"However, with both Ofgem and the government seeking views on the future of the default tariff cap and consumer protection in general, it is apparent that we need an enduring solution to the challenge of energy bills that remain hundreds of pounds above the levels we saw prior to the energy crisis."

Dr Craig Lowrey Principal Consultant

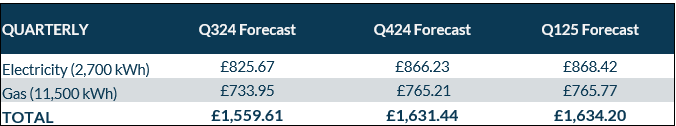

New Default Tariff Cap (price cap) forecasts from Cornwall Insight reveal a rise in predictions for both the July and October 2024 price cap periods against previous forecasts. Predictions for both quarters have risen by around 7%1, with a typical household2 now expected to pay £1560 from July and £1,631 from October.

The forecast for July would represent an 8% decrease from the upcoming £1,690 per year cap for a typical consumer set to take effect in April. The April cap itself marks a 12% decrease from current cap levels.

The increase in predictions for the final two quarters of 2024 is primarily attributed to a rise in wholesale prices since February, which have experienced a slight rebound from their 30-month low earlier this year.

Additionally, the new predictions also include two adjustments from Ofgem which are being introduced from the start of April. The regulator has allowed a temporary allowance to aid suppliers in meeting the cost of customers who are struggling to pay their bills. It has also introduced a levelisation allowance, which is a charge added to the cap in order to equalise bills for consumers on prepayment meters and those using other payment methods.

Cornwall Insight are for the first time also releasing our predictions for the first quarter of 2025. These projections show a relatively stable cap from October, with a marginal rise of £3 expected in January, which would bring the cap to £1,634 for a typical consumer.

**Figure 1: Cornwall Insight’s Default Tariff Cap forecasts using new Typical Domestic Consumption Values (dual fuel, direct debit customer) **

Source: Cornwall Insight

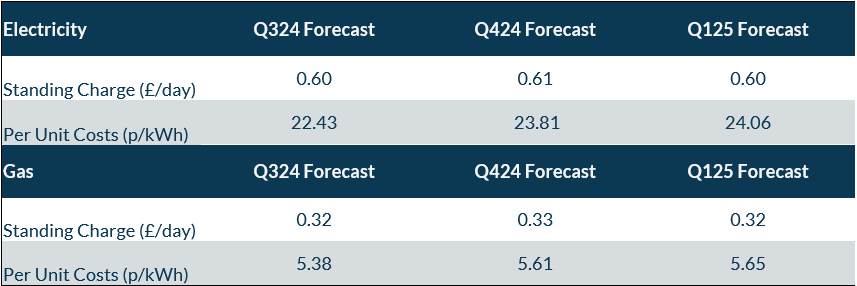

**Figure 2: Default Tariff Cap forecasts, Per Unit Costs and Standing Charge (dual fuel, direct debit customer) **

Note: All figures are national average unless otherwise stated. All intermediate and final calculations are rounded to two decimal places. Totals may not add due to rounding.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight:

“With wholesale prices hitting a two-and-a-half-year low, it was only a matter of time before a slight rise occurred as the market stabilises. Changes from Ofgem have also left their mark on the price cap with those paying via direct debit due to see a small cost in order to level the playing field for prepayment customers. “While no household will want to see forecasts rising, it’s important to recognise that these do still represent a fall from the new cap coming in from April, itself a large drop. So there is every reason to remain optimistic for energy bills moving forward.

"However, with both Ofgem3 and the government4 seeking views on the future of the default tariff cap and consumer protection in general, it is apparent that we need an enduring solution to the challenge of energy bills that remain hundreds of pounds above the levels we saw prior to the energy crisis.

“The next government, regardless of its composition, will face numerous competing priorities. Yet, it must maintain a focus on securing our energy future, whether this be bolstering our investment in renewables, modernising our grid, or streamlining the infrastructure development process, such measures are essential for fostering affordable and stable energy costs for both households and businesses."

Reference:

- Our previous price cap predictions from Market close on 21 February were £1,463 for the July 2024 cap and £1,521 for the October 2024 cap.

- Ofgem’s Typical Domestic Consumption Values (TDCVs) are now set at 2,700 kWh per annum for electricity, and 11,500 kWh per annum for gas.

- Future Price Protection Discussion Paper | Ofgem

- Default energy tariffs for households: call for evidence - GOV.UK (www.gov.uk)