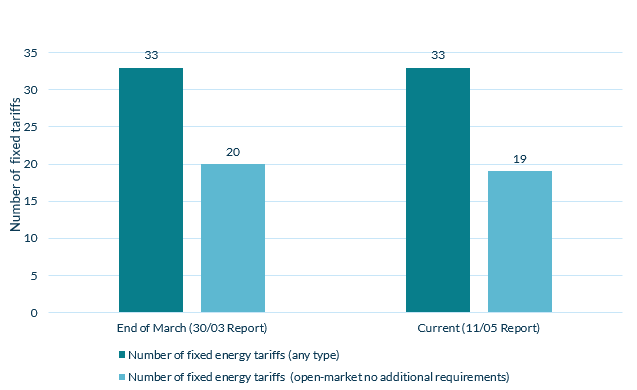

New data from Cornwall Insight has revealed that the number of fixed energy deals entering the market has stalled since March, with only 33 tariffs currently available, matching the number at the end of the previous quarter. Out of the 33 tariffs, only 19 are currently available on the open market, with the other tariffs available only to existing customers or requiring customers to take another service from the supplier.

It was hoped that the conclusion of the Market Stabilisation Charge (MSC), which mandated domestic suppliers to compensate the losing party when acquiring a new customer, would stimulate an influx of tariffs. However, the data, part of Cornwall Insight’s Domestic Tariff Report, shows this has yet to materialise.

Some attribute this stagnation to the Ban on Acquisition only tariffs (BAT), restricting the ability to offer new customers better deals than those offered to existing customers. Calls are growing for the BAT to be removed, with Ofgem announcing a consultation to address the issue. There has however been some push back over the potential removal of the ban. Critics argue that it could erode trust between suppliers and their current customers, with suppliers able to conceal better deals from them.

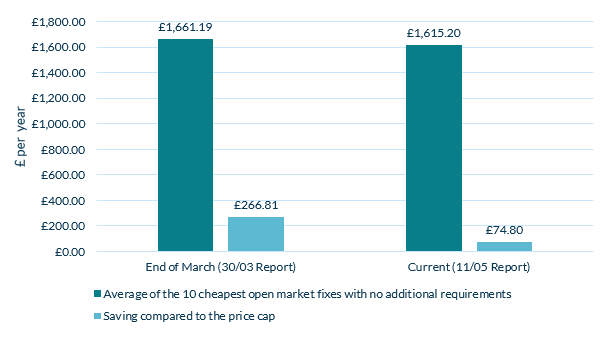

Potential savings compared to the price cap have also dropped dramatically with the average annual saving across the top 10 open-market fixed tariffs now sitting at only £74.80/year, a 4% saving for a typical dual fuel customer. This compares to the average 14% saving typical fixed deal customers were getting in March. The issue is likely to be exacerbated with the price cap for July forecast to fall by around 7%; this reduction would leave many of the currently available deals above the cap. Although the fixed tariffs are guaranteed for a year compared with the cap which changes every three months.

Fixed tariffs offer the benefit of locked-in energy rates, usually for a year or more, but if variable energy prices come down, and customers want to switch before the end of their contract, they could incur a large exit fee.

Figure 1: Fixed Tariffs in the market at the end of March and at 11 May (excluding regional tariffs)

Source: Cornwall Insight’s Domestic Tariff Report

Figure 2: Average saving of customers on the 10 cheapest fixed tariffs compared to the price cap

Source: Cornwall Insight’s Domestic Tariff Report

Note: The price cap in March was set at £1,928/year and the current price cap is £1,690/year

James Mabey, Analyst at Cornwall Insight:

“The return of competitive fixed energy tariffs has been disappointingly slow despite the removal of the Market Stablisation Charge at the end of March. The Ban on Acquisition only tariffs (BAT) has likely contributed to this sluggishness, with limited competition in the market curtailing the return of deals that are priced meaningfully lower than the price cap.

“Should Ofgem opt to lift the BAT, we forecast this will provide a welcomed influx of competition into the market, quickening the return of fixed tariffs, and providing consumers with a greater array of choices for managing their energy bills.

“Of course, any change will have its winners and losers, and a removal of the BAT could come at the expense of loyal customers who don’t regularly switch their energy providers. Ofgem will need to weigh up the benefits of removing the ban against these concerns.”

– Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.