"Fear around a lack of charge-points is a major reason why many people hesitate to switch from traditional vehicles to EVs. This news could further discourage people from making the move."

Jamie Maule Research Analyst

New analysis from Cornwall Insight shows the UK needs to more than double the rate at which it is rolling out publicly accessible charge points for electric vehicles (EVs) if it is to meet its target of installing 300,000 by the end of the decade.

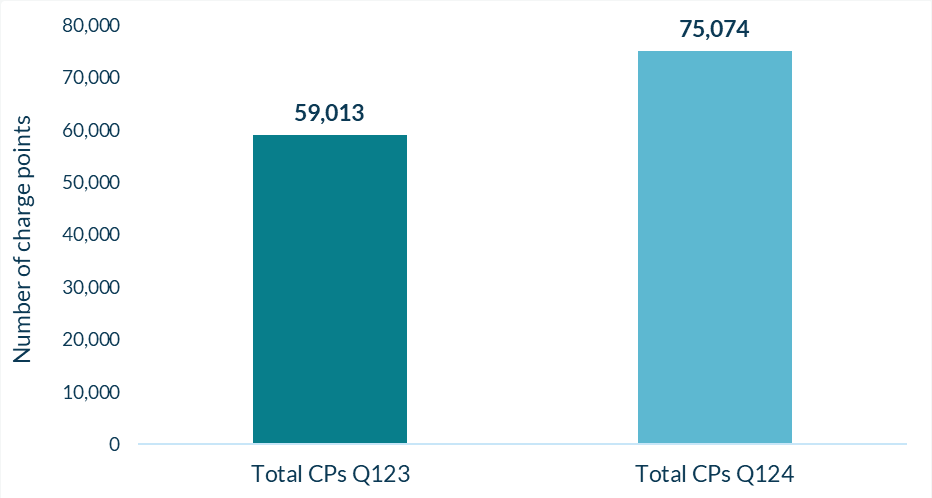

Data analysed for Cornwall Insight’s Electric Vehicle Country Attractiveness (EVCA) Index1, has revealed that as of the end of March 2024 (Q1 2024) the UK had 75,074 publicly accessible charge points. This means it needs nearly 225,000 new chargers to be rolled out by 2030 to meet its target.

Over the past year, from April 2023 to March 2024, the UK only installed 16,061 new charge points – just over 1,300 a month. If the UK maintained this rate of installation, the country would fall short of its target by almost 120,000 charge points, jeopardising the transition away from petrol and diesel vehicles. The UK will need to raise the number of installations to 2,800 a month to stay on track and meet its target, with this figure only growing for each month that the target is missed.

Despite the UK Government pushing back the ban on the sale of new petrol and diesel vehicles from 2030 to 2035, the target for charge point installations remains unchanged.

Delays to programmes including the Rapid Charging Fund, designed to develop the ultra-rapid network at strategic locations (motorway service stations and A roads), have contributed to the slow roll-out. With the pilot, due to launch in 2022, being rescheduled several times, until eventually being launched in Dec 2023.

Cornwall Insight’s EVCA Index, a quarterly ranking which charts the relative attractiveness of major European nations for investment in EVs, currently puts the UK 9th in attractiveness. It trails behind the Netherlands, Norway, France, Belgium, Denmark, Spain, Austria, and Sweden, with the Netherlands taking the top spot.

Figure 1: Publicly accessible charge point growth Q123 – Q124

Source: Cornwall Insight, data from the European Alternative Fuels Observatory

Figure 2: Charge-point growth needed to meet government targets

Source: Cornwall Insight, data from the European Alternative Fuels Observatory

Jamie Maule, Research Analyst at Cornwall Insight:

“The UK’s sluggish pace in rolling out EV charging infrastructure poses a significant threat to our transition away from petrol and diesel cars, and towards a greener and cleaner transportation system. To achieve our EV targets, it is essential that we see a major acceleration in charge-point installations. Without this increase, we risk undermining the progress towards decarbonising the UK’s roads and we could see a delay to broader environmental goals.

“Fear around a lack of charge-points is a major reason why many people hesitate to switch from traditional vehicles to EVs. This news could further discourage people from making the move.

“Whatever the outcome of the general election, the next government must make the expansion of charging infrastructure central to its EV policy if genuine decarbonisation of our transport system is to be achieved. This includes ensuring that existing policy schemes – such as the Rapid Charging Fund – are implemented swiftly and efficiently and barriers in the planning and grid connections process are removed.”

Reference:

- The Electric Vehicle Country Attractiveness (EVCA) Index is a quarterly ranking that charts the relative attractiveness of major European nations for investment in EVs. A range of indicators, subject to differing weightings, have been utilised in the production of this index. They are listed as follows without regard to importance or weighted value:

- Committed government funding

- National EV sales targets

- National EV charge-point implementation targets

- Support for internal combustion engine vehicle rollback or ban

- Available investment subsidies, funds, and tax benefits for EVs and EV charge-points

- Available purchase subsidies, funds, and tax benefits for EVs and EV charge-points

- Ability to conduct business

- Rate of inflation

- Market share of battery EVs

- Year-on-year growth of battery EV sales

- Wholesale cost of electricity scaled to GDP – Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.