Ahead of the April Default Tariff Cap (price cap) rise, Cornwall Insight has released new forecasts for the July 2025 cap. The July cap is forecast to fall to £1,712 a year for a typical dual fuel consumer1, slightly lower than our predictions in February. The fall would represent a 7% drop on April’s £1,849 cap, with an average customer paying £137 less annual equivalent a year.

The fall in predictions would take the July cap to below the current rate of £1,738 per year, albeit still hundreds of pounds above historic averages. With the OBR saying this week that rising energy bills for April will be one of the factors influencing the inflation rise that the organisation is predicting for the summer, this news could be good for households as well as a positive sign for the broader economic outlook.

Looking further ahead we are forecasting October’s prices to rise slightly on the July assessment, before falling again in January 2026. Volatility in the global energy markets remain a key variable, and therefore this view will be subject to change.

Over the past month, geopolitical events have had a big impact. The potential ceasefire between Russia and Ukraine in mid to late February initially brought some stability, but questions surrounding the role of the US in any ceasefire brought with them fresh uncertainty.

Early March saw another dip in the market following the EU's announcement that it would allow some flexibility in how its member states could restock their storage levels ahead of next winter. Although the market started to rise again, warmer weather and lower gas demand from Asia have recently led to falling. We expect geopolitical, market and macroeconomic factors to remain as sources of volatility in prices – and therefore our forecasts – over the coming months.

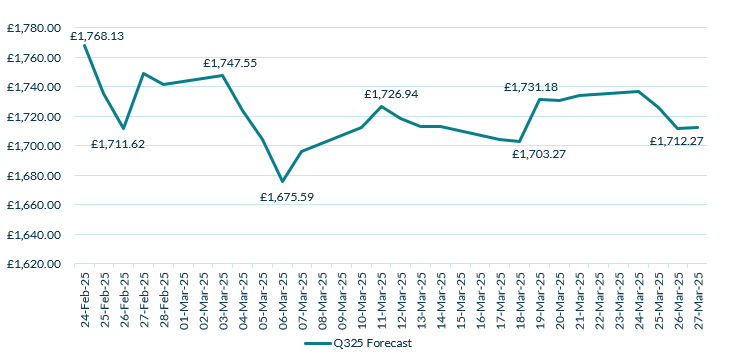

Figure 1: Q3 2025 Default Tariff Cap Daily Forecast using Typical Domestic Consumption Values (dual fuel, direct debit customer)

Source: Cornwall Insight’s Default Tariff Cap Forecast Service

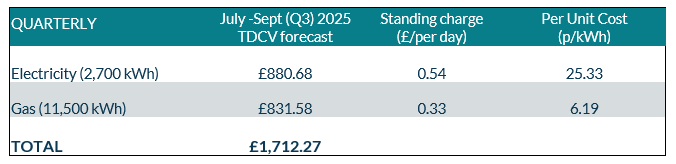

Figure 2: Cornwall Insight’s Default Tariff Cap Forecast Based on Typical Domestic Consumption, and Per Unit Costs and Standing Charge Values (dual fuel, direct debit customer)

Source: Cornwall Insight’s Default Tariff Cap Forecast Service

Note: All figures are national average unless otherwise stated. All intermediate and final calculations are rounded to two decimal places. Totals may not add due to rounding.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight:

"The latest forecast drop will bring some relief to households and the government, offering a welcome sign that energy prices are moving in the right direction. However, we mustn’t get ahead of ourselves. While prices are falling, recent patterns show the impact that wholesale market volatility can have on bills in the space of just a few days. The UK’s heavy reliance on energy imports – particularly gas - combined with ongoing geopolitical tensions, ensure household bills remain highly vulnerable to sudden shocks.

“Looking at our forecasts in a historic context, it is clear that changes to the price cap are only delivering relatively small adjustments compared to the overall cost households face. Furthermore, our longer-term forecasts show little prospect of returning to pre-crisis price levels. The government and Ofgem have tools at their disposal - introducing social tariffs for the most vulnerable households and a zero-standing charge cap are just two of these - but tweaks to the current system won’t deliver the reductions people have been led to expect. A Review of Electricity Market Arrangements (REMA) was started in 2022 to improve how the electricity market works. However, the Government hasn't yet decided on the changes they will make.

“It’s time for a serious conversation about the long-term future of energy pricing, including whether the cap has outlived its purpose. If we want a system that balances consumer protection with supplier innovation while supporting the government’s goals for the energy transition, we need to question whether the cap is helping or holding us back.

“Firefighting high bills isn’t a solution - it’s a short-term fix. To secure the UK’s energy future and drive down costs for good, we must break free from volatile international markets and fast-track the transition to renewables.”

Reference:

- Ofgem’s Typical Domestic Consumption Values (TDCVs), are set at 2,700 kWh per annum for electricity, and 11,500 kWh per annum for gas.