Recent events, from the worker strikes at the Chevron-owned Wheatstone LNG facility in Australia to the Israel-Hamas conflict, have highlighted the potential for disruption to energy exports. The Wheatstone and nearby Gorgon facilities account for ~5% of global LNG supplies. Whilst Europe is not the recipient of notable volumes of Australian LNG, substantial disruptions of supplies to China and Japan (Australia’s biggest customers for LNG) would act to push up global prices, inevitably impacting upon the European market. It should be noted that industrial action was suspended without resulting in any material change to LNG delivery schedules from the Australian facilities. However, the threat of the strikes was still sufficient to cause a >10% increase in European gas prices, highlighting the lack of resilience in the system.

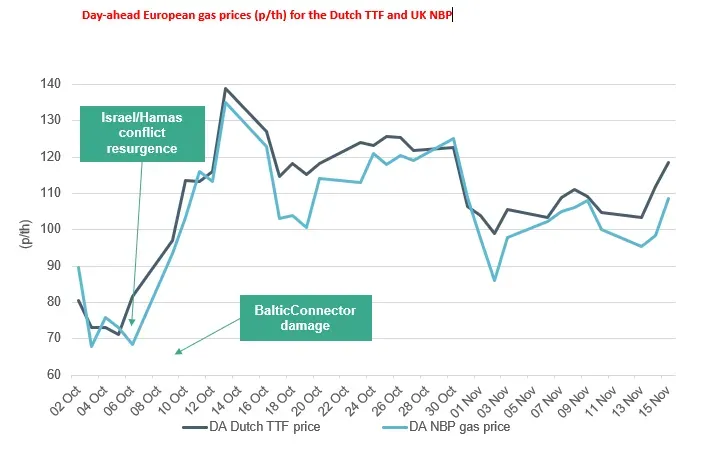

Similarly, the resurgence of conflict between Israel and Hamas has also sparked concerns as we progress further into the winter season, with fears that the potential involvement of Iran in the conflict could cause instability in the Strait of Hormuz, through which roughly a quarter of global LNG cargoes pass. Alongside the damage sustained to the Balticconnector, the Israel-Hamas conflict saw a surge in European gas prices amid a cold weather period too, exacerbating price highs (Figure below).

In the week between 7 and 13 October 2023 the UK National Balancing Point (NBP) day-ahead prices increased 97% and the Dutch Title Transfer Facility (TTF) day-ahead prices increased 70%. Prices have eased since the inception of these events, but it does illustrate a level of price volatility in global gas markets, and how this inevitably affects GB price levels and our price exposure to these macro-events.

We keep track of updates like these in our Energy Market Bulletin. If you would like to find out more about our services, please contact Tom Ross at t.ross@cornwall-insight.com for more information.