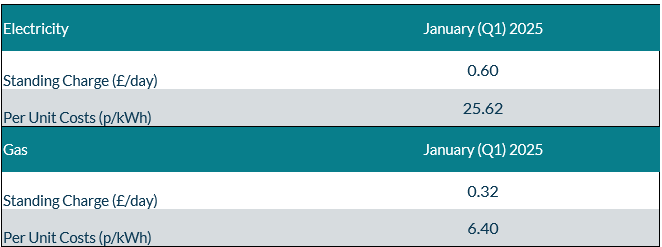

Figure 2: Default Tariff Cap forecast, Per Unit Costs and Standing Charge (dual fuel, direct debit customer)

Source: Cornwall Insight

Note: All figures are national average unless otherwise stated. All intermediate and final calculations are rounded to two decimal places. Totals may not add due to rounding.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight:

“As we move into the colder months, a lift in bills, while expected, is certainly not welcome. Unfortunately, a volatile wholesale market, and a country heavily reliant on imported energy has created a perfect storm for fluctuating household bills.

“Today’s announcement, coupled with our forecasted energy price hikes in the new year, will only intensify the calls for government action to protect vulnerable households. There is a range of options available for the new government, from social tariffs to targeted support, but with just over a month until the cap increases – coupled with the fact that Parliament in on its summer recess - time is not on their side.

“The increase is also likely to reignite the debate over the effectiveness of the cap. While brought in with good intentions, it was only meant as a temporary measure, and some may argue the cap has served its purpose. One thing is clear: the current system is not meeting the needs of households, and without change, this risks being the case on an enduring basis.

“It would be unrealistic to expect the market to simply correct itself and return to pre-crisis price levels, especially as bills remain far from historic norms three years on. We hope that Ofgem’s review of the cap, along with a renewed focus on renewable energy by the government, will provide viable solutions, helping to deliver fair and sustainable energy bills for everyone.”

Reference:

- Ofgem’s Typical Domestic Consumption Values (TDCVs), are set at 2,700 kWh per annum for electricity, and 11,500 kWh per annum for gas. Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is a leading provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish and Australian energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.