Across the mainland states in the NEM, South Australia (SA) relies heavily on variable renewable energy (VRE) resources. SA is an excellent subject to test the premise What if the wind doesn’t blow, and the sun doesn’t shine”?

Negative spot prices persist in South Australia due to an abundant supply from renewable generation and low operational demand. In our latest Energy Market Perspective, we have observed that during this quarter, negative or zero prices were observed in 9% of dispatch intervals, marking a new Q2 record high and representing an increase of five percentage points compared to last year’s quarter. South Australia experienced 17% of quarterly spot prices at or below $0/MWh, seven percentage points higher than the previous Q2.

In this Chart of the week, we are investigating the market price cap event that happened in SA on 11 August. It was an electrifying Friday night party for the South Australian market as it was the first time the spot prices hit the market price cap back-to-back recently.

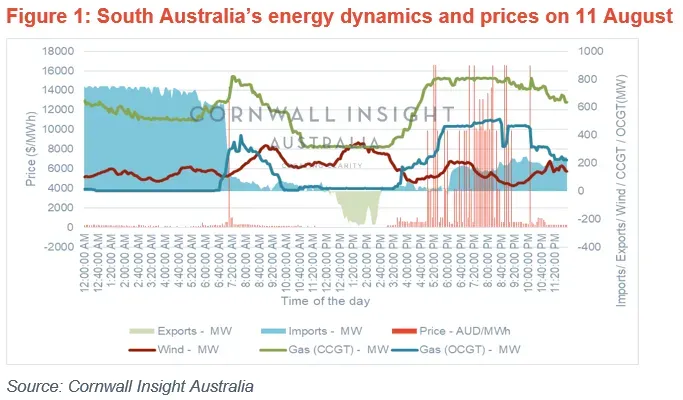

The graph below shows the exports, imports, price, wind availability, and other conventional generators’ operation on 11 August 2023 in SA.

Between 5:25 pm and 5:30 pm, the price spiked to the $16,600/MWh market price cap. While it is expected for demand to peak in the early morning and evenings, hitting the market cap on two separate occasions in one evening deserves attention.

From the graph, it can be seen that there is a considerable reduction in the wind during the evening. This might have led to the supply-demand imbalance as a fair share of SA’s energy is from wind. However, there was a dip in imports around the same time. This dip was caused by an outage on one of the Southeast-Tailem Bend 275kV lines, which resulted in reduced interconnector capacity on the Heywood Interconnector. With AEMO issuing multiple Lack of Reserve (LOR) notices for SA throughout 11 August. It appears there was a minor bottleneck being caused by the outage, reducing the ability from Heywood, and generators within the region (Snuggery, Ladbroke, Lake Bonney, and Canunda), limiting extra capacity towards the node, noting this outage lasted six days from 11 August. Later to spice things up at around 8:50 pm, all the operating units of the Snapper Point Plant tripped, again leading to a price spike of $16,600/MWh.

While recent reforms like the Green paper focus on SA developing a hydrogen export industry, these events in August are a reminder that high volatility will continue to be a feature of the current energy market.

For more information on price trends and energy balance figures, our Energy Market Perspective may be of interest. For more information on the energy market and power systems modelling or other services, please contact enquiries@cornwall-insight.com.au.