Introduction

With the election looming and the parties battling it out for Number 10, we’re casting our eyes on what lies in store in the wholesale energy markets following the election period, even before the victory celebrations have ended and new policy can be implemented.

While each of the parties have their own policy plans and targets for energy, does the market change even before anybody has had a chance to get started? We analysed the day-head, forward month (monthly) and quarterly contract prices during the last four election periods, to see what impact this election could have on the wholesale market.

Recent General Elections

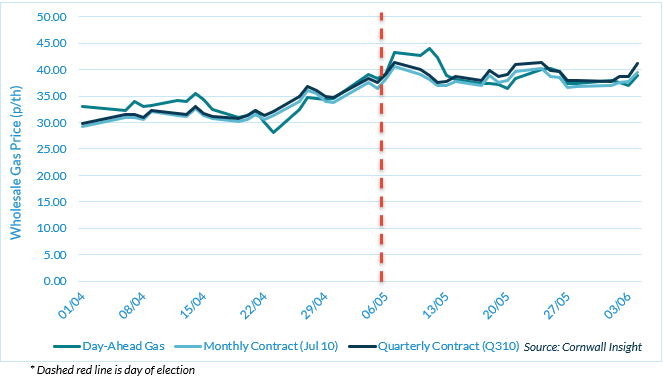

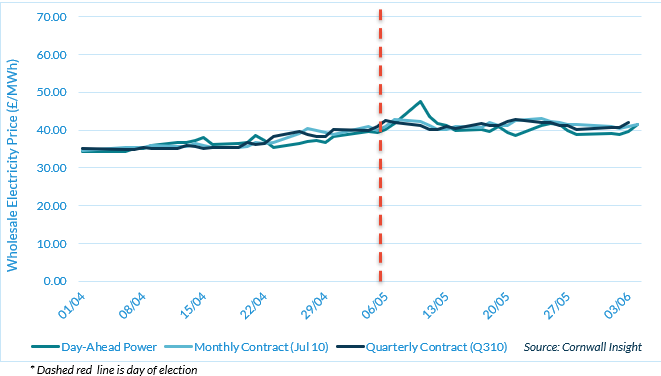

6 May 2010

In the 2010 election, day-ahead gas prices rose slightly in the two weeks leading up to the election. On the day of the election, day-ahead gas prices climbed by around 5p/th, before dropping again after around a week, but remaining higher than pre-election levels. The forward month (July 10) and Q310 gas contracts also rose slightly on election day, but remained less volatile overall throughout the election period, rising slightly across the month surrounding the election. Power contracts rose very gradually throughout the period, with day-ahead power reaching a peak in the week following the election before return in line with the longer term contracts. These are the some of the more pronounced changes seen across any election period in this dataset, potentially a result of it being the only one that saw a change in governing party.

Gas

Power

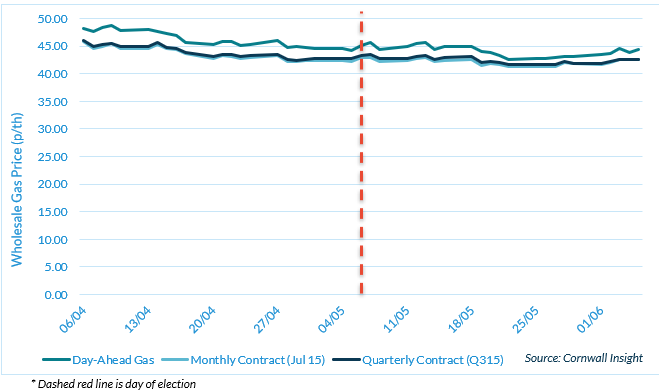

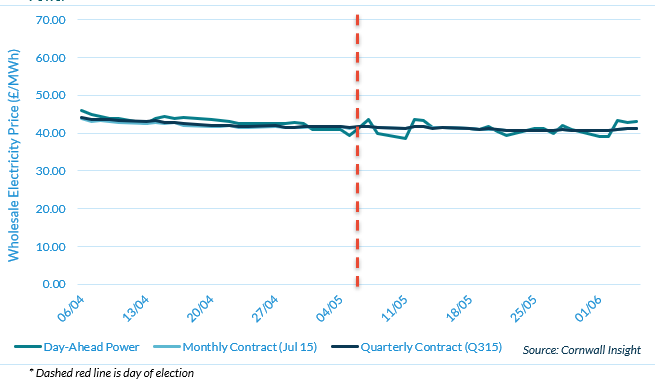

7 May 2015

In the 2015 General Election, all contracts remained very stable throughout the election period, with day-ahead gas registering only a minimal spike on the day after the election. Day-ahead power saw marginally increased volatility following the election, but nothing to the contrary of normal market functioning.

Gas

Power

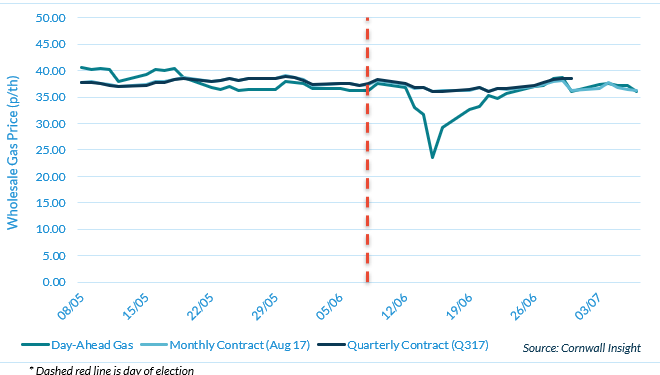

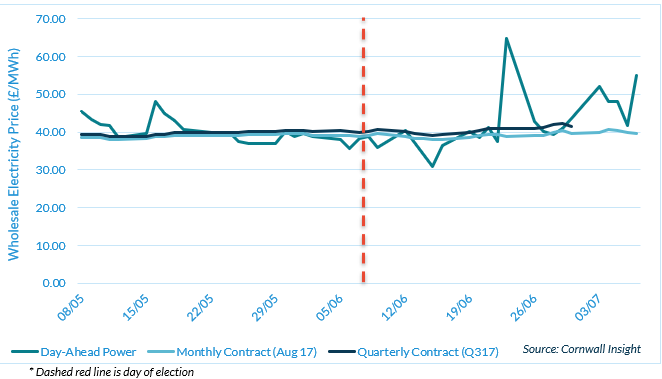

8 June 2017

In the week following the election there was a drop of over 10p/th in day-ahead gas prices, however it returned to the same level as the unchanged longer-term contracts within 10 days of the election. Following its gas counterpart, monthly and quarterly power contracts also remained stable throughout the election period, with day-ahead power volatility increasing in the month following the election, but remaining more stable around the election day itself.

Gas

Power

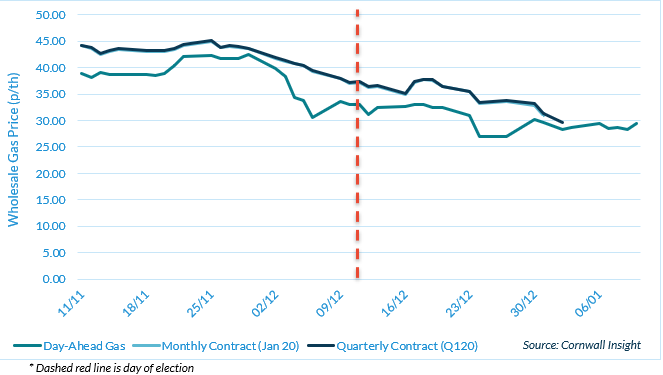

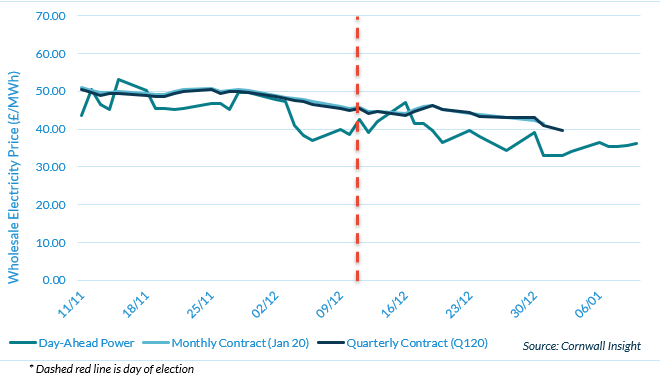

12 December 2019

Across the election period there was an overall downward trend in the wholesale markets, with longer-term contracts showing less volatility than the day-ahead markets. There were very minimal changes to day-ahead prices on the day of the election itself, and no significant changes to volatility across the period.

Gas

Power

Conclusion

Overall, there was no clear trend in pricing behaviour during the election period.

In most cases there was some immediate volatility, however the scale and direction of the volatility varied in each election. The volatility was usually followed by a recovery within the following days or weeks, which should provide a level of confidence that, to date, the wholesale markets remain relatively well insulated to general elections here in the UK.

Day-ahead, as is often the case, was the most volatile, with longer term gas and power contracts following similar but less pronounced patterns. In three of the elections we analysed, the same party remained in power. However, when the party in power changed in 2010 we saw a more pronounced immediate change. This pattern may be repeated were the ruling party to change in the upcoming election.

In summary, while election periods do introduce some market volatility, historical trends suggest that markets stabilise relatively quickly, which should help ease any atypical trading behaviour across the wholesale market here in the UK.