"Rather than critiquing the methodology of the cap, it may be time to consider the cap’s place altogether. After all, if it is not controlling consumer prices, and is damaging suppliers’ business models, we must wonder if it is fit for purpose - especially in these times of unprecedented energy market conditions."

Dr Craig Lowrey Principle Consultant

The predictions for the Default Tariff Cap in this piece are out of date please click HERE to find our most up to date forecasts.

New forecasts for the January Default Tariff Cap (price cap) from Cornwall Insight have risen by over £6501, meaning a typical household is now predicted to pay the equivalent of £4,266 a year for the three months to March 2023. Forecasts for the October cap have also seen a rise, going up by over £200, with predictions for an average bill now sitting at £3,582.

The increase in our forecasts since last month reflects both the increase in the wholesale market in the intervening period and – crucially in the case of the Q1 2023 (Jan-Mar) and Q2 2023 (Apr – Jun) forecasts – a change in calculation methodology set for finalisation by Ofgem. In its initial proposals from May, the regulator stated that an element of supplier costs associated with wholesale market hedging would be explicitly included within the cap methodology and would be recoverable over a 12-month period. However, in the consultation documents released last week, it was confirmed that these costs would be recoverable over a six-month period – resulting in higher bills than previously forecast for the crucial January cap.

We note Ofgem’s concerns in agreeing to the application and structure of these additional backwardation2 costs, as these reflect the suppliers’ wholesale energy trading requirements and recovery of these is essential to help avoid more supplier failures. If the wholesale market remains unchanged, this change in methodology should result in lower bills in the second half of next year than we had previously forecast. These new forecasts for the January to March 2023 quarter further underline the need for support for households who will struggle to pay their energy bills this winter.

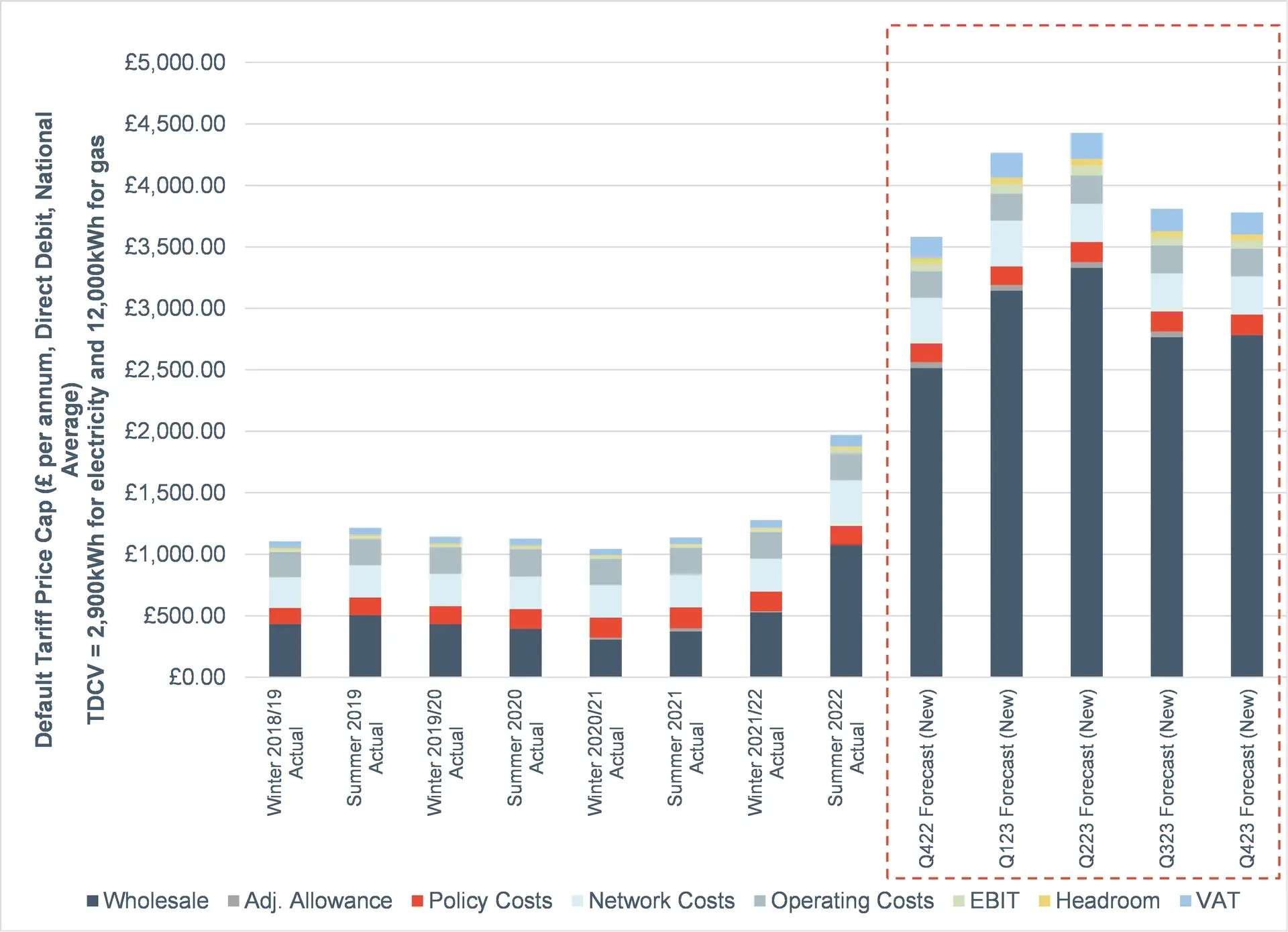

Figure 1: Cornwall Insight’s default tariff cap forecasts, £ per year including VAT (dual fuel, direct debit customer, national average figures)

| QUARTERLY | Q4 2022 CI Forecast | Q1 2023 CI Forecast | Q2 2023 CI Forecast | Q3 2023 CI Forecast | Q4 2023 CI Forecast |

|---|---|---|---|---|---|

| Electricity | £1,686.04 | £2,098.53 | £2,073.91 | £1,717.03 | £1,744.79 |

| Gas | £1,895.97 | £2,167.95 | £2,353.03 | £2,093.17 | £2,036.60 |

| TOTAL | £3,582.02 | £4,266.48 | £4,426.94 | £3,810.20 | £3,781.40 |

| AVERAGE | £3,924.25 | £4,118.57 |

Source: Cornwall Insight

Figure 2: Default Tariff Price cap levels chart since 2018 and Cornwall Insight’s predictions for the next four quarterly cap periods

Source: Cornwall Insight

Dr Craig Lowrey, Principal Consultant at Cornwall Insight said:

While our price cap forecasts have been steadily rising since the Summer 2022 cap was set in April, an increase of over £650 in the January predictions comes as a fresh shock. The cost-of-living crisis was already top of the news agenda as more and more people face fuel poverty, this will only compound the concerns.

Many may consider the changes made by Ofgem to the hedging formula, which have contributed to the predicted increase in bills, to be unwise at a time when so many people are already struggling. However, with many energy suppliers under financial pressure, and some currently making a loss, maintaining the current timeframe for suppliers to recover their hedging costs could risk a repeat of the sizable exodus seen in 2021. Given that the costs of supplier failure are ultimately met by consumers through their energy bills, a change which means that this is less likely is welcome, even if the timing of it may well not be.

“Rather than critiquing the methodology of the cap, it may be time to consider the cap’s place altogether. After all, if it is not controlling consumer prices, and is damaging suppliers’ business models, we must wonder if it is fit for purpose – especially in these times of unprecedented energy market conditions.

It is essential that the government use our predictions to spur on a review of the support package being offered to consumers. If the £400 was not enough to make a dent in the impact of our previous forecast, it most certainly is not enough now. The government must make introducing more support over the first two quarters of 2023 a number one priority. In the longer-term, a social tariff or other support mechanism to target support at the most vulnerable in society are options that we at Cornwall Insight have proposed previously. Right now, the current price cap is not working for consumers, suppliers, or the economy.”

Reference:

- Our latest forecasts use a view of the wholesale market from industry sources in conjunction with our own in-house view of the non-wholesale elements of the bill. We continuously update our assumptions, with this forecast using closing wholesale prices from Friday 5 August 2022. This is alongside a view of the outcomes of the Ofgem consultations on the reform of the cap as announced by the regulator on Thursday 4 August 2022. As this is a snapshot, we would therefore anticipate volatility to present in the forecasts due to movements in wholesale prices and how this feeds through to the calculations given the underlying Ofgem model.

- Backwardation costs are a result of the difference between the wholesale calculation methodology used to set this element of the cap and the way in which suppliers are able to purchase energy to meet the demand of their customers on the cap. Historically, Ofgem has worked on the basis that seasonal differences in the wholesale price will average out, and hence there has not been a need for an explicit forward-looking backwardation allowance. However, due to the increase in volatility in the wholesale market, it has judged that this assumption is no longer valid, necessitating the inclusion of this additional element. For more information, please refer to the Ofgem consultation documents on this subject: https://www.ofgem.gov.uk/publications/price-cap-statutory-consultation-changes-wholesale-methodology

–Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.