The ISP also forecasts that greater flexible gas generation is needed

From Cornwall Insight Australia’s Energy Market Alerts service

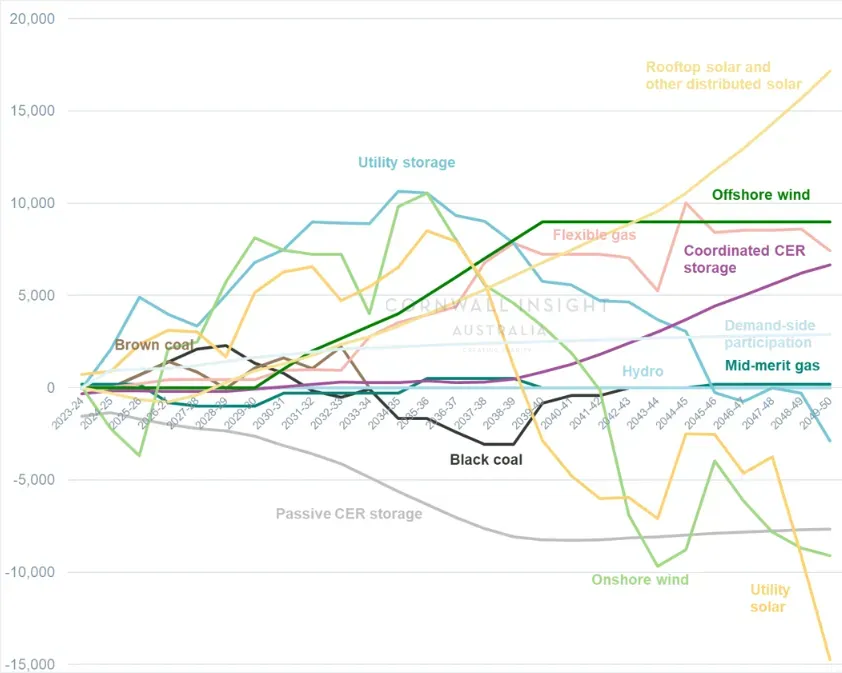

Offshore wind officially appears in the draft 2024 ISP due to state-based offshore wind targets. Figure 1 below from our latest Energy Market Alert, shows the variance in forecast generation between the 2022 and draft 2024 ISP. While offshore wind is still relatively uneconomic compared to onshore wind, the more significant social licence issues encountered in onshore wind projects combined with the prospect of state government support may make offshore wind increasingly attractive. This is borne in this ISP, where offshore wind hits a cap of 9,000 GW, displacing onshore wind and utility-scale solar.

Find out more | Energy Market Alert

Figure 1: Variance in generation capacity between 2022 and draft 2024 ISP (GW)

Source: AEMO Draft 2024 ISP data, AEMO 2022 ISP data

The above figure also forecasts the more significant role ‘flexible’, or peaking, gas plants will play over time. Flexible gas includes gas-powered generation and potential hydrogen and biomass capacity, although the ISP only forecasts a small proportion from these fuels. In total, the NEM is forecast to need 16.2 GW of gas-powered generation. Of the current 11.2 GW capacity, about 8 GW is forecast or announced to retire so that that capacity would be replaced and another 5 GW added. This may be either a greenfield or a brownfield development, but the gas generation must be flexible. This is a change in the role of GPG from more continuous ‘mid-merit’ gas to a strategic, backup role. Gas generation may be at risk should electricity and gas demand peak simultaneously.

Find out more | Energy Market Alert

Our Energy Market Alerts are designed for asset developers and owners, retailers, generators, regulators, policymakers, investors, and other energy stakeholders.

The alerts are published ad hoc and sent to customers as soon as possible after major regulatory and market developments, including rule changes in Australia. In addition, subscribers have free access to our online ‘Quarterly regulatory and policy webinar updates’, where you can hear from our experts on the latest insights.