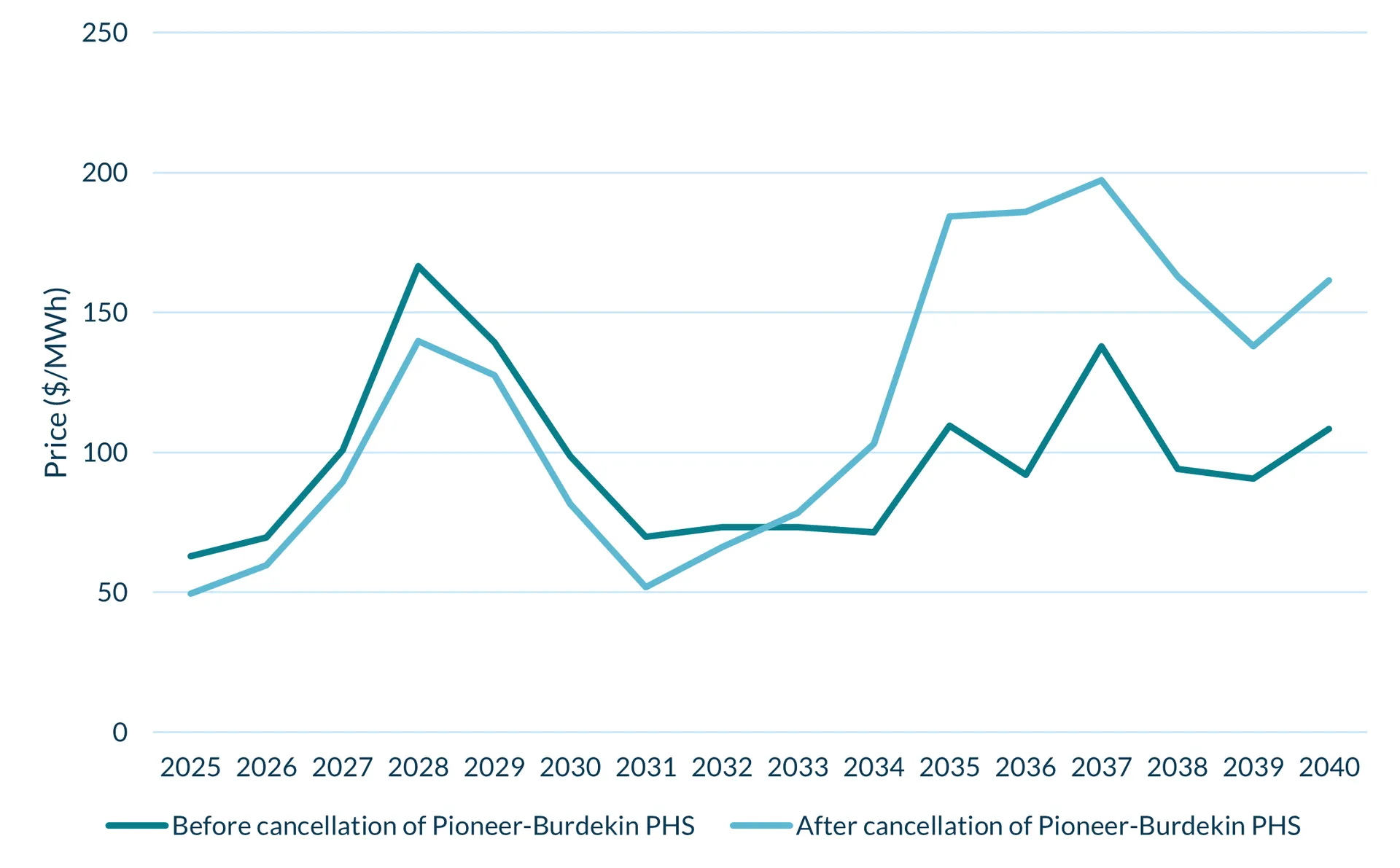

The cancellation of the Pioneer-Burdekin Pumped Hydro Storage project by the new Queensland government has seen power price forecasts jump by over 60% for 2035, when the first stage of the project was scheduled to have come online.

The growing share of renewable energy in Queensland and across Australia is driving an urgent need for storage solutions to efficiently dispatch this capacity. Without a replacement for the project's 120GWh of storage, forecasts suggest prices will remain at least 40% higher annually through to 2040, filtering through to consumer energy bills.

The 5GW/120GWh (240hr) project, with its first 2.5GW stage expected to be energised in 2035, was shelved by the Queensland government in November, with the government saying the project was not financially viable or environmentally appropriate, and that the community had not been properly consulted.

A report by Queensland Hydro, commissioned prior to the new government coming to power, backed up claims that the project was financially unviable, although it highlighted that a scaled-down version of the scheme could provide exceptional value. Despite this, no alternative version is currently under consideration.

The Queensland government will be hoping the market moves in to close the gap in storage capacity left by the cancellation of the Pioneer-Burdekin project, with the potential for a large build-out of Battery Energy Storage System (BESS) assets over the next few years.

Figure 1: Annual power price forecasts before and after the cancellation of Pioneer-Burdekin Pumped Hydro Storage project

Source: Cornwall Insight NEM Benchmark Power Curve Q4 2024

Thomas Fitzsimons, Senior Modeller, at Cornwall Insight:

"The Queensland government’s decision to cancel the Pioneer-Burdekin project is a consequence of the budgetary and delivery problems many of these large, pumped hydro projects continue to face across the NEM. That said, with renewable energy capacity rapidly expanding, the need for long-duration storage like pumped hydro will only increase. Without alternatives to the 120GWh of storage the project promised, we face a future of elevated power prices, which could impact households and businesses alike.

“The market now has a crucial role to play in addressing this storage shortfall and will need to deliver large-scale storage systems in order to bridge the gap left by this project. We would expect such a clear pricing signal to drive fresh interest in storage development in Queensland, and indeed we are already seeing alternatives beginning to take shape. Going forward the development of cost-effective storage solutions will be crucial to support Queensland’s 2035 clean energy target and provide reliable, affordable power for all Queenslanders.”

Reference:

- Operational Capacity as of June 2024 rounded to nearest GW: Offshore wind 15GW, Onshore wind 16GW Solar 17GW.

Notes to Editors For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is a leading provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish and Australian energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.