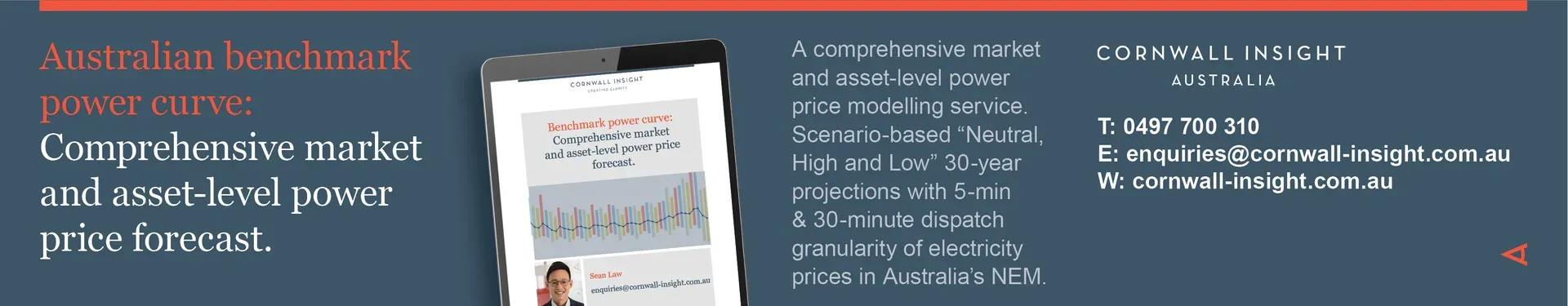

Over the last five financial years, South Australia has seen a significant increase in price volatility, with substantial portions of time both negative and above $250/MWh, leading to increasing opportunities for storage systems to provide arbitrage services. A number of events initiated the reduction in wholesale energy prices between $50/MWh and $150/MWh that dominated the last decade. However, the emergence of enduring negative price periods can also be seen in Figure 1 below.

Figure 1: SA proportions of 5m prices over the last 5 years

Source: AEMO MMS

Unpacking the factors that have influenced the last five years, the 2020 calendar year saw significant changes in the national energy market (NEM) demand as Covid shifted not only the size but also the location of load in the network. At the same time, liquified natural gas (LNG) netback prices saw some of their lowest points in recent history, with a $2.29/GJ price tag registered in July of 2020. This juxtaposes with the very high prices of mid-2022, where LNG prices peaked at $66.99/GJ, a product of the Russian invasion of Ukraine. Another factor in was insufficient coal stockpiles due to flooding and supply chain complications, resulting in the cumulative price threshold being breached and consequent suspension of the market by the Australian Energy Market Operator (AEMO).

In South Australia, we can also see the effect of increasing penetration of variable renewable energy (VRE contributed 62.1% of SA energy in July 2023), and this transition explains the underlying increase in negative price periods. Consistent high prices can also be seen, influenced by the intermittent nature of VRE, but primarily due to the ongoing heightened global price of LNG, sustained local coal outages, and ongoing retirements.

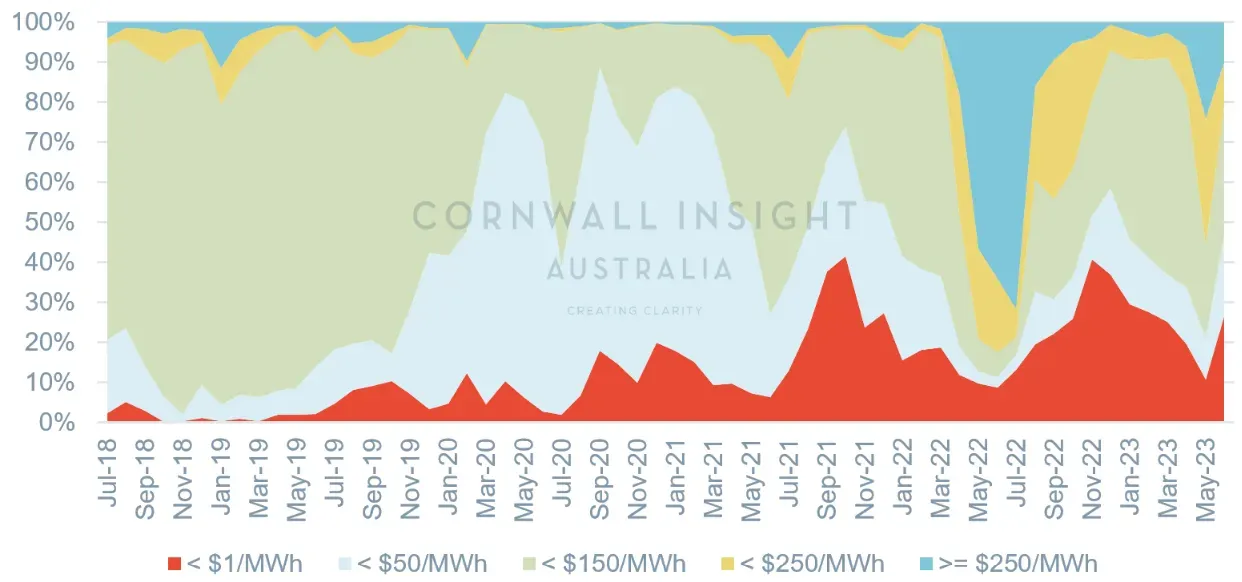

New South Wales saw the same macro transient events as South Australia. However, it has not yet had the same localised transition to VRE, with only 20% of NSW energy coming from wind and solar in July 2023. This results in substantially fewer negative price periods, as shown in Figure 2 below. However, the occurrence of negative prices is gradually increasing. While this might suggest fewer opportunities for arbitrage in NSW, the state governments support of the transition through the long-term energy service agreements and corresponding renewable energy zone developments will certainly lead to NSW following SA’s trend in energy source, and as such, reflecting on South Australia’s recent history is a good indicator for where other regions in the NEM will have their opportunities moving forward.

Figure 2: NSW proportions of 5m prices over the last 5 years

Source: AEMO MMS

If you’d like to understand more about how this effect is playing out in other regions or what the future of the NEM might look like, please reach out to discuss how our benchmark power curve, battery modelling, and bespoke consulting services can be leveraged to enhance your commercial energy decisions. Contact enquiries@cornwall-insight.com.au.