Both the Republic of Ireland and Northern Ireland are facing significant challenges in terms of grid connections and planning processes and without concerted efforts to accelerate progress in these areas, hitting these 2030 targets could slip further out of reach.

Kitty Nolan Modeller

Slow growth of onshore wind across the Single Electricity Market (SEM) could see 2030 renewable energy targets missed by three years according to new modelling from Cornwall Insight’s SEM Benchmark Power Curve.

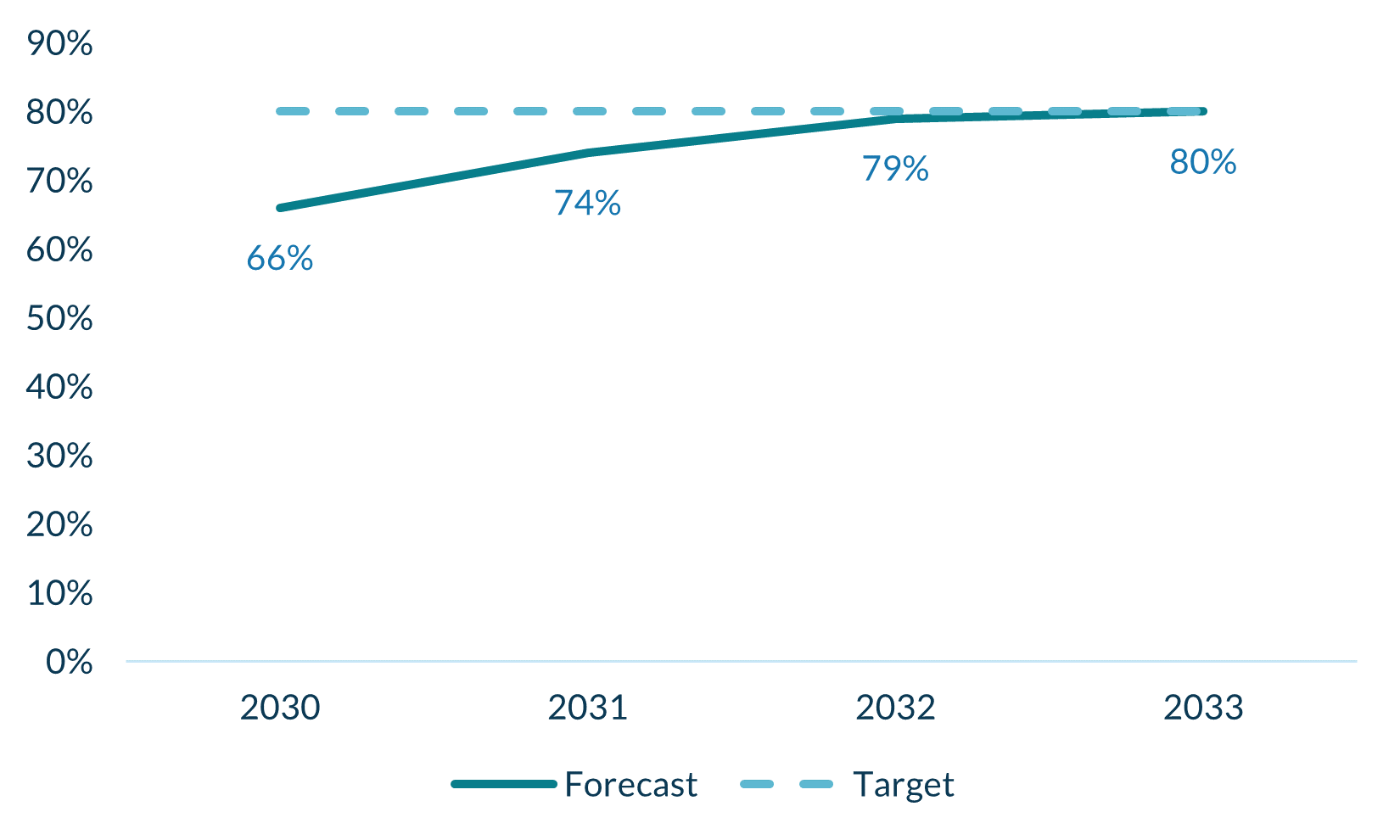

Both Ireland and Northern Ireland, have a separate target to achieve 80% of electricity from renewables by the end of the decade. Cornwall Insight’s data currently sees the all-island SEM reaching 66% renewable power generation by 2030 and achieving 80% in 2033, with Northern Ireland specifically reaching 80% by 2034 and Ireland by 2033. Delays to planning and grid connection concerns have been named as the chief cause with the growth of renewables, most notably onshore wind, moving slower than expected.

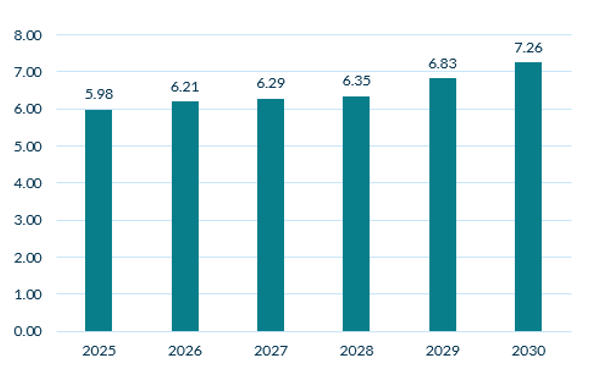

The forecast follows the most recent Irish Renewable Electricity Support Scheme (RESS 4) auction, which saw the volume of contracts awarded to onshore wind fall well below the level required to meet the 2030 targets. The RESS 4 auction saw 374MW of onshore wind procured, with only four successful onshore wind projects, which based on the already existing and contracted capacity would, when built, take the total capacity in Ireland up to a little above 5GW. The Climate Action Plan in Ireland has set a 9GW 2030 target for onshore wind. The target is ambitious given current procurement levels. In contrast, solar generators continued to perform well in RESS 4, securing 960MW in awarded contracts and building on the rapid growth seen in 2024.

In Northern Ireland SONI the Transmission System Operator is planning for 2.5GW1 of onshore wind by 2030 and is currently operating at around 1.3GW1. A Renewable Energy Support Scheme is currently under development, which could see 500MW (0.5GW) of onshore wind, solar and other technologies (aside from offshore wind) available to the network for 2027, with indications of auctions taking place as early as 2025. Whilst there is optimism surrounding the scheme, given the timelines for projects, any further delays could harm the level of capacity that could be brought online by 2030.

Despite these issues the SEM does still currently have the highest contribution of wind generation of any power system in the world.

While the 80% targets set by both the Irish and Northern Irish governments are likely to be missed, significant progress is forecast to be made with the percentage of renewable power on the grid expected to jump from just over 40% in 20231 to 66% in 2030 and 74% in 2031.

The 2030 targets have encountered a number of challenges, chief amongst these have been planning delays and a shortage of grid connections in both jurisdictions. In Ireland, these issues led to investors being deterred from bidding in the RESS auctions for fear their projects will be substantially delayed, or not get off the ground at all.

Action has been taken by the Irish government including allowing generators to delay their required operational date by up to two years if systems operator grid connection issues or judicial reviews of planning permissions arise, which it is hoped will increase the number of renewables bids.

Figure 1: Forecast4 percentage of electricity from renewables in the Single Electricity Market

Source: Cornwall Insight, SEM Benchmark Power Curve

Figure 2: Onshore wind capacity forecast for the Single Electricity Market

Source: Cornwall Insight, SEM Benchmark Power Curve

Kitty Nolan, Cornwall Insight, Modeller:

“While progress is being made, the renewables targets remain very ambitious. The RESS 4 auction procured lower than expected capacity, with onshore wind trailing a long way behind where it needs to be. Both the Republic of Ireland and Northern Ireland are facing significant challenges in terms of grid connections and planning processes and without concerted efforts to accelerate progress in these areas, hitting these 2030 targets could slip further out of reach.

“While there are many barriers, we should not let missed targets overshadow the good progress that is being made. Moving from just over 40% of power from renewable sources in 2023 to 66% by 2030 is still an impressive achievement – with 80% due by 2033. It's vital that policymakers maintain momentum for renewables, and recent changes in Ireland’s grid connection policies show promising signs for renewed growth. With the right drive and support, reaching these ambitious goals could be within sight."

Reference:

- Tomorrow’s Energy Scenarios 2023 – EirGrid and SONI

- The Statistical Landscape of Wind Farms in the UK – Green Match

- Ireland had 41% of electricity generated from renewables in 2023 (SEAI Renewable energy in Ireland) and Northern Ireland had 46% (Department for the Economy - Electricity Consumption and Renewable Generation in Northern Ireland).

- Our forecast percentage encompasses onshore wind, offshore wind, solar, and hydro energy, and is calculated based on the demand met by renewables.

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.