Our forecasts show these lower costs are not just a temporary blip but are part of a sustained shift towards energy affordability.

Tom Edwards Senior Modeller

The latest projections from Cornwall Insight's Q1 Power Curve suggest that the recent drop in power prices is here to stay, extending all the way to the end of the decade. The new data shows a striking decline in projected prices, which bodes well for both households and businesses, offering potential relief as it filters through to energy bills.

Fuelled by high gas stocks in Europe and a mild winter, gas prices dropped from an average £94 per MWh in 2023-2024 to around £79 per MWh (as of 26 March 2024)1. Projections calculated in March suggest these prices will remain, with costs forecast to be £82 per MWh for 2024/25 and £84 per MWh for 2025/26.

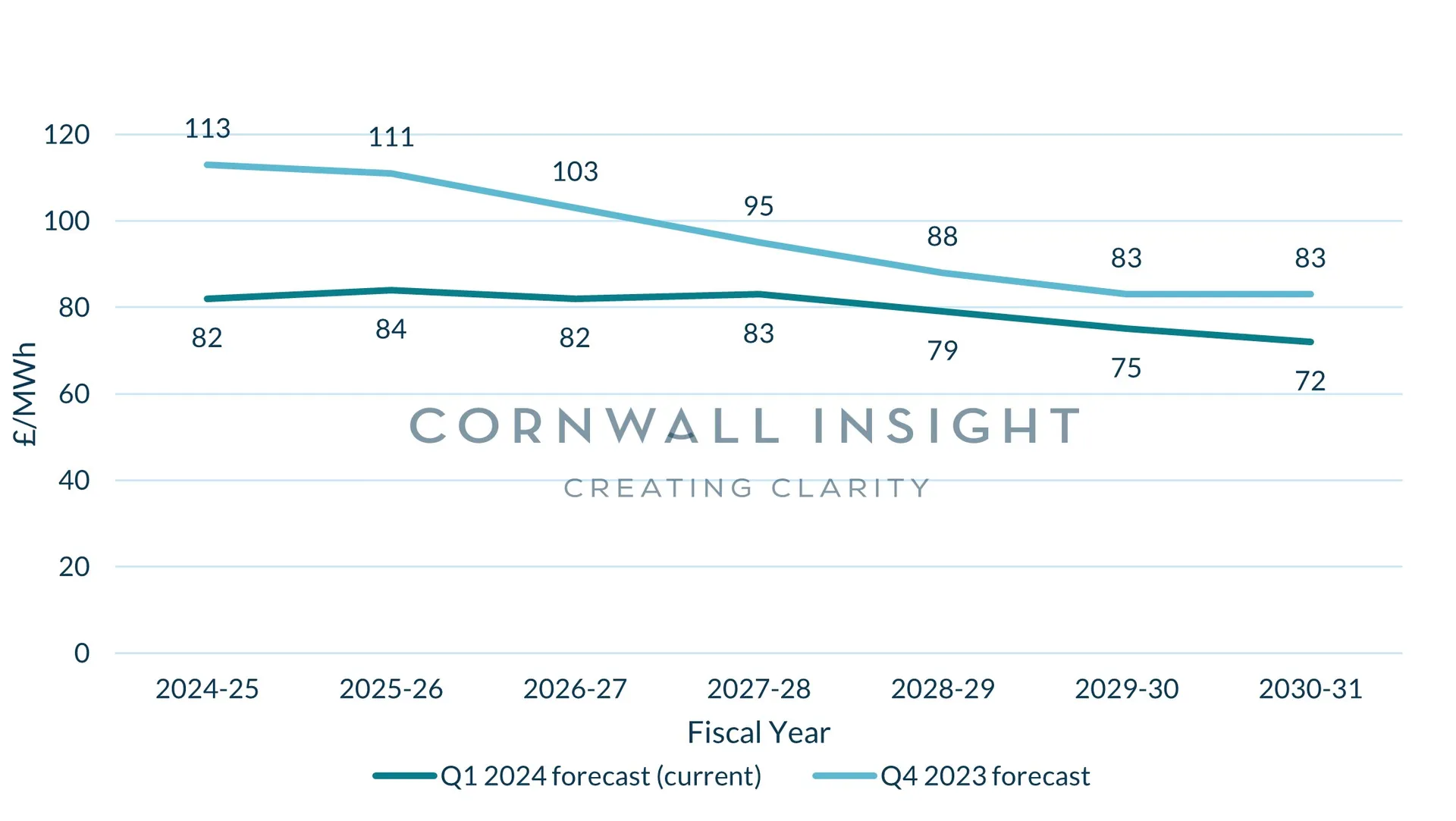

The forecasts for the next two years mark a substantial reduction of £31 per MWh and £27 per MWh respectively compared to Cornwall Insight's previous Power Curve released in late 2023 (Figure 1).

Looking ahead, prices through 2027 are anticipated to remain largely level before falling from 2028, as gas prices reduce due to increased Liquified Natural Gas (LNG) supply and higher marginal cost fossil fuel technologies being replaced by new renewables including solar, onshore, and offshore wind.

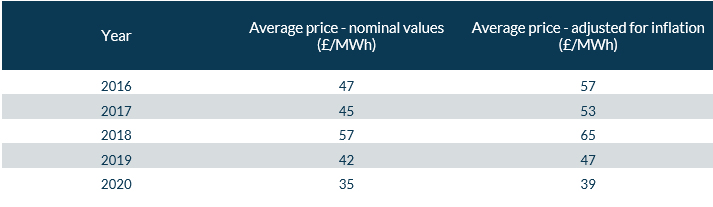

Despite the fall, forecasts remain substantially higher than historic averages2, with Europe's reliance on international LNG, especially in the wake of sanctions on imports from Russia, identified as a key factor.

Figure 1: Power price forecast comparison - average price per fiscal year (£/MWh)

Source: Cornwall Insight

- £/MWh in real money 2022-2023 prices

Tom Edwards, Senior Modeller at Cornwall Insight:

“Fuelled by ample gas stocks and a mild winter, gas prices are falling. Our forecasts show these lower costs are not just a temporary blip but are part of a sustained shift towards energy affordability. With stability projected until 2027 and further reductions on the horizon as more renewables come online, this is a welcome ray of hope for households and businesses struggling with economic uncertainties.

“Despite the fall, prices remain above historic averages, something we expect to continue beyond the end of the decade. Tight margins for renewables developers combined with commodity prices staying comparatively high, mean substantial drops are unfortunately not currently on the cards.

“This period of relative stability does however provide a crucial window of opportunity. As we move forward, our forecasts show continued investment in renewable energy infrastructure is paramount. By diversifying our energy mix and continuing our drive for innovation, it is clear we can unlock a future where energy affordability becomes the norm, not a fleeting moment.”

Reference:

- £/MWh in real money 2022-23 prices

- Historic power price comparison – average price per year in nominal values and adjusted for inflation 2022-23 prices

- Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.