On 3 August, at the request of the Australian Energy Market Operator (AEMO), the Australian Energy Market Commission (AEMC) initiated a rule change request proposing to clarify the mandatory primary frequency response (PFR) obligations of scheduled bidirectional plant (i.e. batteries with a capacity of 5MW and greater)”.

One of the proposals within the rule change request is that batteries enabled for FCAS should be required to provide PFR. The AEMO has stated that as well as increasing the availability of PFR, which will promote power system security, using batteries to supply PFR promotes economic efficiency.

It is unclear whether mandating the provision of PFR for batteries would promote either economic efficiency or security, as suggested by the AEMO. If the provision of PFR, relative to contingency enablement, follows a similar path to the regulation raise market, then it is likely that under this rule change, batteries will require higher contingency FCAS prices to compensate for the opportunity cost of discharging at suboptimal times of the day[1]. This means utilising energy that could be discharged at higher prices (evening peak) and utilising throughput that limits storage (mostly) to an average of once per day. In terms of promoting economic efficiency and system reliability, it also seems counterintuitive to mandate batteries to discharge during the middle of the day, often when electricity prices are at their lowest with an excess of energy being produced, reducing the available energy supply for the evening peak when prices are at their highest. In an environment where financing battery projects on a merchant basis is already challenging, this rule change will likely reduce the revenue streams available to batteries or, at the very least, add more complexity to estimating future revenue streams for battery projects. The potential impacts could be:

- reduced revenues from contingency markets as battery operators decide to reduce enablement in these markets to conserve energy for the evening peak,

- a reduction in arbitrage opportunities as energy is required during the middle of the day for the provision of PFR,

- reductions in battery life because of increased cycling,

- a reduction in participation in contingency and/or energy markets due to warranty restrictions for cycle rates, or

- a combination of the above.

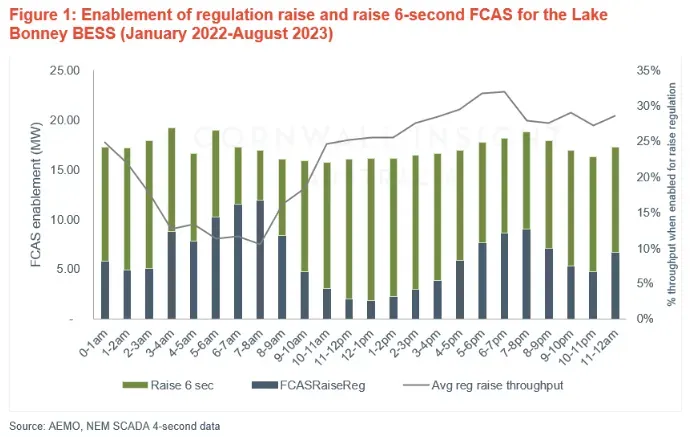

This Chart of the week looks at the participation of the Lake Bonney BESS in the regulation raise and contingency raise 6-second markets relative to regulation raise throughput[2]. The chart below details Lake Bonney’s average participation in the raise regulation and raise 6-second markets per hour (January 2022-August 2023) along with the average regulation raise throughput percentage[3].

As the requirement to discharge energy increases throughout the day (the grey line), the Lake Bonney BESS reduces its enablement of regulation FCAS and switches to the provision contingency FCAS. This is particularly pronounced between the hours of 8am and 5pm. Between 5-8pm the enablement of regulation raise FCAS increases despite the higher chances of being required to discharge. This is likely because there is little opportunity cost in discharging during the evening peak when energy prices are generally at their highest (see Figure 2 below). The hours with the highest participation in regulation raise are during the morning and evening peaks. Over the period, Lake Bonney, on average, discharged 46.8MWh per day to the grid, equating to a daily cycle rate of close to 1[4].

In the context of future intraday spreads[5], providing regulation raise in the morning and evening whilst sitting in the contingency raise markets during the day ensures energy is dispatched at the times where the value is highest (i.e. at the highest market prices). The rule change proposed by the AEMO has the potential to change this dynamic by requiring batteries that are enabled in contingency FCAS markets to provide PFR support. If the requirement of PFR follows a similar path to regulation raise, this would mean batteries discharging throughout the middle of the day, where the value of the energy is at its lowest. It would also mean battery operators would likely have to reduce participation in some markets to ensure cycle rates are within manufacturer warranties.

Cornwall Insight Australia provides technical advisory services on BESS projects, and our Storage Investment Model provides revenue stream forecasts (energy and FCAS) for 20 years. We also have a new quarterly subscription product, BESS investment benchmark, outlining future revenue opportunities for storage assets across 20 years for 2, 4, and 8 hours duration in all mainland states for COD 2025 and 2030, which breaks down revenues by market and provides an assessment of the different project financial metrics. For more information, please contact enquiries@cornwall-insight.com.au.

[1] Frequency Performance Payments would be another source of revenue

[2] Regulation raise is a secondary frequency response market where AEMO schedules, on a 4-second basis, enabled FCAS providers to discharge (raise) and charge (lower).

[3] For example, if a generator was enabled for 10MW and was instructed by AEMO to provide 5MW this would represent a 50% regulation raise throughput percentage.

[4] A degradation rate of 3% applied to 52MWh over 3.5 years of operation has been assumed.

[5] The difference between the lowest and highest price of electricity within the day