"Even countries currently lower in the rankings are showing promising year-on-year advancements, indicating a shift in interest towards the EV market."

Jamie Maule Research Analyst

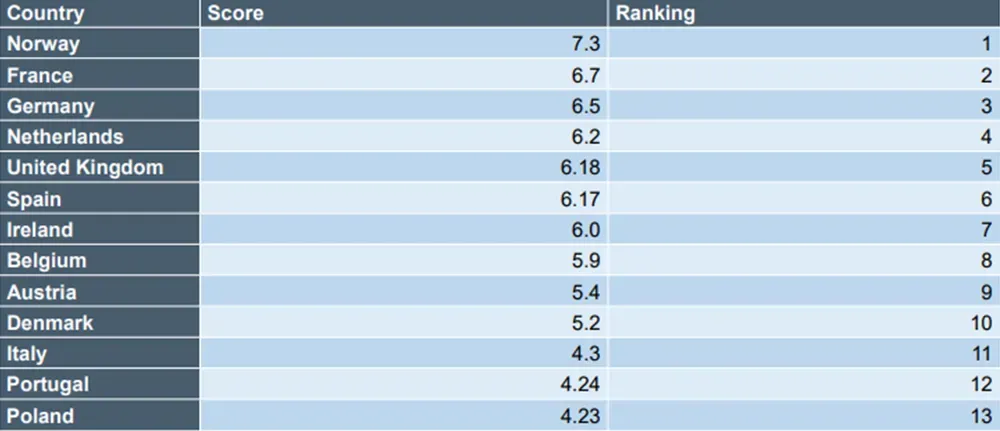

The UK has been ranked the 5th most attractive European country for Electric Vehicle (EV) market potential, according to the Electric Vehicle Country Attractiveness (EVCA) Index. The new Index developed by Cornwall Insight and law firm Shoosmiths identifies a range of factors1 from purchase subsidies to national EV charging targets which can accurately rank European nations on their EV market appeal, with Norway clinching the top spot.

The transition to e-mobility has been a mixed bag amongst nations in the EVCA index, with some being enthusiastic supporters and others having been more hesitant. With most European nations, including the UK, imposing a ban on the sale of new petrol and diesel passenger cars and light commercial vehicles (vans) by at least 2035, it was positive that many nations saw an increase in EV uptake in 2022, with the EV market expected to become more established across Europe.

Norway has been a leader in EV adoption due to subsidies, tax cuts, and a large-scale charging network. Other countries are following suit, with EV market share largely ranging from 10-20% across the index. Year-on-year growth is also an important indicator, with Ireland, Belgium, and Poland emerging as top performers with growth rates of over 50% compared to 2021, Ireland sits at an impressive 81.3%.

Figure 1: EV Country Attractiveness index scores and rankings:

Source Cornwall Insight

Jamie Maule, Research Analyst at Cornwall Insight, said:

The results of the Electric Vehicle Country Attractiveness Index may not come as a surprise, after all Norway is well known for its EV success, however it is, the promise for the future across Europe which is the most encouraging. Although the countries leading the Index, including the UK, had an early advantage in implementing EV incentives, a larger market share is not the only indicator of success. Even countries currently lower in the rankings are showing promising year-on-year advancements, indicating a shift in interest towards the EV market.

As the Index evolves, it will be interesting to see how countries move up the ranks through the implementation of new policies, targets, subsidies, and investment incentives, hopefully resulting in a surge of EV adoption throughout the continent.”

Calum Stacey, E&I Legal Director in Shoosmiths Energy and Infrastructure Team, said:

The index highlights the differing approaches taken by European countries and how they wish to incentivise the transition to zero-emission vehicles.

One of the key drivers for those countries towards the top of the Index is the allocation of public funds to support the rollout of the necessary charging infrastructure to support this transition. However, as can be seen in both Germany and the UK, the public funding model is likely to be time-limited with the private sector needing to step in once a critical mass in relation to EV adoption has been reached.”

Reference:

- A range of indicators, subject to differing weightings, have been utilised in the production of this index. They are listed as follows without regard to importance or weighted value: Committed government funding, National EV sales target, National EV charge-point implementation targets, Support for ICE vehicle rollback or ban, Available investment subsidies, funds, and tax benefits for EVs and EV charge-points, Available purchase subsidies, funds, and tax benefits for EVs and EV charge-points, Ability to conduct business, Rate of inflation, Market share of BEVs, Year-on-year growth of BEV sales, Wholesale cost of electricity scaled to GDP.

– Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.

About Shoosmiths

Shoosmiths is a major law firm with a network of offices working together as one team. A key tenet of the firm’s strategy is its focus on five sectors – Mobility, Energy & Infrastructure, Technology, Living, and Financial Services. Electric vehicle (EV) charging infrastructure touches on all of these sectors and, as such, is an area of combined focus for the firm’s sector groups.

Shoosmiths’ national multi-disciplinary e-Mobility & infrastructure team has a proven track record supporting the EV sector. Their specialists advise companies involved throughout the sector from initial corporate fundraising and investment to project site selection (including real estate, commercial, planning and construction advice), to project operation and maintenance, to operational commercial offers for consumers and third-party access to charging infrastructure, to final divestment.