"Without a guarantee that the energy generated in Gippsland will be effectively delivered to where it is needed, investment in the areas offshore wind may be impacted and, with it, the growth of the region’s renewable energy sector."

Dominic Pacaba Energy Modelling & Analytics Consultant

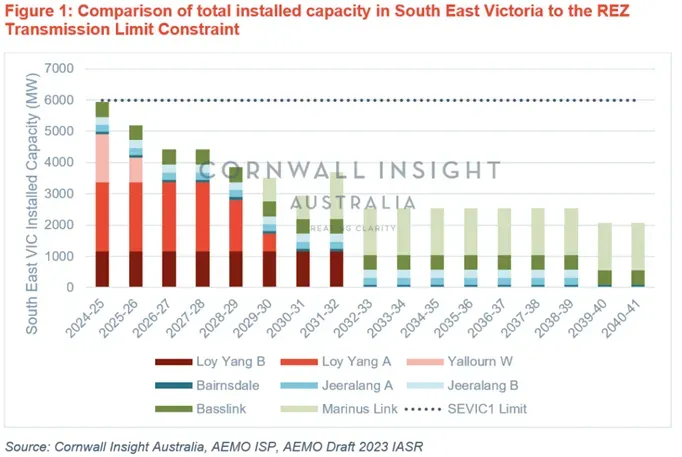

Data analysed by Cornwall Insight Australia has shown that Victoria will need to increase its transmission capacity in the South East by an additional 2GW by 2035 and 7GW by 2040 if it wants to capitalise on new capacity and help meet the state’s ambitious offshore wind targets.

The Bass Strait off the Victorian Gippsland Coast has been declared an official zone for offshore wind1. This official declaration allows offshore wind developers to apply for feasibility licenses. The declared area has a potential capacity of 75GW using both fixed and floating foundation technology.2 This will help the Victorian government achieve their offshore wind targets of 2GW offshore wind capacity by 2032, 4GW by 2035, and 9GW by 2040.

To achieve these targets, transmission infrastructure needs to be built to link the offshore wind farms to the rest of the grid and transport the energy generated from the offshore wind resources to the load centres. Although the Victorian government has a plan and schedule for connecting the offshore wind from the coast to the grid, there is still uncertainty about how the generated energy will be delivered to the load centres. The transfer capacity limitation will arise when building up to the targets in 2035 and 2040.

The draft Input, Assumptions and Scenarios Report (IASR) for 2023 has set a transmission limit of 6GW for South East Victoria, which considers the existing coal and gas plants, the Gippsland Renewable Energy Zone (REZ), Basslink, and the proposed Marinus Link. The data3 (Figure 1) tallies the existing generators’ installed capacity and the maximum transfer limits of the interconnectors to Tasmania. However, when the goal for offshore wind capacity is combined with the existing onshore wind in Gippsland (2GW) and total interconnector capacity (around 2GW), the total capacity for 2035 and 2040 will be 8GW and 13GW, respectively, exceeding the 6GW limit.

Although there is another proposed area to install the offshore wind capacity to meet the target, the South West Victoria area is already constrained due to expected onshore wind installations and the energy coming from the Heywood Interconnector. Ideally, the optimal build path will change when considering the offshore wind target, and some of the onshore wind capacity required will be shifted to other REZs, but when considering Gippsland as the only option, an additional 2GW and 7GW of transfer capacity will be required in 2035 and 2040.

Dominic Pacaba, Energy modelling and Analytics consultant at Cornwall Insight Australia:

The offshore wind opportunities now available in the Bass Strait represent an important step towards delivering Victoria’s ambitious offshore wind targets. However, while the extra generation capacity is to be applauded, the proposed transmission infrastructure will not be able to handle the increased energy demand by 2035.

Without a guarantee that the energy generated in Gippsland will be effectively delivered to where it is needed, investment in the areas offshore wind may be impacted and, with it, the growth of the region’s renewable energy sector.

It is crucial that Victoria delivers new transmission infrastructure to meet the region’s growing demand for renewable energy and ensure that the state can take full advantage of the vast potential of offshore wind energy and achieve its renewable energy goals.”

References:

- On your marks, Gippsland, go! (DCCEEW)

- Based on AEMO’s latest draft 2023 Input, Assumptions, and Scenarios Report (IASR) and adjusting for the smaller Renewable Energy Zone (REZ) area

- The chart uses the generator retirement schedule and interconnector build schedule from AEMO’s 2022 ISP.

–Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/au/

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.