There is always a cost to these transitions, and it won't be easy, but given the energy crisis we've witnessed, it is clear that investing in renewables is essential.

Lee Drummee Senior Analyst

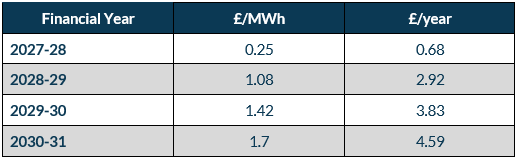

New forecasts from Cornwall Insight reveal that this year’s Contracts for Difference (CfD) renewables auction is expected to add approximately £4.59 to a typical household1 energy bill by 2030-31.

The Sixth CfD auction (AR6) which concluded on Tuesday, saw a record-breaking 131 projects securing 9.6GW of renewable capacity. Due to the competitive nature of the auction, strike prices, which ensure that generators receive a guaranteed income, were set below the maximum allowed, with offshore wind coming in 19% under the cap — although still higher than the record lows of AR4.

CfD operates by guaranteeing generators a set income through a strike price. If generators’ earnings exceed the strike price, they repay the excess. Conversely, if they earn less, the government compensates them. Generators’ earnings are based on a relevant wholesale electricity market price, so if the market price is low, generators receive a greater payment from consumers. However, in theory, if market prices are low, consumer bills will decrease, which would offset any payments to generators.

The data which comes from Cornwall Insight’s Third Party Charges Forecast , was calculated by projecting the energy market up to the end of the decade. It incorporates the new CfD strike prices to forecast costs beginning in 2027-2028, when the first significant costs from this auction are anticipated, according to developers' target commissioning dates they submitted with their bids.

The cost impacts are expected to rise in later years as more of the larger offshore wind projects are scheduled to come online. Wholesale price forecasts are based on our in-house forecasts.

While Cornwall Insight estimates the scheme will cost consumers a small amount, the shift towards more stable domestic energy generation is expected to reduce the UK's reliance on volatile international energy markets. This transition could lead to a more stable energy environment for households, with fewer price fluctuations due to the scheme providing protection from potentially volatile wholesale prices, which may see energy bill savings higher than the cost of the scheme.

Figure 1: The projected cost of the AR6 CfD auction for a typical energy consumer, based on Ofgem’s Typical Domestic Consumption Values (dual fuel, direct debit customer) calculated in 2024/25 money

Source: Cornwall Insight Third Party Charge’s Forecast

Lee Drummee, Senior Analyst at Cornwall Insight:

“There has been considerable speculation on the cost of the Contract for Difference scheme, but our data shows the impact on consumers will be relatively minimal. While any increase in bills would be unwelcome, particularly for households already under pressure, it's crucial to consider the broader benefits of moving towards a renewables led energy future.

“The scheme does carry a small cost, but if the past three years have shown us anything, it is the risks of relying heavily on the international energy market, which has had a significantly adverse impact on energy bills. Without investing in renewable energy, we remain vulnerable to price spikes driven by global events. Increasing our own energy generation reduces our exposure to such volatility.

“There is always a cost to these transitions, and it won't be easy, but given the energy crisis we've witnessed, it is clear that investing in renewables is essential for the security of our energy, the stability of our bills and the health of our nation.”

- Ends

Reference

- Ofgem’s Typical Domestic Consumption Values (TDCVs) are set at 2,700 kWh per annum for electricity, and 11,500 kWh per annum for gas.

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish, Australian, German and Japanese energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.